If inflation rises again while non-farm payrolls are booming, the possibility of the Federal Reserve skipping a rate cut at one of the last two meetings of the year will further increase. So, how will the US CPI data for September, to be announced at 8:30 tonight Beijing time, perform?

Caixin on October 10th (Editor Xiaoxiang) Prior to the release of last Friday's non-farm payroll data, perhaps hardly anyone would have thought that tonight's US CPI data would have much impact on the market. However, now everything has changed significantly...

Against the backdrop of the Federal Reserve focusing more on employment data, inflation data may not determine whether the Fed cuts rates by 25 or 50 basis points at a meeting, but in the discussion of whether the Fed still needs to cut rates, inflation data still plays a crucial role in the decision-making process. Especially with last week's non-farm payroll report showing not only far more job additions than expected, but also faster wage growth than expected, the Fed may still be unable to assert whether the 'wage-inflation' spiral will reignite!

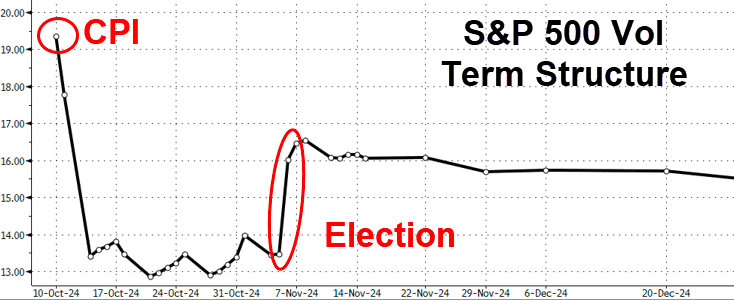

Many industry insiders have expressed that last week's non-farm payroll report, which completely changed market expectations, has put even greater pressure on this week's US CPI data. If inflation unexpectedly exceeds expectations, it is likely to further reduce market expectations for the magnitude of a rate cut by the Fed before the end of the year, leading to another wave of market turmoil. This can already be seen from the 'facing a formidable enemy' options volatility indicators...

Many industry insiders have expressed that last week's non-farm payroll report, which completely changed market expectations, has put even greater pressure on this week's US CPI data. If inflation unexpectedly exceeds expectations, it is likely to further reduce market expectations for the magnitude of a rate cut by the Fed before the end of the year, leading to another wave of market turmoil. This can already be seen from the 'facing a formidable enemy' options volatility indicators...

Currently, the expectations in the interest rate market already indicate that a rate cut at the Federal Reserve's next meeting early next month is not a foregone conclusion. If inflation rises again while non-farm payrolls are strong, then the possibility of the Fed skipping a rate cut at one of the last two meetings of the year will further increase. The latest pricing in the interest rate market is actually below the forecast of an additional 50 basis points of rate cuts within the year in the September dot plot.

So, how will the US CPI data for September, to be announced at 8:30 tonight Beijing time, perform?

Preview of US CPI data for September

Let's take a look at Wall Street's expectations for tonight's CPI data:

After the continued decline in CPI in August, economists from institutions currently surveyed by the media expect that the overall CPI in September is expected to increase by 2.3% year-on-year (lower than 2.5% in August), and increase by 0.1% month-on-month (lower than 0.2% in August).

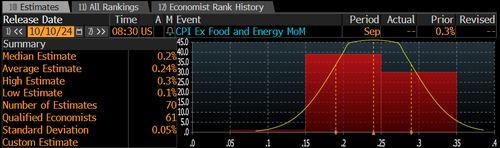

Excluding the volatile energy and food prices, the core CPI in September is expected to increase by 3.2% year-on-year (flat with the previous value of 3.2%), and increase by 0.2% month-on-month (lower than 0.3% in August).

The following chart is a summary of the estimates by major investment banks as reported by "The New Fed Wire" Nick Timiraos:

From the above estimates, it is not difficult to see that market participants are generally confident that overall CPI data in the USA will further decline. Once the overall CPI growth rate in September can smoothly decrease to 2.3% as expected, it will be the sixth consecutive month of decline, and also bring it closer to the Federal Reserve's 2% inflation target.

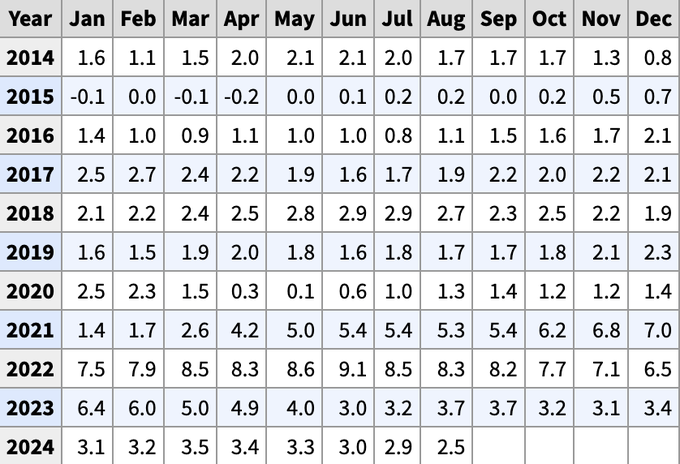

Note: CPI data trends over the past 10 years.

