Shenzhen Breo Technology Co., Ltd. (SHSE:688793) shareholders have had their patience rewarded with a 37% share price jump in the last month. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

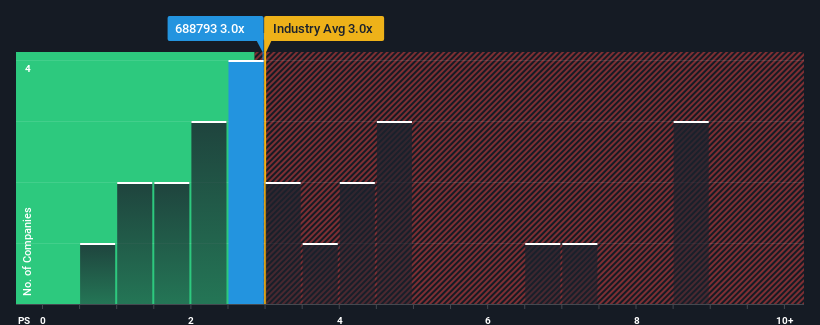

Although its price has surged higher, there still wouldn't be many who think Shenzhen Breo Technology's price-to-sales (or "P/S") ratio of 3x is worth a mention when it essentially matches the median P/S in China's Personal Products industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Shenzhen Breo Technology's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Shenzhen Breo Technology has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen Breo Technology will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Shenzhen Breo Technology would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, Shenzhen Breo Technology would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. As a result, it also grew revenue by 23% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 24% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 19%, which is noticeably less attractive.

In light of this, it's curious that Shenzhen Breo Technology's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Shenzhen Breo Technology's P/S

Shenzhen Breo Technology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Shenzhen Breo Technology's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Shenzhen Breo Technology (1 is a bit unpleasant!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.