Taiwan Semiconductor announced a 39% quarterly revenue growth, better than expected, easing concerns about the reduction in spending on artificial intelligence hardware.

According to the Sina Finance app, Taiwan Semiconductor (TSM.US) announced a 39% quarterly revenue growth, better than expected, easing concerns about the reduction in spending on artificial intelligence hardware.

The main chip manufacturers for Nvidia (NVDA.US) and Apple (AAPL.US) announced sales of 759.7 billion New Taiwan dollars (23.6 billion US dollars) for the September quarter, higher than the analysts' average expectation of 748 billion New Taiwan dollars. The company will announce its third-quarter performance next Thursday.

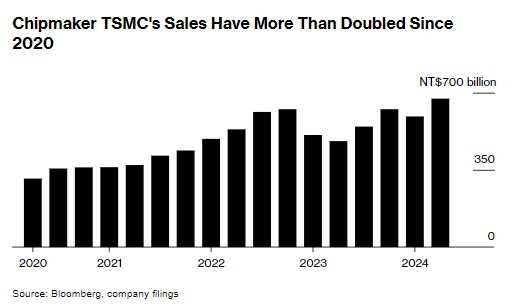

Taiwan Semiconductor is one of the key companies driving the surge in global artificial intelligence development spending, producing cutting-edge chips needed for AI training. Since 2020, its revenue has more than doubled, and the groundbreaking launch of ChatGPT has triggered a race to purchase Nvidia AI server hardware clusters.

Taiwan Semiconductor is one of the key companies driving the surge in global artificial intelligence development spending, producing cutting-edge chips needed for AI training. Since 2020, its revenue has more than doubled, and the groundbreaking launch of ChatGPT has triggered a race to purchase Nvidia AI server hardware clusters.

However, in recent months, there have been diverging views on whether the growth momentum driven by artificial intelligence will continue.

Some investors have warned that without convincing and profitable AI use cases, companies like Meta (META.US) and Google (GOOGL.US) will not be able to sustain their current pace of infrastructure spending. This doubt led to a decline in AI stocks earlier this year, including the leading Nvidia.

Nevertheless, since the launch of ChatGPT, Taiwan Semiconductor's stock price has more than doubled, and its market cap briefly crossed the $1 trillion mark in July. That month, after exceeding expectations in quarterly performance, this chip foundry also raised its revenue growth forecast for 2024.

This upward adjustment highlights Taiwan Semiconductor's view that despite the increasing geopolitical tensions, spending on artificial intelligence will remain high.

Some analysts are concerned that Nvidia's latest Blackwell chip delay in delivery may disrupt the industry, but most investors do not see this as a long-term issue for Taiwan Semiconductor. With Intel (INTC.US) and Samsung Electronics (SSNLF.US) struggling in the custom chip manufacturing business, Taiwan Semiconductor's market leadership position is expected to help boost its profit margin.

Nvidia's main server assembly partner Hon Hai Precision (Foxconn) reiterated earlier this week that the demand for artificial intelligence hardware remains strong. Hon Hai Chairman Liu Yangwei stated in an interview on Tuesday that the company plans to increase server capacity to meet the "crazy" demand for the next generation Blackwell chips, echoing similar remarks made earlier this month by Nvidia CEO Huang Renxun.

Bloomberg Intelligence analyst Charles Shum: "While demand for the new iPhone 16 may be weak, Apple's A18 chip orders may decline, but strong orders from Nvidia and Intel may offset any revenue gap for Taiwan Semiconductor. Other key themes include the potential for early production of the 2-nanometer (N2) node, and plans to expand its CoWoS packaging capacity by 2025."

Currently, more than half of Taiwan Semiconductor's revenue comes from high-performance computing, driven by artificial intelligence demand. Despite increasing concerns among analysts about lower-than-expected demand for the new iPhone 16 series, it remains the sole manufacturer of iPhone processors.

台积电是全球人工智能开发支出激增的关键企业之一,生产训练人工智能所需的尖端芯片。自2020年以来,其销售额翻了一番多,ChatGPT的开创性推出引发了一场抢购英伟达人工智能服务器群硬件的竞赛。

台积电是全球人工智能开发支出激增的关键企业之一,生产训练人工智能所需的尖端芯片。自2020年以来,其销售额翻了一番多,ChatGPT的开创性推出引发了一场抢购英伟达人工智能服务器群硬件的竞赛。