Investors with a lot of money to spend have taken a bearish stance on Salesforce (NYSE:CRM).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CRM, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CRM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 8 uncommon options trades for Salesforce.

This isn't normal.

The overall sentiment of these big-money traders is split between 25% bullish and 50%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $61,226, and 6 are calls, for a total amount of $306,449.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $250.0 to $340.0 for Salesforce over the last 3 months.

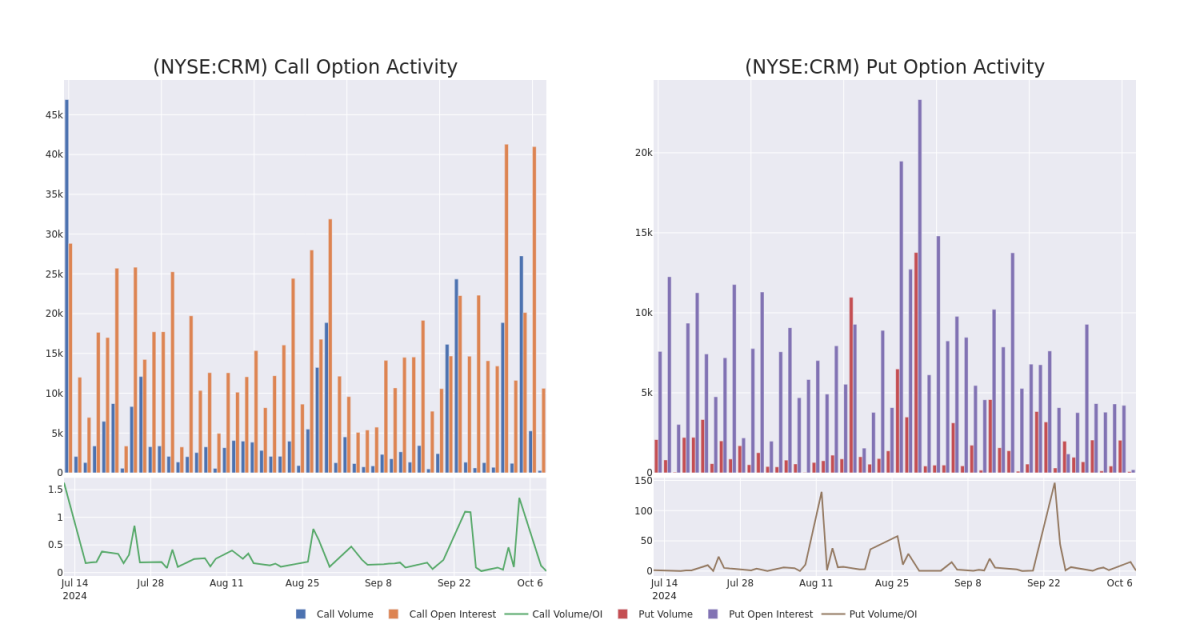

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Salesforce's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Salesforce's whale activity within a strike price range from $250.0 to $340.0 in the last 30 days.

Salesforce 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | CALL | SWEEP | BULLISH | 09/19/25 | $20.2 | $19.3 | $20.05 | $340.00 | $98.2K | 159 | 77 |

| CRM | CALL | TRADE | NEUTRAL | 10/18/24 | $12.7 | $12.15 | $12.39 | $280.00 | $61.9K | 4.2K | 52 |

| CRM | CALL | TRADE | BEARISH | 11/01/24 | $43.45 | $41.55 | $42.1 | $250.00 | $42.1K | 39 | 10 |

| CRM | CALL | TRADE | BULLISH | 09/19/25 | $20.25 | $19.35 | $20.05 | $340.00 | $40.1K | 159 | 117 |

| CRM | PUT | TRADE | BEARISH | 11/08/24 | $6.35 | $5.95 | $6.35 | $285.00 | $34.9K | 122 | 66 |

About Salesforce

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

Where Is Salesforce Standing Right Now?

- With a volume of 514,628, the price of CRM is down -1.09% at $288.39.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 49 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Salesforce with Benzinga Pro for real-time alerts.