Deep-pocketed investors have adopted a bullish approach towards AbbVie (NYSE:ABBV), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ABBV usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for AbbVie. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 50% bearish. Among these notable options, 2 are puts, totaling $109,500, and 6 are calls, amounting to $402,314.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $195.0 for AbbVie over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $195.0 for AbbVie over the recent three months.

Volume & Open Interest Development

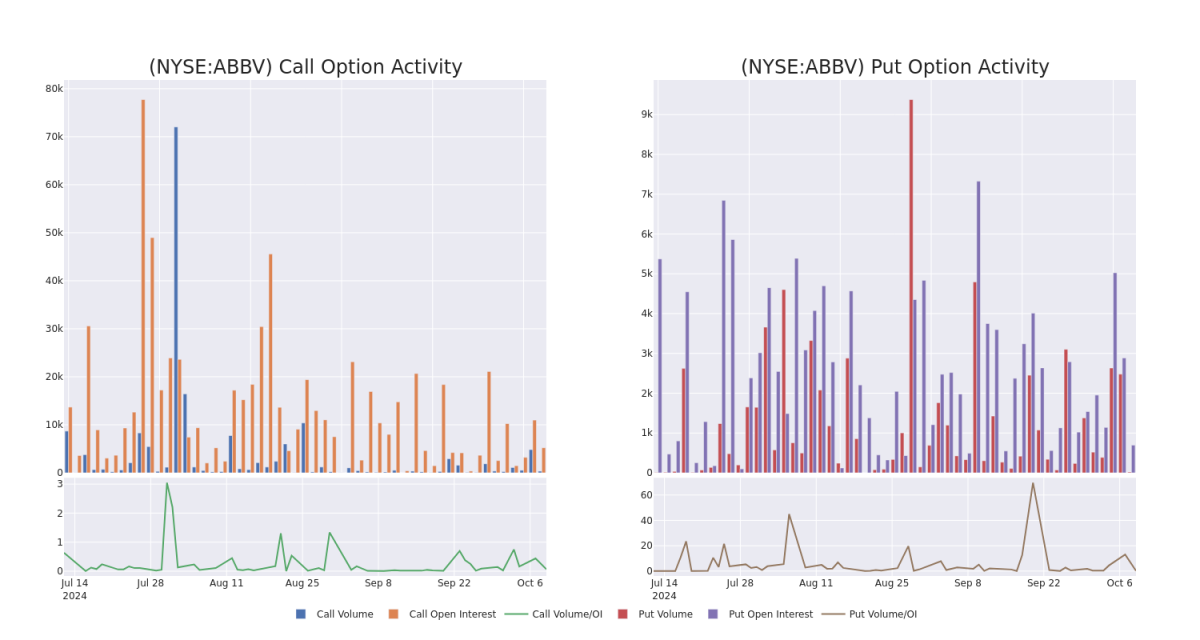

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in AbbVie's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to AbbVie's substantial trades, within a strike price spectrum from $150.0 to $195.0 over the preceding 30 days.

AbbVie Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| ABBV | CALL | TRADE | BEARISH | 11/15/24 | $14.95 | $14.65 | $14.65 | $180.00 | $99.6K | 1.6K | 69 |

| ABBV | CALL | TRADE | BULLISH | 10/11/24 | $12.85 | $12.05 | $12.61 | $180.00 | $87.0K | 76 | 69 |

| ABBV | CALL | TRADE | BEARISH | 01/16/26 | $28.2 | $27.9 | $27.9 | $180.00 | $80.9K | 408 | 29 |

| ABBV | PUT | TRADE | BEARISH | 02/21/25 | $11.45 | $10.1 | $11.45 | $195.00 | $68.7K | 598 | 0 |

| ABBV | CALL | SWEEP | BULLISH | 11/15/24 | $5.75 | $5.65 | $5.75 | $195.00 | $63.8K | 3.0K | 200 |

About AbbVie

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

Having examined the options trading patterns of AbbVie, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is AbbVie Standing Right Now?

- Trading volume stands at 729,519, with ABBV's price up by 0.12%, positioned at $193.25.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 21 days.