However, at the same time, people may not be able to celebrate too early - tonight's major market risk point is likely to be focused on the core CPI data. The median estimate currently shows that the year-on-year increase in core CPI in September is likely to stay at 3.2% for the third consecutive month. While the overall CPI is declining, the core CPI has consistently stayed above 3%, which, in the case of a 50 basis point interest rate cut by the Federal Reserve, may bring significant risks.

From the situation of a media survey, the expected distribution of the month-on-month core CPI in September shows that the number of analysts expecting growth of 0.2% and 0.3% is approximately the same, with only one economist (Jason Schenker from Prestige) expecting a growth of 0.1%. Therefore, people need to be cautious about the risk of the core month-on-month CPI slightly exceeding expectations tonight.

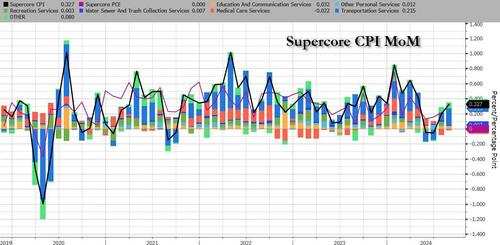

In recent months, due to the soaring prices of auto insurance, the 'super core CPI' (excluding housing and rental costs in service industry data) that the Federal Reserve has been paying extra attention to has been quite hot. If this trend continues, it will also be an unfavorable phenomenon.

How will investment banks specifically analyze tonight's data?

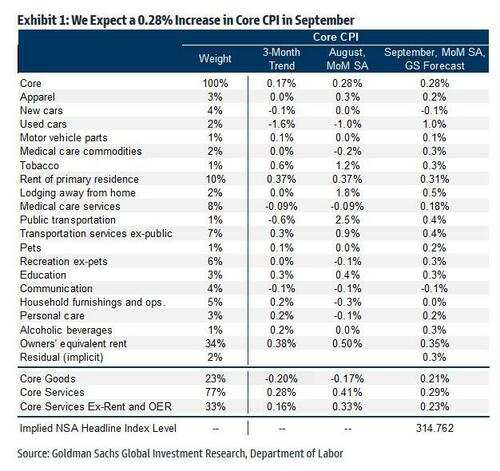

Currently, Goldman Sachs expects the core CPI in September to rise by 0.28% month-on-month (higher than the general expectation of 0.2%) and rise by 3.16% year-on-year (consistent with the general expectation of 3.2%). The bank also expects the overall CPI in September to rise by 0.10% month-on-month and rise by 2.27% year-on-year (consistent with the general expectation).

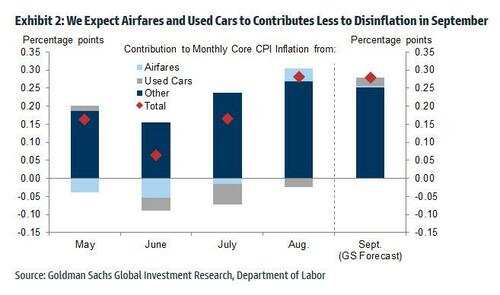

Goldman Sachs' forecast for core CPI in September is consistent with its forecast for August. Similar to August, Goldman Sachs expects the downward pressure on prices from the used car and airfare sectors to decrease in September. Due to the recent rebound in auction prices for used cars in the past few months, used car prices are expected to increase by 1.0% month-on-month, and airfare prices are expected to rise by 0.5%, reflecting a moderate push from seasonal factors.

Goldman Sachs also emphasized the trends of the other two key components expected in the September CPI report:

① Auto Insurance. It is expected that auto insurance prices will rise strongly by 0.7% in September, reflecting the continued increase in premiums, although the rate of increase has slowed down. The higher car prices, repair costs, medical and litigation costs have put pressure on insurers to raise prices, but there is a long lag before premiums are passed on to consumers, in part because insurers must negotiate price increases with state regulatory agencies.

Now, most of the gap between premiums and costs has narrowed. Therefore, Goldman Sachs expects the growth rate of auto insurance prices next year to return to pre-pandemic levels.

② Housing Prices. After experiencing significant growth in July and August, Goldman Sachs expects housing inflation to moderate, with Owner's Equivalent Rent (OER) increasing by 0.35% and single-family residential rent increasing by 0.31%. Looking ahead, the strong growth in single-family residential rents may cause them to outpace OER.

Morgan Stanley's forecast is also similar to Goldman Sachs'. Morgan Stanley believes that the overall decline in inflation is mainly attributed to the drop in gasoline prices. Driven by used cars, commodity inflation is expected to show positive growth, while airfare prices are also expected to remain positive.

In addition, Morgan Stanley expects that the service industry inflation will slow down, mainly due to the decline in housing inflation. The company believes that the recent rise in OER (rent) may be influenced by temporary seasonal factors, and expects this indicator to undergo some correction.

