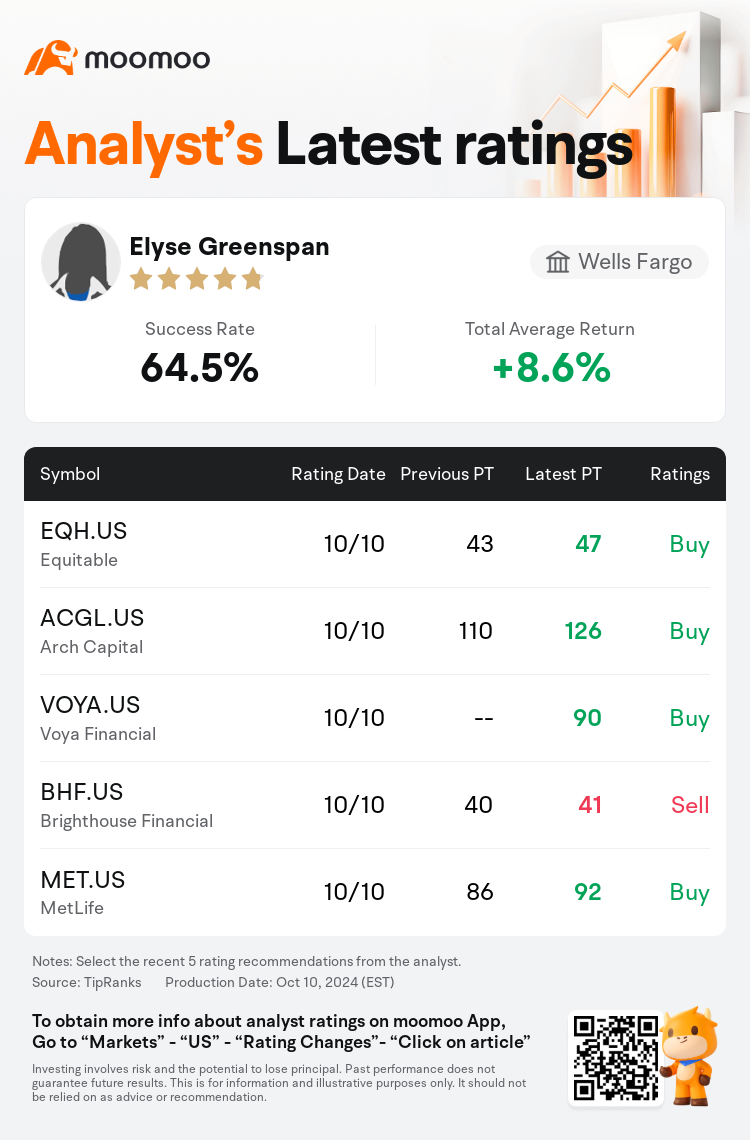

Wells Fargo analyst Elyse Greenspan maintains $Brown & Brown (BRO.US)$ with a buy rating, and adjusts the target price from $112 to $114.

According to TipRanks data, the analyst has a success rate of 64.5% and a total average return of 8.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Brown & Brown (BRO.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Brown & Brown (BRO.US)$'s main analysts recently are as follows:

Insurance brokers maintain a generally optimistic stance concerning organic growth prospects for 2024. It is broadly anticipated that large-cap broker organic growth will continue to surpass the average in Q3. Nonetheless, there is an expectation for a gradual deceleration of the group's underlying growth towards long-term averages as we approach 2025-26. Changes in targets throughout the quarter, as well as a general expansion in market P/E multiples, have been observed.

