Artificial intelligence (AI) stocks are surging and the 2024 presidential election is shaping up to be one of the most contentious in history. But ask retail traders how it affects them and the response is, "meh."

What Happened: According to the latest survey from Public, an investing platform that prides itself on helping members build asset portfolios, most retail traders just aren't excited by AI stocks.

Never mind the fact that AI companies — Nvidia Corp. (NASDAQ:NVDA), Super Micro Computer Inc (NASDAQ:SMCI), Micron Technology (NASDAQ:MU) — saw significant gains and outpaced broader market indexes like the S&P 500.

Of the 1,300 responses Public sourced from investors, the firm determined:

Of the 1,300 responses Public sourced from investors, the firm determined:

- 35% say that new technology excites them.

- 30% have purchased a company stock because of their AI capabilities.

- 64% say AI will be a standard tool for research in the future.

- 50% are likely to use it to process financial information in the future.

The contentious presidential election between Republican Donald Trump and Democrat Vice President Kamala Harris doesn't seem to faze investors, either.

"Many investors are indifferent to the election as it relates to the market or their own portfolio, but a number of investors purchased company stocks or traded options based on who they predict will win and how it will benefit their portfolio," Public derived from the findings.

Here's a breakdown:

- 63% say no, the election does not impact their investing strategy.

- 37% say yes, it does impact their investing strategy.

- 16% of investors are buying more stocks or options of a company based on who they predict will win and the impact it will have on their portfolio.

- 13% are investing less in 2024 due to the election.

- 12% are investing more.

There is also a direct 50/50 split among investors saying that economic data from the Federal Reserve impacts their investing decisions with 50.4% of retail traders saying "yes" and 49.6% saying "no."

Why It Matters: The ho-hum response toward the economy is something that has plagued the Biden-Harris administration for months, despite solid numbers.

As Election Day draws near, there is ongoing coverage of how the electorate views the economy and costs.

But here are the facts:

- Annual inflation has fallen to 2.4 percent, its slowest pace since early 2021.

- The unemployment rate recently dropped to 4.1%

- With gains of 20.9%, the S&P 500 year-to-date performance is up from recent presidential election years.

- Consumer morale hit a four-month high in September, driven by more spending and favorable price conditions.

And regarding AI, automation continues to be a major point of concern to labor workers who fear replacement. In June, the Kobeissi Letter claimed the AI hype was "stronger than ever."

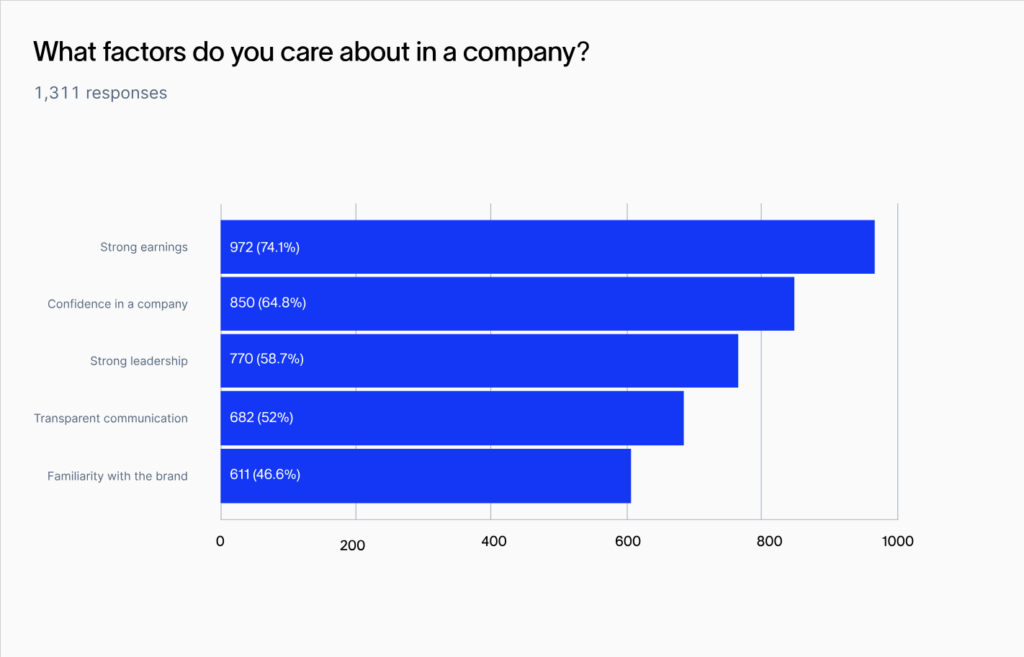

As for what retail traders care about when crafting their portfolios, Public ranked these responses: strong earnings,

personal confidence in a company, leadership, transparent communication and familiarity with the brand. See chart below.

Now Read:

- Kamala Harris Beats Trump On Housing Affordability, Renters Say

Photo: Shutterstock