Citigroup economists Veronica Clark and Andrew Hollenhorst wrote in a report on Tuesday: "Continued strong wage growth will pose a significant upward risk to inflation, especially in sectors such as medical care."

How will tonight's CPI affect the Federal Reserve and the financial markets?

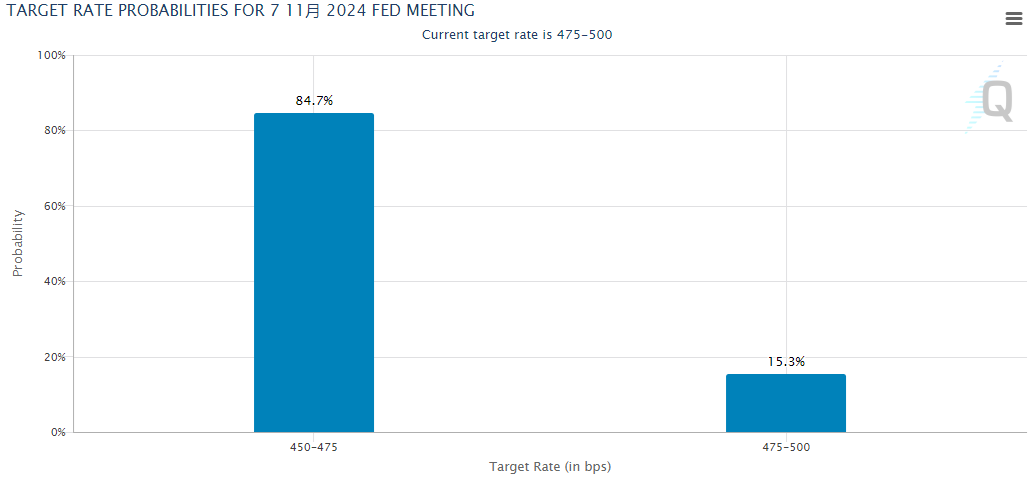

According to the CME FedWatch Tool, currently market traders estimate an 85% probability of a 25-basis-point rate cut at the Fed's November meeting, with a probability of staying put at only 15%.

However, despite the current overwhelming expectation of a 25-basis-point rate cut, UBS economist Brian Rose warned in a report last Friday, "If the pace of price increases is faster than expected, coupled with the strong labor data earlier, the possibility of the Fed staying put at the November meeting will increase."

Analysts at Bank of America also stated, "Following last Friday's surge in job reports, we believe the importance of this week's CPI has increased. A fairly large surprise could bring uncertainty to the easing cycle and more volatility to the market."

Matthew Weller of Forex.com and City Index stated that the Federal Reserve has decided to shift its focus from inflation to the labor market, meaning that inflation data including CPI may not have as much impact on the market as before. Although this view has been logical in the past, this month's CPI report may still trigger market volatility driven by last Friday's excellent job report, which could suggest inflation is facing upward risks once again.

From the recent performance of the financial markets, as the expectations of interest rate cuts have greatly diminished, the yields of the 10-year US Treasury bonds and the US dollar index have both reached their highest levels in about eight weeks. Although the US stock market has not been significantly impacted, if there are fluctuations in the inflation situation, it may bring more uncertainty to the future performance of the US stock market.

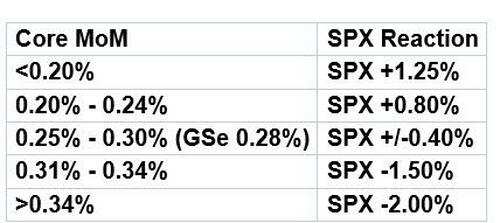

Regarding the impact of tonight's CPI performance on the S&P 500 index, the Goldman Sachs team has made the following forecast as shown in the graph:

Simply put, the lower the CPI data, the greater the market's upward potential, and the worst case scenario is a core CPI increase of more than 0.34%.

Goldman Sachs strategist Dominic Wilson summarized that last week's strong non-farm payroll report significantly changed the background of the CPI. A few weeks ago, I believed that the market would be quite tolerant of slightly higher inflation data and would be excited about the prospect of accelerating easing in cases lower than expected. However, now the risk is that higher inflation data could exacerbate the recent narrative shift - that the Fed's likely loose action is far less than previously expected.

Wilson believes that people's reaction tonight to higher-than-expected inflation may be greater than to lower-than-expected reactions, therefore this data may pose relatively greater downside risks to the stock market.

A survey by 22V Research before tonight's CPI release shows that 42% of investors expect the market's reaction to CPI tonight to be 'mixed/insignificant,' 32% of investors believe it will trigger risk aversion, and only 25% of investors anticipate risk preference being triggered.

22V founder Dennis DeBuschere stated, "Overall, people are optimistic about inflation." He also pointed out that the proportion of investors expecting an economic downturn has decreased, while the proportion of investors believing that financial conditions need to tighten hit the highest levels since June.

Edward Devis Research Institute's Ed Cleesord believes that to sustain the bull market, inflation needs to continue to decline, the economy needs to achieve a soft landing, and U.S. corporate profit growth needs to remain strong and expand.