Author: CoinMarketCap Research & Footprint Analytics; Compiled by: Plain Language Blockchain

The role of bitcoin in defi (decentralized finance) is undergoing a huge transformation. From initially just simple point-to-point transfers, the world's first cryptocurrency is now gradually emerging as a powerful force in the defi space, starting to challenge Ethereum's long-standing dominance.

Through comprehensive analysis of on-chain data on the current status and growth trajectory of the bitcoin ecosystem, we have identified a clear picture: BTCFi (the combination of bitcoin and defi) is not just a technical transformation, but may also trigger a paradigm shift in the role of bitcoin in defi. As we delve into, the impact of this shift may redefine the entire landscape of the defi field.

01. The Rise of BTCFi

In 2008, Satoshi Nakamoto introduced bitcoin, initially designed as a peer-to-peer electronic cash system. While this architecture is revolutionary in the field of crypto assets, it has significant limitations in more complex financial applications, such as defi.

In 2008, Satoshi Nakamoto introduced bitcoin, initially designed as a peer-to-peer electronic cash system. While this architecture is revolutionary in the field of crypto assets, it has significant limitations in more complex financial applications, such as defi.

02. Bitcoin's Original Design and its Limitations in DeFi

Core design elements and their limitations:

1) UTXO Model: Bitcoin uses the Unspent Transaction Output (UTXO) model, which is effective in handling simple transfers but lacks the flexibility needed to support complex smart contracts.

Limited script language: Bitcoin's script language is designed to be limited primarily to avoid security vulnerabilities. However, this limitation also hinders its support for complex DeFi applications because of the limited number of executable operation codes (opcodes).

Lack of Turing completeness: Unlike Ethereum, Bitcoin's script is not Turing complete, making it difficult to implement complex smart contracts that rely on state, which are crucial for many DeFi protocols.

Block size and transaction speed: Bitcoin's 1MB block size limit and 10-minute block generation time result in transaction processing speeds much lower than other blockchains focused on DeFi.

While these design choices enhance Bitcoin's security and decentralization, they also pose obstacles to directly implementing DeFi functionality on the Bitcoin blockchain. The lack of native support for features like loops, complex conditions, and state storage makes it very difficult to build applications such as DEX, lending platforms, or liquidity mining protocols on Bitcoin.

Early attempts and development of DeFi on Bitcoin

Despite these limitations, Bitcoin's strong security and wide application have prompted developers to seek innovative solutions:

1) Colored Coins (2012-2013): This was one of the early attempts to expand Bitcoin's functionality. Colored coins represented and transferred real-world assets by 'coloring' specific bitcoins and attaching unique metadata. While not true DeFi, it laid the foundation for developing more complex financial applications on Bitcoin.

2) Counterparty (2014): This protocol introduced the ability to create and trade custom assets on the Bitcoin blockchain, including the first NFT. Counterparty demonstrated the potential of developing more complex financial instruments on Bitcoin.

Lightning Network (2015-present): The Lightning Network is a layer-two protocol designed to improve transaction scalability. By introducing payment channels, it opens up possibilities for more complex financial interactions, including some initial DeFi applications.

Discreet Log Contracts (DLC) (2017-present): Proposed by Tadge Dryja, DLC allows for complex financial contracts to be achieved without altering the Bitcoin base layer, providing new possibilities for derivatives and other DeFi tools.

Liquid Network (2018-present): Developed by Blockstream, this is a sidechain-based settlement network that supports the issuance of crypto assets and more complex Bitcoin transactions, paving the way for DeFi-like applications.

Taproot Upgrade (2021): By introducing Merkelized Abstract Syntax Trees (MAST), Taproot compresses complex transactions into a single hash, reducing transaction fees and memory usage. While not a DeFi solution itself, it enhances Bitcoin's smart contract capabilities, making complex transactions simpler and more efficient, laying the foundation for future DeFi developments.