Q3 results, especially those of reinsurers, might be eclipsed by the recent Hurricane Milton, with a more favorable view held on the Personal segment due to improvements in margins and policies-in-force. For Q3, catastrophe losses are anticipated to be lower than the five-year seasonal average, yet significantly higher than those in the third quarter of the prior year, possibly affecting primary insurers negatively.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

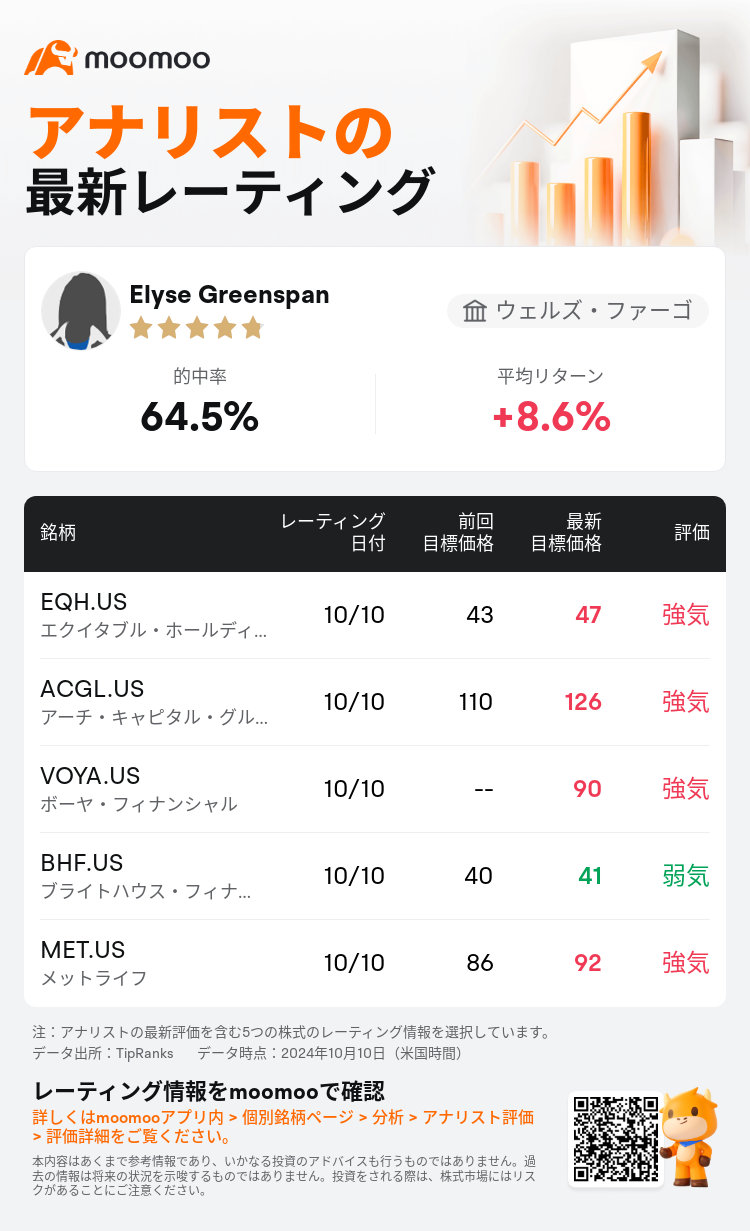

ウェルズ・ファーゴのアナリストElyse Greenspanは$ブラウン・アンド・ブラウン (BRO.US)$のレーティングを強気に据え置き、目標株価を112ドルから114ドルに引き上げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は64.5%、平均リターンは8.6%である。

また、$ブラウン・アンド・ブラウン (BRO.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ブラウン・アンド・ブラウン (BRO.US)$の最近の主なアナリストの観点は以下の通りである:

保険ブローカーは、2024年の有機的成長の見通しについて、概ね楽観的な見方をしています。大型株ブローカーの有機的成長率は、第3四半期も平均を上回り続けると広く予想されています。とはいえ、2025-26年に近づくにつれ、グループの基礎となる成長は長期平均に向かって徐々に減速すると予想されます。四半期を通じて目標が変化し、市場の株価収益率も全般的に拡大しています。

第3四半期の業績、特に再保険会社の業績は、最近のハリケーン・ミルトンによって覆い隠される可能性があります。利益率と施行中の保険契約の改善により、個人セグメントではより好意的な見方が保たれます。第3四半期の大災害損失は、5年間の季節平均を下回ると予想されますが、前年の第3四半期よりも大幅に増加し、一次保険会社に悪影響を及ぼす可能性があります。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$ブラウン・アンド・ブラウン (BRO.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ブラウン・アンド・ブラウン (BRO.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of