Whales with a lot of money to spend have taken a noticeably bullish stance on IBM.

Looking at options history for IBM (NYSE:IBM) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $282,080 and 3, calls, for a total amount of $112,981.

From the overall spotted trades, 5 are puts, for a total amount of $282,080 and 3, calls, for a total amount of $112,981.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $110.0 to $240.0 for IBM over the last 3 months.

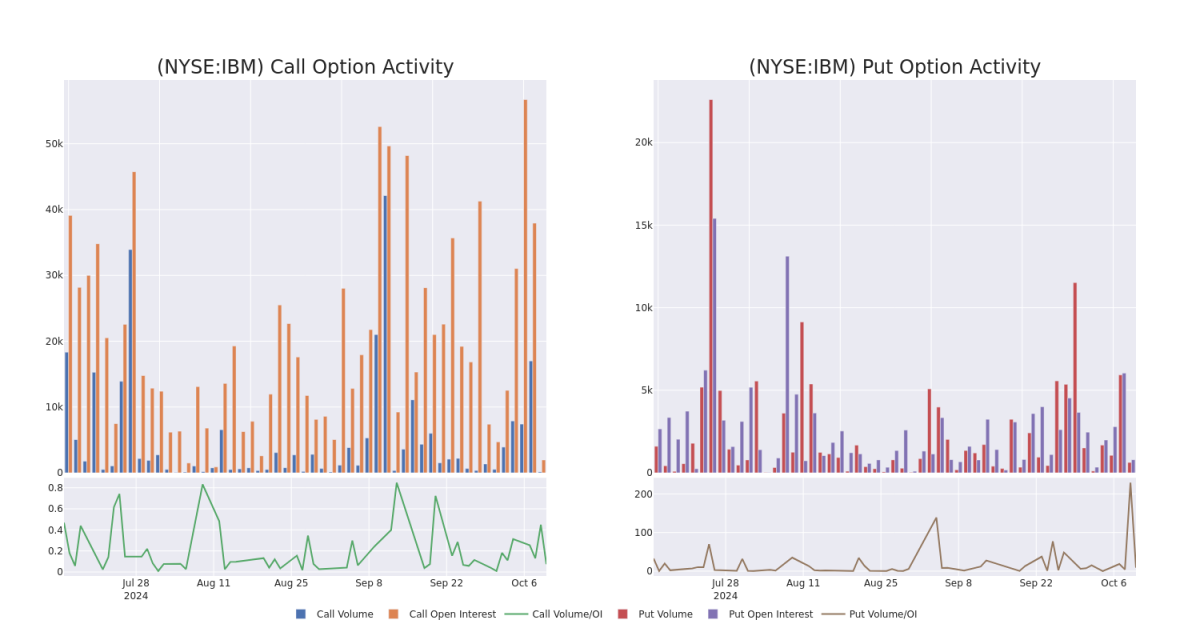

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for IBM's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of IBM's whale trades within a strike price range from $110.0 to $240.0 in the last 30 days.

IBM Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IBM | PUT | TRADE | BEARISH | 11/15/24 | $12.5 | $11.45 | $12.3 | $240.00 | $123.0K | 14 | 100 |

| IBM | PUT | SWEEP | BULLISH | 10/18/24 | $2.97 | $2.5 | $2.71 | $235.00 | $54.0K | 691 | 308 |

| IBM | PUT | TRADE | BEARISH | 12/20/24 | $14.1 | $13.5 | $13.95 | $240.00 | $50.2K | 85 | 93 |

| IBM | CALL | TRADE | NEUTRAL | 01/15/27 | $91.9 | $87.15 | $89.52 | $150.00 | $44.7K | 10 | 5 |

| IBM | CALL | TRADE | BEARISH | 01/15/27 | $127.85 | $124.05 | $125.57 | $110.00 | $37.6K | 166 | 3 |

About IBM

IBM looks to be a part of every aspect of an enterprise's IT needs. The company primarily sells software, IT services, consulting, and hardware. IBM operates in 175 countries and employs approximately 350,000 people. The company has a robust roster of 80,000 business partners to service 5,200 clients, which includes 95% of all Fortune 500. While IBM is a B2B company, IBM's outward impact is substantial. For example, IBM manages 90% of all credit card transactions globally and is responsible for 50% of all wireless connections in the world.

Having examined the options trading patterns of IBM, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

IBM's Current Market Status

- With a volume of 169,740, the price of IBM is up 0.14% at $234.62.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 13 days.

What The Experts Say On IBM

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $246.66666666666666.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from B of A Securities persists with their Buy rating on IBM, maintaining a target price of $250. * An analyst from Goldman Sachs persists with their Buy rating on IBM, maintaining a target price of $250. * Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for IBM, targeting a price of $240.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.