Performance exceeds expectations

On October 9, TSMC announced its September revenue report.

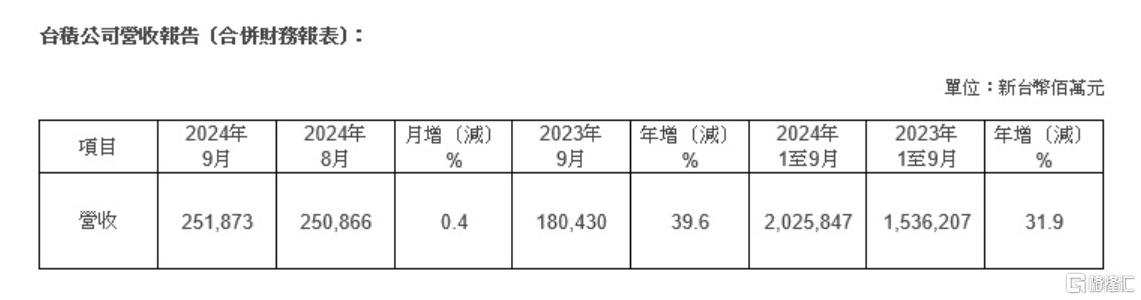

According to published data, TSMC's consolidated revenue for September 2024 was approximately NT$251.873 billion, up 0.4% from the previous month and 39.6% from the same period last year. The cumulative revenue from January to September 2024 was approximately NT$2025.847 billion, an increase of 31.9% over the same period last year.

Driven by demand for artificial intelligence (AI), TSMC's third-quarter revenue easily surpassed market and company forecasts.

Driven by demand for artificial intelligence (AI), TSMC's third-quarter revenue easily surpassed market and company forecasts.

According to calculations, the company's revenue for the quarter ending September was NT$759.7 billion ($23.6 billion), while the average analyst forecast was NT$748 billion ($23.2 billion). TSMC previously predicted third-quarter revenue of $22.4 billion to $23.2 billion in its latest earnings conference call in July.

TSMC will announce full earnings for the third quarter next Thursday (October 17), at which time it will also update its outlook.

Since 2020, TSMC's sales have more than doubled, and the launch of the pioneering ChatGPT has sparked competition to acquire Nvidia hardware for use in the AI server fleet.

However, in recent months, opinions have begun to diverge as to whether the AI-driven growth momentum can continue.

Some investors have warned that companies like Meta Platforms Inc. and Alphabet Inc.'s Google won't be able to maintain the current pace of infrastructure spending without compelling and profitable use cases for artificial intelligence. This skepticism led to a correction in artificial intelligence stocks earlier this year, including leader Nvidia.

Despite this, TSMC's stock price has more than doubled since the launch of ChatGPT, and its market capitalization once broke through the $1 trillion mark in July. In the same month, TSMC raised its revenue growth forecast for 2024 after its quarterly results exceeded expectations.

This also highlights TSMC's optimistic expectations that AI spending will remain high despite rising trade tension between China and the US. In both countries, startups and technology companies, from Microsoft to Baidu, are investing heavily in artificial intelligence infrastructure and competing to develop applications.

The stock closed up 0.83% to a market capitalization of $964.855 billion on Wednesday before revenue data was released.