Shanghai Sinyang Semiconductor Materials Co., Ltd. (SZSE:300236) shares have had a really impressive month, gaining 50% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

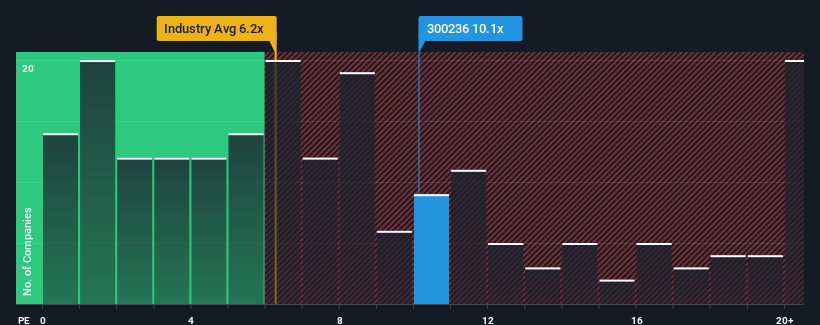

Since its price has surged higher, Shanghai Sinyang Semiconductor Materials' price-to-sales (or "P/S") ratio of 10.1x might make it look like a strong sell right now compared to other companies in the Semiconductor industry in China, where around half of the companies have P/S ratios below 6.2x and even P/S below 3x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Shanghai Sinyang Semiconductor Materials Has Been Performing

With revenue growth that's inferior to most other companies of late, Shanghai Sinyang Semiconductor Materials has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Shanghai Sinyang Semiconductor Materials' future stacks up against the industry? In that case, our free report is a great place to start.How Is Shanghai Sinyang Semiconductor Materials' Revenue Growth Trending?

In order to justify its P/S ratio, Shanghai Sinyang Semiconductor Materials would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Shanghai Sinyang Semiconductor Materials would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. The latest three year period has also seen an excellent 59% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 38% over the next year. Meanwhile, the rest of the industry is forecast to expand by 36%, which is not materially different.

In light of this, it's curious that Shanghai Sinyang Semiconductor Materials' P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

The strong share price surge has lead to Shanghai Sinyang Semiconductor Materials' P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Analysts are forecasting Shanghai Sinyang Semiconductor Materials' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Shanghai Sinyang Semiconductor Materials that you should be aware of.

If you're unsure about the strength of Shanghai Sinyang Semiconductor Materials' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.