The Porton Pharma Solutions Ltd. (SZSE:300363) share price has done very well over the last month, posting an excellent gain of 38%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 43% in the last twelve months.

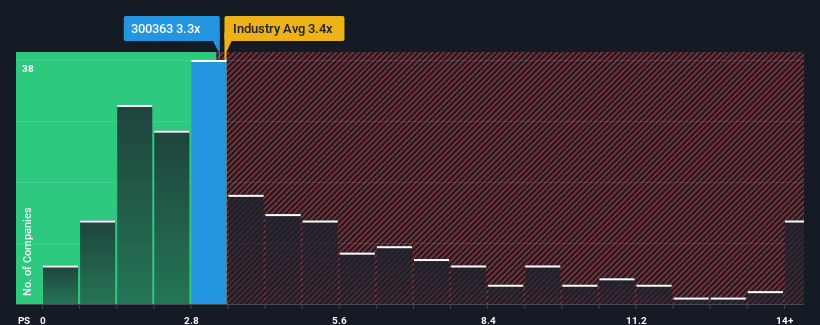

Even after such a large jump in price, there still wouldn't be many who think Porton Pharma Solutions' price-to-sales (or "P/S") ratio of 3.3x is worth a mention when the median P/S in China's Pharmaceuticals industry is similar at about 3.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Porton Pharma Solutions Has Been Performing

While the industry has experienced revenue growth lately, Porton Pharma Solutions' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Porton Pharma Solutions' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Porton Pharma Solutions' to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Porton Pharma Solutions' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 51%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 12% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 30% over the next year. Meanwhile, the rest of the industry is forecast to expand by 142%, which is noticeably more attractive.

With this information, we find it interesting that Porton Pharma Solutions is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Porton Pharma Solutions appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Porton Pharma Solutions' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 2 warning signs for Porton Pharma Solutions you should be aware of, and 1 of them is a bit unpleasant.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.