These early developments laid the foundation for expanding Bitcoin's functionality from simple transfers to more applications. Although introducing DeFi on Bitcoin faces challenges, these innovations also demonstrate the potential of the Bitcoin ecosystem. These foundations pave the way for the innovation wave of layer-two solutions, sidechains, and Bitcoin DeFi, and we will delve into this area further.

Key Innovations: Implementing Smart Contracts on Bitcoin

In recent years, the Bitcoin ecosystem has seen multiple protocols aimed at introducing smart contracts and DeFi capabilities to this global first cryptocurrency. These innovations are changing the use cases of Bitcoin, making it more than just a store of value or medium of exchange. Here are some key protocols driving Bitcoin to achieve smart contracts:

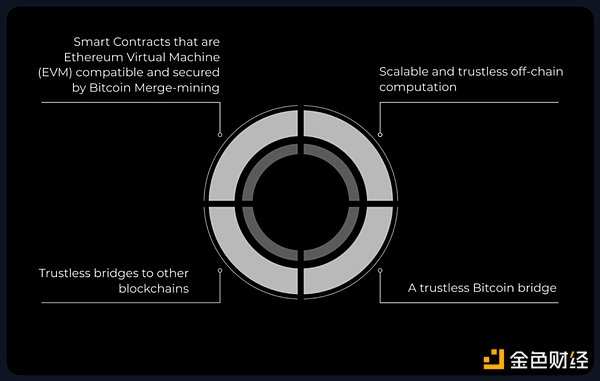

1) Rootstock: As a pioneer in Bitcoin smart contracts, Rootstock is the longest-running Bitcoin sidechain and has become a critical foundation for the BTCFi ecosystem.

It utilizes 60% of Bitcoin's hash power, supports dual mining, and is compatible with the Ethereum Virtual Machine (EVM), allowing Ethereum smart contracts to run on Bitcoin. Rootstock's unique Powpeg mechanism ensures seamless conversion between Bitcoin (BTC) and Rootstock Bitcoin (RBTC), while its 'deep defense' security model emphasizes simplicity and robustness.

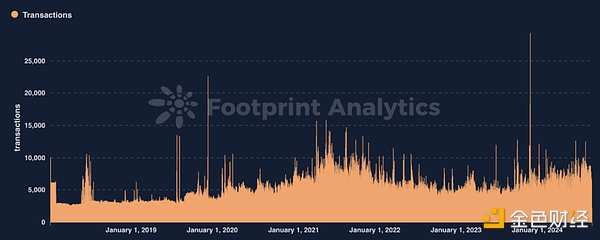

Since the mainnet launch in 2018, Rootstock's on-chain activities have been steadily growing. Footprint Analytics points out that it has established a stable and scalable solution within the Bitcoin ecosystem.

2) Core: Core is a Bitcoin-based blockchain closely integrated with Bitcoin and compatible with the Ethereum Virtual Machine (EVM).

Core has attracted attention with its innovative dual pledge model, combining Bitcoin and Core. Through non-custodial Bitcoin pledging, Core has established a risk-free yield for Bitcoin, effectively transforming Bitcoin into an income-generating asset. Core reports that 55% of Bitcoin mining hash power is delegated to its network, enhancing its security in DeFi applications.

3) Merlin Chain: Merlin Chain is a relatively new Bitcoin layer 2 network dedicated to unlocking Bitcoin's DeFi potential and is gaining increasing attention. It integrates ZK-Rollup technology, decentralized oracle and on-chain anti-fraud module, providing Bitcoin holders with a complete set of DeFi functions. M-BTC introduced by Merlin is a packaged Bitcoin asset that can earn staking rewards, opening up new avenues for yield generation and participation in DeFi.

