WindSun Science&Technology Co.,Ltd. (SHSE:688663) shares have had a really impressive month, gaining 46% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 12% in the last twelve months.

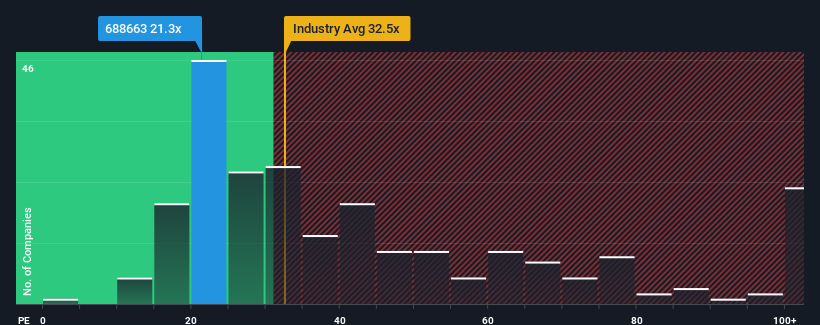

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may still consider WindSun Science&TechnologyLtd as an attractive investment with its 21.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, WindSun Science&TechnologyLtd has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Does Growth Match The Low P/E?

In order to justify its P/E ratio, WindSun Science&TechnologyLtd would need to produce sluggish growth that's trailing the market.

In order to justify its P/E ratio, WindSun Science&TechnologyLtd would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 7.4%. Pleasingly, EPS has also lifted 34% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 29% per year during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 19% per year, which is noticeably less attractive.

With this information, we find it odd that WindSun Science&TechnologyLtd is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On WindSun Science&TechnologyLtd's P/E

WindSun Science&TechnologyLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of WindSun Science&TechnologyLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with WindSun Science&TechnologyLtd, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on WindSun Science&TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.