The Baotou Dongbao Bio-Tech Co.,Ltd (SZSE:300239) share price has done very well over the last month, posting an excellent gain of 37%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.2% over the last year.

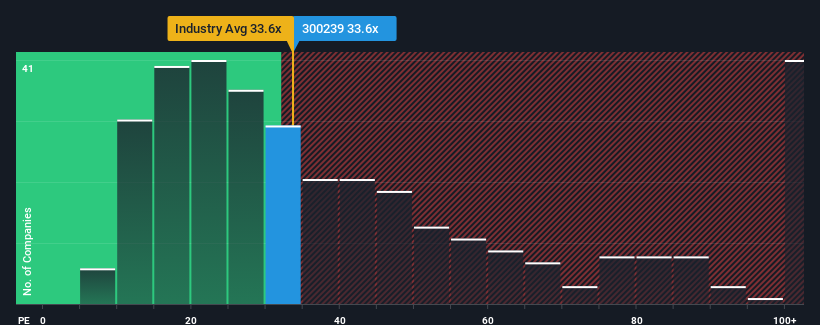

In spite of the firm bounce in price, it's still not a stretch to say that Baotou Dongbao Bio-TechLtd's price-to-earnings (or "P/E") ratio of 33.6x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 34x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

As an illustration, earnings have deteriorated at Baotou Dongbao Bio-TechLtd over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Is There Some Growth For Baotou Dongbao Bio-TechLtd?

There's an inherent assumption that a company should be matching the market for P/E ratios like Baotou Dongbao Bio-TechLtd's to be considered reasonable.

There's an inherent assumption that a company should be matching the market for P/E ratios like Baotou Dongbao Bio-TechLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 8.8% decrease to the company's bottom line. Even so, admirably EPS has lifted 389% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 37% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Baotou Dongbao Bio-TechLtd is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Baotou Dongbao Bio-TechLtd's P/E

Baotou Dongbao Bio-TechLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Baotou Dongbao Bio-TechLtd currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Baotou Dongbao Bio-TechLtd with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Baotou Dongbao Bio-TechLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.