4) BEVM: BEVM represents a significant advancement in directly introducing Ethereum's extensive DeFi ecosystem into Bitcoin. As the first fully decentralized and EVM compatible Bitcoin layer network, BEVM uses Bitcoin as fuel, allowing seamless deployment of Ethereum decentralized applications (DApps) on Bitcoin. BEVM is supported by mining giant Bitmain, pioneering the concept of 'hash power RWA,' potentially unlocking new value dimensions for the Bitcoin ecosystem.

Key innovations in Bitcoin layer 2 networks and sidechains:

Tokenizing bitcoin assets;

Smart contract and EVM compatibility;

Bitcoin with yield;

Scalability and enhanced privacy.

These protocols are not just replicating Ethereum's DeFi strategies on Bitcoin, but are opening up new directions by leveraging Bitcoin's unique characteristics. From Rootstock's deep defense mechanisms, to Core's dual staking model, to Merlin's comprehensive DeFi solutions and BEVM's computing power RWA innovation, the BTCFi sector is rapidly evolving.

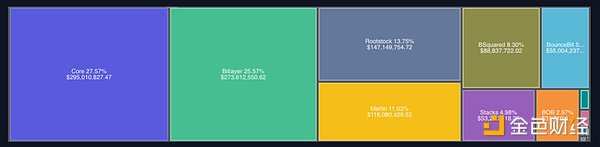

As of September 8, 2024, the total value locked (TVL) in Bitcoin's layer 2 solutions and sidechains has reached $1.07 billion, growing 5.7 times since January 1, 2024, and a remarkable 18.4 times since January 1, 2023.

Core leads with 27.6% of the total locked value (TVL), followed closely by Bitlayer at 25.6%; Rootstock at 13.8%; Merlin Chain at 11.0%.

05, The Current Situation of Bitcoin DeFi

As the Bitcoin DeFi ecosystem continues to evolve, some key projects have emerged, becoming important participants driving innovation and user adoption. These projects rely on Bitcoin's layer 2 solutions and sidechains to provide various DeFi services:

1)Major BTCFi Projects

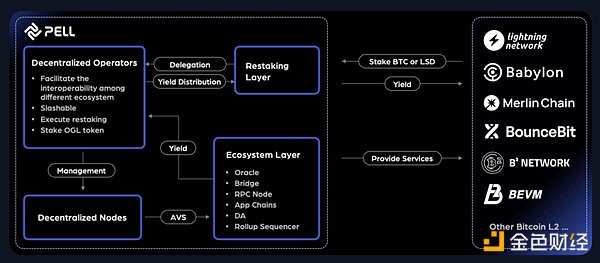

Pell Network (Cross-chain)

Pell Network is a cross-chain re-collateralization protocol designed to enhance the security of the Bitcoin ecosystem and optimize returns. Users earn rewards by staking Bitcoin or Liquidity Staking Derivatives (LSD), while decentralized operators are responsible for running verification nodes to ensure network security. Pell offers a range of proactive verification services such as oracles, cross-chain bridges, and data availability, supporting a wider Bitcoin layer 2 ecosystem. With its robust infrastructure, Pell aims to become a key player in providing liquidity and securing the crypto economy, driving sustainable growth of the Bitcoin economy.

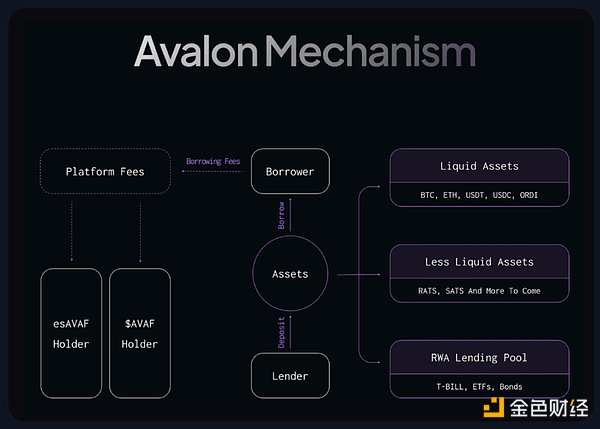

Avalon Finance (multichain)

