While not a mind-blowing move, it is good to see that the Tangshan Jidong Cement Co.,Ltd. (SZSE:000401) share price has gained 21% in the last three months. But that is little comfort to those holding over the last half decade, sitting on a big loss. In fact, the share price has declined rather badly, down some 68% in that time. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance.

With the stock having lost 7.3% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Because Tangshan Jidong CementLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Tangshan Jidong CementLtd reduced its trailing twelve month revenue by 3.8% for each year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 11% per year doesn't really surprise us. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

Over half a decade Tangshan Jidong CementLtd reduced its trailing twelve month revenue by 3.8% for each year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 11% per year doesn't really surprise us. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

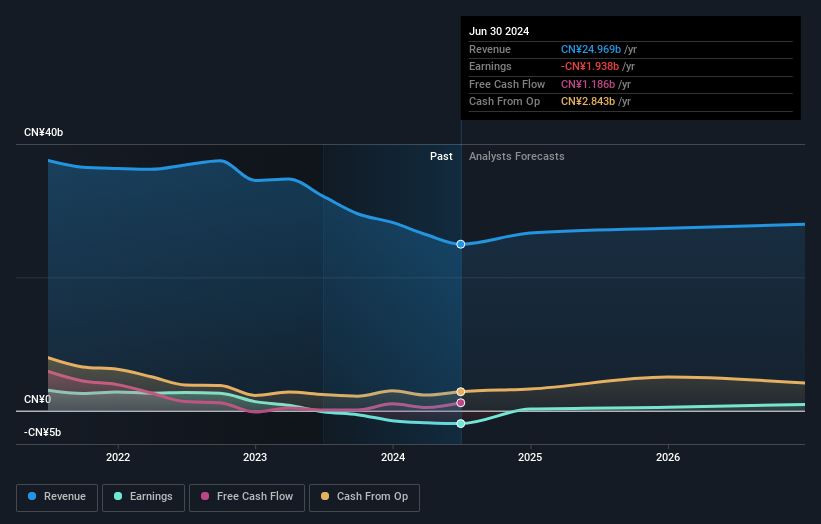

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Tangshan Jidong CementLtd will earn in the future (free profit forecasts).

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Tangshan Jidong CementLtd's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Tangshan Jidong CementLtd shareholders, and that cash payout explains why its total shareholder loss of 63%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Investors in Tangshan Jidong CementLtd had a tough year, with a total loss of 28%, against a market gain of about 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Tangshan Jidong CementLtd better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Tangshan Jidong CementLtd .

But note: Tangshan Jidong CementLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.