CareRay Digital Medical Technology Co., Ltd. (SHSE:688607) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

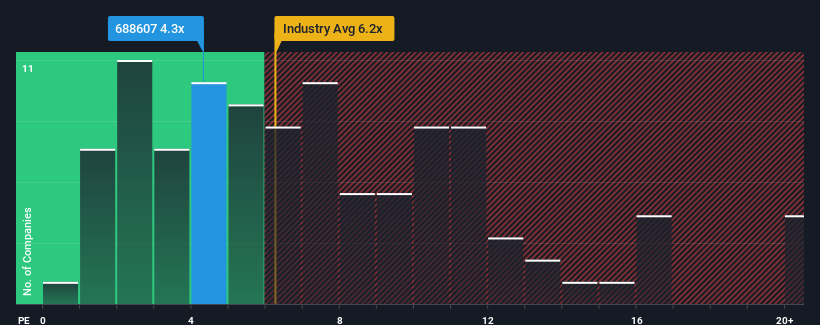

Even after such a large jump in price, CareRay Digital Medical Technology may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.3x, since almost half of all companies in the Medical Equipment industry in China have P/S ratios greater than 6.2x and even P/S higher than 10x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does CareRay Digital Medical Technology's P/S Mean For Shareholders?

Recent times have been advantageous for CareRay Digital Medical Technology as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CareRay Digital Medical Technology.Do Revenue Forecasts Match The Low P/S Ratio?

CareRay Digital Medical Technology's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

CareRay Digital Medical Technology's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 36%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 26% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 33% as estimated by the only analyst watching the company. With the industry only predicted to deliver 27%, the company is positioned for a stronger revenue result.

With this information, we find it odd that CareRay Digital Medical Technology is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift CareRay Digital Medical Technology's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems CareRay Digital Medical Technology currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for CareRay Digital Medical Technology with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on CareRay Digital Medical Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.