Professional Analyst Ratings for AbbVie

2 market experts have recently issued ratings for this stock, with a consensus target price of $218.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on AbbVie with a target price of $225. * Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for AbbVie, targeting a price of $212.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

資金力のある投資家たちはアッヴィェ(nyse:ABBV)に対して強気なアプローチを採用しており、市場参加者が無視すべきではないものです。Benzingaが公開オプションの記録を追跡した結果、今日この重要な動きが明らかになりました。これら投資家の正体は不明ですが、ABBVでのこのような重要な動きは通常、何か大きなことが起ころうとしていることを示唆しています。

私たちはBenzingaのオプションスキャナーがアッヴィェのために8つの非凡なオプションアクティビティを強調したという情報を得ました。このレベルの活動は普通ではありません。

これらの重要な投資家の間では一般的なムードが分かれており、50%が強気に傾き、50%が弱気です。これらの注目すべきオプションの中で、2つはプットで総額は109,500ドルであり、6つはコールで合計402,314ドルです。

予想される価格の変動

取引活動に基づいて、重要な投資家たちは過去3か月でアッヴィの株価が150.0ドルから195.0ドルに及ぶ価格帯を狙っているようです。

取引活動に基づいて、重要な投資家たちは過去3か月でアッヴィの株価が150.0ドルから195.0ドルに及ぶ価格帯を狙っているようです。

出来高と建玉の進展

出来高と建玉を評価することは、オプション取引において戦略的な段階です。これらの指標は、指定された権利行使価格でのアッヴィのオプションにおける流動性や投資家の関心を明らかにします。今後のデータは、直近30日間における150.0ドルから195.0ドルまでの権利行使価格スペクトラムに関連するアッヴィの主要取引における、コールとプットの出来高と建玉の変動を可視化します。

アッヴィのコールとプットの出来高:30日間の概要

注目すべきオプション活動:

| シンボル | プット/コール | 取引タイプ | センチメント | 権利行使日 | 売気配 | 買気配 | 価格 | 権利行使価格 | トータル取引価格 | 建玉 | 出来高 |

|---|

| アッヴィ | コール | 取引 | 弱気 | 24年11月15日 | $14.95 | $14.65 | $14.65 | $180.00 | $99.6K | 1.6K | 69 |

| アッヴィ | コール | 取引 | 強気 | 10/11/24 | $12.85 | $12.05 | $12.61 | $180.00 | $87.0K | 76 | 69 |

| アッヴィ | コール | 取引 | 弱気 | 01/16/26 | $28.2 | $27.9 | $27.9 | $180.00 | $80.9K | 408 | 29 |

| アッヴィ | プット | 取引 | 弱気 | 02/21/25 | $11.45 | $10.1 | $11.45 | 195.00ドル | $68.7K | 598 | 0 |

| アッヴィ | コール | スイープ | 強気 | 24年11月15日 | $5.75 | $5.65 | $5.75 | 195.00ドル | $63.8K | 3.0K | 200 |

アッヴィについて

アッヴィは、免疫学(Humira、Skyrizi、Rinvoqを含む)と腫瘍学(Imbruvica、Venclextaを含む)に強く影響を受けている製薬会社です。同社は、2013年初頭にアボットから分離されました。アラガンの2020年の買収により、美容分野(ボトックスを含む)の多くの新製品や薬剤が追加されました。

AbbVieのオプション取引パターンを調査した後、私たちの関心は会社に直接向けられます。この転換により、現在の市場ポジションとパフォーマンスを調べることができます。

現在、アッヴィはどのような状況にありますか?

- 取引高は729,519となり、ABBVの株価は0.12%上昇し、$193.25で位置しています。

- RSI指標によると、株は現在、オーバーボートとオーバーソールドの間でニュートラル状態です。

- 決算発表予定日は21日後です。

アッヴィの専門アナリスト評価

この株について最近2人の市場専門家が評価を発表し、目標株価は218.5ドルとなっています。

たった20日で$1000を$1270に変えることができますか?

20年間のプロオプショントレーダーが、購入時と売却時を示す1行チャート技術を明らかにしました。彼の取引は、20日ごとに平均27%の利益を上げています。アクセスするにはこちらをクリック。* 一貫して評価を行っているTD Cowenのアナリストは、アッヴィに対する購入評価を維持し、目標株価は225ドルです。* バークレイズのアナリストも同様に立場を維持し、アッヴィに対してオーバーウェイトの評価を続けており、212ドルの価格を目指しています。

オプションは、株式だけを取引するよりもリスキーな資産ですが、より高い利益ポテンシャルがあります。真剣なオプショントレーダーは、毎日自己教育を行い、トレードをスケーリングイン・スケーリングアウトし、2つ以上のインジケーターをフォローし、市場を密接に追いかけることでこのリスクを管理します。

取引活動に基づいて、重要な投資家たちは過去3か月でアッヴィの株価が150.0ドルから195.0ドルに及ぶ価格帯を狙っているようです。

取引活動に基づいて、重要な投資家たちは過去3か月でアッヴィの株価が150.0ドルから195.0ドルに及ぶ価格帯を狙っているようです。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $195.0 for AbbVie over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $195.0 for AbbVie over the recent three months.