The Hefei Gocom Information Technology Co.,Ltd. (SHSE:688367) share price has done very well over the last month, posting an excellent gain of 38%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.9% over the last year.

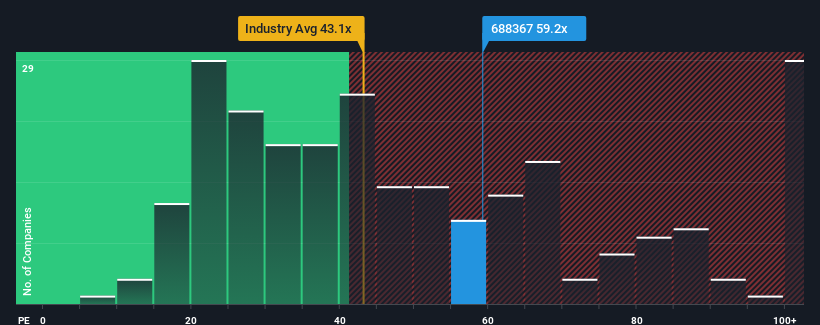

After such a large jump in price, Hefei Gocom Information TechnologyLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 59.2x, since almost half of all companies in China have P/E ratios under 33x and even P/E's lower than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

As an illustration, earnings have deteriorated at Hefei Gocom Information TechnologyLtd over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Is There Enough Growth For Hefei Gocom Information TechnologyLtd?

In order to justify its P/E ratio, Hefei Gocom Information TechnologyLtd would need to produce outstanding growth well in excess of the market.

In order to justify its P/E ratio, Hefei Gocom Information TechnologyLtd would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 44% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 67% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's an unpleasant look.

In light of this, it's alarming that Hefei Gocom Information TechnologyLtd's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

The strong share price surge has got Hefei Gocom Information TechnologyLtd's P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Hefei Gocom Information TechnologyLtd revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Hefei Gocom Information TechnologyLtd (1 is potentially serious!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than Hefei Gocom Information TechnologyLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.