The OEM sales model is risky

After a lapse of three months, the Beijing Stock Exchange accepted a new IPO application.

Glonghui learned that Shanghai Barranz Automobile Testing Equipment Co., Ltd. (hereinafter referred to as “Valance”) has submitted a prospectus declaration and plans to go public on the Beijing Stock Exchange. The sponsor is Guojin Securities Co., Ltd.

Valance was established in 2005, listed for public transfer in the National Equity Transfer System in March 2023, and adjusted to the Innovation Level in May 2024. The company focuses on R&D, production and sales of automobile repair, inspection and maintenance equipment, and is registered in Jiading District, Shanghai.

Valance was established in 2005, listed for public transfer in the National Equity Transfer System in March 2023, and adjusted to the Innovation Level in May 2024. The company focuses on R&D, production and sales of automobile repair, inspection and maintenance equipment, and is registered in Jiading District, Shanghai.

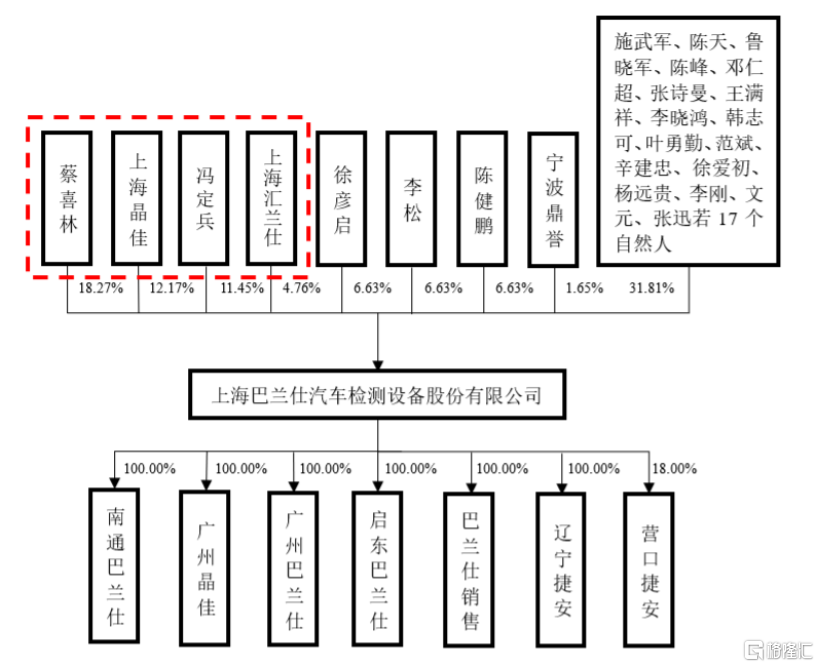

In terms of the shareholding structure, as of the date the prospectus was signed, Cai Xilin and Sun Lina controlled a total of 46.66% of the company's shares and were the joint actual controllers of the company.

Cai Xilin was born in 1959 and has a college degree. She has successively held positions such as workshop director at Hukou Tool Factory in Jiangxi Province, business manager of Zhuhai Dazhong Electric Co., Ltd., and manager of the branch office of Zhuhai Haida Industry & Trade Company. From 2005 to 2009, she was the general manager of Shanghai Barranz Automobile Inspection Equipment Co., Ltd., and is now the chairman and general manager of Barrance.

Sun Lina was born in 1982 and has a master's degree. She worked as an overseas sales manager at Guangzhou Huifeng Machinery Co., Ltd. for several years, and was also the general manager of Guangzhou Puli Machinery Co., Ltd. Since February 2015, she has been the executive director and general manager of Guangzhou Jingjia Auto Equipment Co., Ltd., and has been the company's deputy general manager since August 2022.

Chart of the company's pre-issuance shareholding structure, image source: prospectus

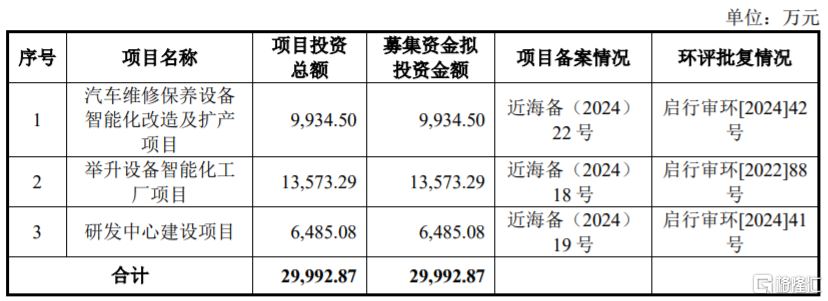

Chart of the company's pre-issuance shareholding structure, image source: prospectusWith this listing application, Barrance plans to raise about 0.3 billion yuan in capital for intelligent transformation and production expansion projects for automobile maintenance equipment, intelligent factory projects for lifting equipment, and R&D center construction projects.

Fundraising usage, image source: prospectus

Fundraising usage, image source: prospectus01

There are fluctuations in performance

Valance is a large-scale manufacturer in the domestic automobile repair and maintenance equipment industry. Its main products include tire changers, balancers, elevators, refrigerant recovery and filling machines, pneumatic oil extraction machines, etc., and other equipment.

Specifically, from 2021 to the first half of 2024, the lift business contributed more than 40% of Balans' revenue, accounting for a relatively large share; the revenue share of tire changers declined, but it was still over 25%; and businesses such as balancing machines and maintenance equipment accounted for a relatively low share of revenue.

