Market Whales and Their Recent Bets on Procter & Gamble Options

Market Whales and Their Recent Bets on Procter & Gamble Options

Financial giants have made a conspicuous bearish move on Procter & Gamble. Our analysis of options history for Procter & Gamble (NYSE:PG) revealed 8 unusual trades.

金融巨頭在普葛收購上採取了明顯的看淡舉動。我們對普葛(紐交所:PG)的期權歷史進行分析,發現有8筆異常交易。

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $64,067, and 6 were calls, valued at $265,953.

深入細節,我們發現37%的交易者看好,而62%表現出看淡傾向。在我們發現的所有交易中,有2筆看跌交易,價值爲$64,067,有6筆看漲交易,價值爲$265,953。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $175.0 for Procter & Gamble, spanning the last three months.

在評估了成交量和持倉量之後,顯而易見,主要的市場攪局者都把焦點放在普葛的股價區間在$150.0和$175.0之間,涵蓋了過去三個月的時間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

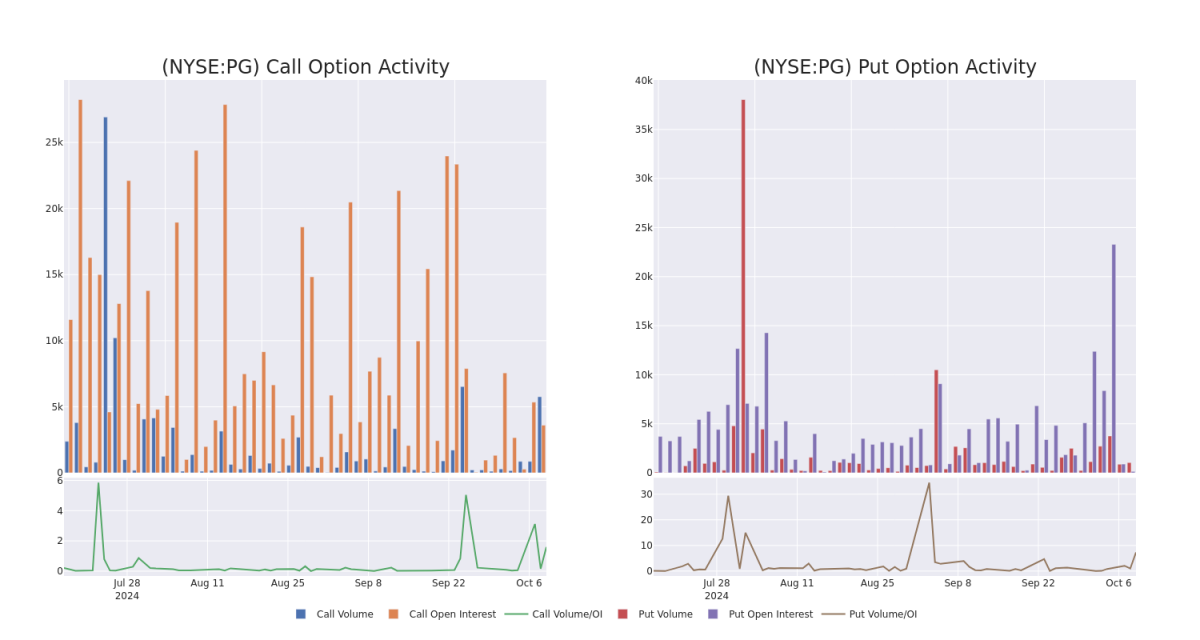

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Procter & Gamble's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Procter & Gamble's significant trades, within a strike price range of $150.0 to $175.0, over the past month.

