Guangdong Greenway Technology Co.,Ltd (SHSE:688345) shareholders would be excited to see that the share price has had a great month, posting a 48% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 42% over that time.

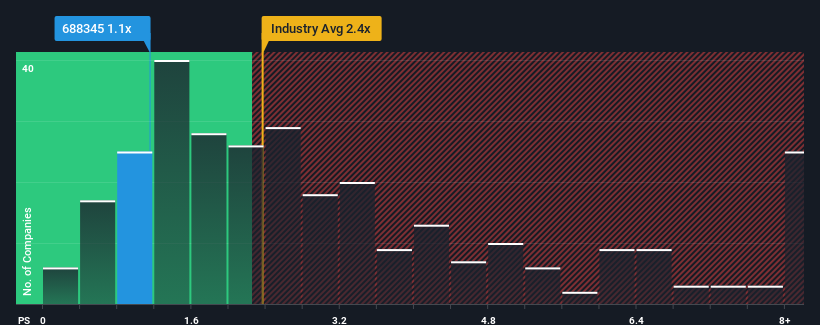

Although its price has surged higher, Guangdong Greenway TechnologyLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.1x, considering almost half of all companies in the Electrical industry in China have P/S ratios greater than 2.4x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Guangdong Greenway TechnologyLtd's Recent Performance Look Like?

Guangdong Greenway TechnologyLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangdong Greenway TechnologyLtd.Is There Any Revenue Growth Forecasted For Guangdong Greenway TechnologyLtd?

In order to justify its P/S ratio, Guangdong Greenway TechnologyLtd would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Guangdong Greenway TechnologyLtd would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. The last three years don't look nice either as the company has shrunk revenue by 6.7% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 18% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 23%, which is noticeably more attractive.

In light of this, it's understandable that Guangdong Greenway TechnologyLtd's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite Guangdong Greenway TechnologyLtd's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Guangdong Greenway TechnologyLtd maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 1 warning sign for Guangdong Greenway TechnologyLtd that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.