The main components of the company's main business revenue. Image source: Prospectus

The main components of the company's main business revenue. Image source: ProspectusAmong them, lifting equipment is one of the basic equipment for automobile maintenance and inspection. Its main function is to lift the car so that it can safely leave the ground at a certain height, so that the repairers can work at the bottom of the car. The products mainly include column lifts, scissor lifts, motorcycle lifts, and elevators suitable for new energy vehicles.

Tire changers developed and manufactured by Valance are automobile maintenance equipment for removing and installing car tires during car maintenance. There are many types of tire changers. Typical models in the main series include fully automatic crow-free tire removers, back-tilting crow-free tire removers, and multi-functional auxiliary arm tire removers.

Photo source: Prospectus

Photo source: ProspectusIn terms of performance, in 2021, 2022, 2023, and the first half of 2024 (“reporting period”), Balanz' revenue was approximately 0.744 billion yuan, 0.643 billion yuan, 0.794 billion yuan, and 0.511 billion yuan, respectively. The corresponding net profit was about 0.061 billion yuan, 0.03 billion yuan, 0.081 billion yuan, and 0.069 billion yuan, respectively. The company's performance fluctuated.

Main financial data and financial indicators, photo source: prospectus

Main financial data and financial indicators, photo source: prospectusDuring the reporting period, Balans' comprehensive gross margins were 22.33%, 23.62%, 27.04% and 28.50%, respectively, showing an increasing trend, in line with the trend of changes in comparable companies in the same industry. The company's gross margin is close to Gaochang Electromechanical, higher than Changrun Co., Ltd., mainly due to product differences between the company and Changrun Co., Ltd.

Comparative analysis of gross margins of comparable companies. Image source: Prospectus

Comparative analysis of gross margins of comparable companies. Image source: ProspectusBalances faces the risk of fluctuating raw material prices. During the reporting period, the total amount of raw materials purchased accounted for more than 70% of the total procurement of raw materials. The raw materials purchased by the company were mainly steel, finished products and components. If steel prices rise in the future, it may increase the company's production costs, thereby affecting the company's gross margin and profitability.

02

The OEM sales model is risky

With the rapid development of the automotive aftermarket, the market space in the auto repair and maintenance industry also continues to expand. This has also attracted more companies to enter and intensified competition among enterprises. Homogenized competition in the middle and low end markets will further affect the accumulation of profits by enterprises. Although Barrance has certain technical advantages and scale advantages, it still faces fierce competition in the industry.

The China Association of Automobile Manufacturers divides the automotive aftersales service market into 9 categories: auto parts supply, auto repair services, auto finance, used car and leasing, automobile culture, scrap recycling and remanufacturing, automobile specialty market, and others, and Balanz's auto repair service is an important segment in the aftermarket.

Photo source: Prospectus

Photo source: ProspectusThe automobile maintenance industry includes automobile 4S stores, special maintenance service stations, comprehensive repair shops, express repair chains, special repair shops, beauty decoration stores, etc., while the automobile warranty equipment industry in which Barranz is located provides equipment support and technical support for automobile inspection, repair, and maintenance for the automobile maintenance industry.

Balans' products are eventually sold to users such as automobile 4S stores, auto repair and maintenance shops, and automobile manufacturers all over the world. Domestic customers include well-known vehicle manufacturers such as BYD Auto, Ideal Auto, and Great Wall Motor, as well as large car maintenance chains such as Tourover, JD Auto, and Tmall Car Maintenance, and well-known oil companies such as CNPC, Mobil, and Shell. At the same time, the company's products are also exported to hundreds of countries and regions such as Europe, South America, North America, Africa, and Asia.

During the reporting period, Balans' export revenue accounted for about 75% of the current main business revenue, accounting for a relatively large share. Export sales were mainly settled in US dollars. If the RMB appreciates sharply against the US dollar in the future, the competitiveness of Barrance's export products will decline. At the same time, exchange losses will occur, which may affect the company's operating performance. At the same time, the company's sales revenue to customers in Russia and Belarus accounts for about 10% of the main business revenue, and the company's overseas market sales face certain risks.

Main business revenue is classified by sales region. Image source: Prospectus

Main business revenue is classified by sales region. Image source: ProspectusIt is worth noting that Balanz's export sales are mainly in the OEM model. Under the OEM model, the company cannot label its own brand, and end users cannot directly obtain the company's product information. Its overseas customers are mainly local automobile repair and maintenance equipment brands. In the future, if the revenue scale of the main OEM customers falls, or the company fails to meet the product development or quality requirements of the main customers, it may lead to a decrease in cooperation between the main OEM customers and the company, which will affect the company's export revenue.

At the end of each period of the reporting period, the book value of the company's accounts receivable was 46.6779 million yuan, 46.4032 million yuan, 54.5417 million yuan, and 0.1 billion yuan respectively, showing an overall upward trend. The proportion of current assets at the end of the reporting period was 18.99%, 15.80%, 14.35%, and 22.73%, respectively. If the customer's financial situation changes in the future, the company's accounts receivable collection may slow down or even become unrecoverable.

03

Epilogue

As an automobile repair, inspection, and maintenance equipment manufacturer, Balanz's performance has fluctuated to a certain extent in recent years. At the same time, the company relies more on export revenue. Its export sales are mainly in the OEM model, and there are certain risks. In an environment where market competition is intensifying, the company needs to increase investment in R&D and continuously research and upgrade products to continuously improve competitiveness.

巴兰仕2005年成立,于2023年3月在全国股转系统挂牌公开转让,2024年5月调整至创新层。公司专注于

巴兰仕2005年成立,于2023年3月在全国股转系统挂牌公开转让,2024年5月调整至创新层。公司专注于