Linhai Co.,Ltd. (SHSE:600099) shares have continued their recent momentum with a 35% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 9.5% isn't as attractive.

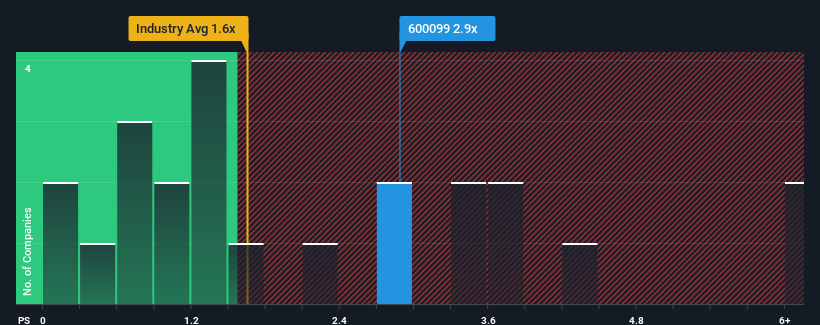

Since its price has surged higher, when almost half of the companies in China's Auto industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider LinhaiLtd as a stock probably not worth researching with its 2.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How LinhaiLtd Has Been Performing

LinhaiLtd has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on LinhaiLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as LinhaiLtd's is when the company's growth is on track to outshine the industry.

The only time you'd be truly comfortable seeing a P/S as high as LinhaiLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 6.3% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 40% shows it's noticeably less attractive.

With this information, we find it concerning that LinhaiLtd is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

The large bounce in LinhaiLtd's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of LinhaiLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 1 warning sign for LinhaiLtd that we have uncovered.

If these risks are making you reconsider your opinion on LinhaiLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.