Despite an already strong run, Pacific Radiance Ltd. (SGX:RXS) shares have been powering on, with a gain of 33% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

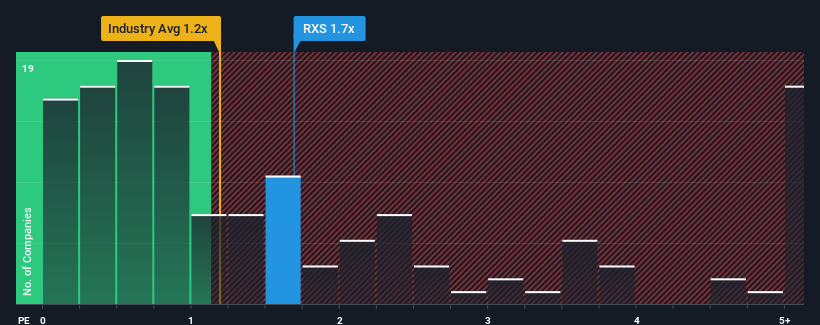

After such a large jump in price, when almost half of the companies in Singapore's Energy Services industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Pacific Radiance as a stock probably not worth researching with its 1.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Pacific Radiance's Recent Performance Look Like?

Recent times haven't been great for Pacific Radiance as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pacific Radiance.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Pacific Radiance would need to produce impressive growth in excess of the industry.

In order to justify its P/S ratio, Pacific Radiance would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 16% over the next year. With the industry only predicted to deliver 12%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Pacific Radiance's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The large bounce in Pacific Radiance's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Pacific Radiance shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 6 warning signs for Pacific Radiance (3 are a bit unpleasant!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.