Chengdu Tangyuan Electric Co.,Ltd. (SZSE:300789) shareholders have had their patience rewarded with a 39% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.0% over the last year.

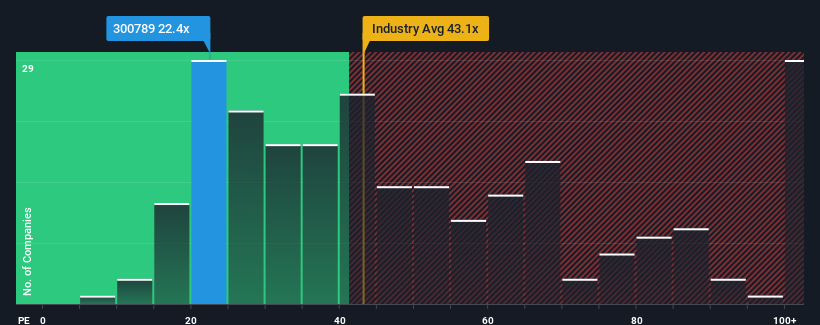

Although its price has surged higher, Chengdu Tangyuan ElectricLtd's price-to-earnings (or "P/E") ratio of 22.4x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 34x and even P/E's above 64x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

It looks like earnings growth has deserted Chengdu Tangyuan ElectricLtd recently, which is not something to boast about. It might be that many expect the uninspiring earnings performance to worsen, which has repressed the P/E. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Is There Any Growth For Chengdu Tangyuan ElectricLtd?

The only time you'd be truly comfortable seeing a P/E as low as Chengdu Tangyuan ElectricLtd's is when the company's growth is on track to lag the market.

The only time you'd be truly comfortable seeing a P/E as low as Chengdu Tangyuan ElectricLtd's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. However, a few strong years before that means that it was still able to grow EPS by an impressive 62% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to deliver 37% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Chengdu Tangyuan ElectricLtd's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

The latest share price surge wasn't enough to lift Chengdu Tangyuan ElectricLtd's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Chengdu Tangyuan ElectricLtd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Chengdu Tangyuan ElectricLtd you should know about.

You might be able to find a better investment than Chengdu Tangyuan ElectricLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.