審視成交量和持倉量可爲股票研究提供關鍵見解。這些信息是衡量普葛的期權在特定行權價上的流動性和興趣水平的關鍵。下面,我們爲您呈現了過去一個月內普葛重要交易的成交量和持倉量趨勢快照,涵蓋了$150.0到$175.0的行權價範圍。

Procter & Gamble Call and Put Volume: 30-Day Overview

寶潔公司看漲和看跌期權成交量:30天概述

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | CALL | SWEEP | BULLISH | 12/20/24 | $20.85 | $20.5 | $20.8 | $150.00 | $66.5K | 89 | 34 |

| PG | CALL | SWEEP | BEARISH | 10/25/24 | $0.97 | $0.96 | $0.96 | $175.00 | $65.2K | 532 | 879 |

| PG | CALL | TRADE | BEARISH | 12/20/24 | $5.45 | $5.3 | $5.35 | $170.00 | $39.0K | 2.2K | 161 |

| PG | CALL | SWEEP | BEARISH | 10/25/24 | $1.03 | $0.94 | $0.94 | $175.00 | $37.4K | 532 | 2.1K |

| PG | PUT | SWEEP | BULLISH | 04/17/25 | $2.33 | $2.32 | $2.32 | $150.00 | $36.4K | 143 | 638 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | 看漲 | SWEEP | 看好 | 12/20/24 | $20.85 | $20.5 | $20.8 | $150.00 | $66.5K | 89 | 34 |

| PG | 看漲 | SWEEP | 看淡 | 10/25/24 | $0.97 | 0.96美元 | 0.96美元 | $175.00 | $65.2K | 532 | 879 |

| PG | 看漲 | 交易 | 看淡 | 12/20/24 | $5.45 | $5.3 | $5.35 | $170.00 | $39.0K | 2.2K | 161 |

| PG | 看漲 | SWEEP | 看淡 | 10/25/24 | $1.03 | $0.94 | $0.94 | $175.00 | 37,400美元 | 532 | 2.1K |

| PG | 看跌 | SWEEP | 看好 | 04/17/25 | $2.33 | $2.32 | $2.32 | $150.00 | 成交量: $36.4K | 143 | 638 |

About Procter & Gamble

關於寶潔公司

Since its founding in 1837, Procter & Gamble has become one of the world's largest consumer product manufacturers, generating more than $80 billion in annual sales. It operates with a lineup of leading brands, including more than 20 that generate north of $1 billion each in annual global sales, such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. Sales outside its home turf represent more than half of the firm's consolidated total.

自1837年創立以來,Procter&Gamble已成爲世界上最大的消費品製造商之一,年銷售額超過800億美元。公司經營着一系列領先品牌,包括超過20個品牌的全球年銷售額均超過10億美元,例如Tide洗衣粉、Charmin衛生紙、Pantene洗髮水和Pampers紙尿褲。公司在國外的銷售額佔其總銷售額的一半以上。

After a thorough review of the options trading surrounding Procter & Gamble, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在全面審視寶潔(Procter & Gamble)周邊期權交易之後,我們將深入研究該公司。這包括對它當前的市場地位和業績的評估。

Current Position of Procter & Gamble

寶潔公司的當前持倉

- Currently trading with a volume of 3,925,689, the PG's price is up by 0.59%, now at $169.15.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 9 days.

- 目前交易量爲3,925,689,PG的價格上漲了0.59%,目前爲169.15美元。

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預計發佈收益報告還有9天。

Expert Opinions on Procter & Gamble

關於寶潔(Procter & Gamble)的專家意見

3 market experts have recently issued ratings for this stock, with a consensus target price of $174.33333333333334.

3位市場專家最近對這隻股票發出了評級,一致目標價爲174.33333333333334美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Procter & Gamble, targeting a price of $186. * Reflecting concerns, an analyst from Piper Sandler lowers its rating to Neutral with a new price target of $174.* In a cautious move, an analyst from Barclays downgraded its rating to Equal-Weight, setting a price target of $163.

20年期期權交易專家透露了他的一線圖表技術,顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。單擊此處進行訪問。* 派傑投資的分析師堅持維持看好評級,目標價爲186美元。* 反映擔憂,派傑投資的分析師將評級調降爲中立,設定新的目標價174美元。* 巴克萊銀行的分析師採取謹慎舉措,將評級下調爲中性,設定目標價163美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Procter & Gamble's options at certain strike prices. Below, we present a snapshot of the

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Procter & Gamble's options at certain strike prices. Below, we present a snapshot of the