Avalon Finance is a multichain defi platform that spans Bitlayer, Core, and Merlin Chain, known for providing comprehensive borrowing and trading services in the BTC defi ecosystem. Avalon's main services include over-collateralized lending for major assets and low liquidity assets, with dedicated isolation pools. The platform also integrates derivative trading, enhancing its lending services. Additionally, Avalon has introduced an algorithmic stablecoin designed to optimize capital efficiency, making it a versatile and secure defi solution in the Bitcoin ecosystem. Its governance token AVAF adopts the ES Token model, incentivizing liquidity provision and protocol usage.

Colend Protocol (Core)

Colend Protocol is a decentralized lending platform built on the Core blockchain, where users can securely borrow Bitcoin and other assets. By leveraging Core's dual collateral model, Colend seamlessly integrates with the wider defi ecosystem, enhancing the utility of Bitcoin in defi. Its main features include decentralized and immutable transactions, multiple dynamic interest rate liquidity pools, and a flexible collateral system.

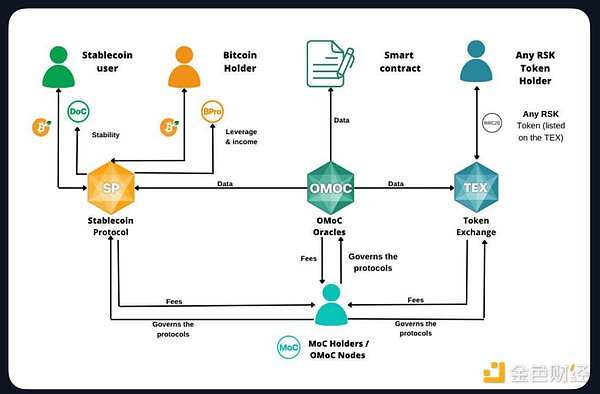

MoneyOnChain (Rootstock)

MoneyOnChain is a comprehensive defi protocol built on Rootstock, allowing Bitcoin holders to increase asset returns while retaining full control of private keys. At the core of this protocol is the issuance of a stablecoin called Dollar on Chain (DoC), which is fully collateralized by Bitcoin and designed for users who wish to maintain the value of their Bitcoin holdings pegged to the Dollar. Additionally, MoneyOnChain offers the BPRO token, enabling users to gain leverage exposure to Bitcoin for passive income.

The architecture of the protocol is based on a risk-sharing mechanism, using a proprietary financial model to deal with extreme market fluctuations. Additionally, it includes a decentralized Token trading platform (TEX), a decentralized oracle (OMoC), and governance Token (MoC), allowing users to participate in protocol decisions, stake, and earn rewards.

Sovryn (Multi-chain)

Sovryn is a DEX and one of the most feature-rich DeFi platforms built on Bitcoin, designed to enable users to trade, borrow, and earn profits using Bitcoin. Spanning both BOB and Rootstock platforms, Sovryn offers a variety of DeFi services including trading, swapping, liquidity provision, staking, and borrowing. The platform focuses on creating a permissionless financial layer for Bitcoin and integrates with other blockchains, making it a unique multi-chain platform in the Bitcoin DeFi ecosystem.

Sovryn's governance Token SOV plays a critical role in decentralized protocols managed through the Bitocracy system, representing voting rights and rewarding active participants.

Solv Protocol (Merlin Chain)

Solv Protocol is at the forefront of NFT securitization, enabling users to create, trade, and manage on-chain credentials. The protocol aims to tokenize and aggregate the income of various DeFi protocols in the Merlin Chain ecosystem. Its flagship product SolvBTC is an income Token that allows Bitcoin holders to earn profits while maintaining liquidity.

Solv Protocol is dedicated to building a powerful liquidity layer through staking and other income-generating activities. This flexibility makes it an important defi project on Merlin Chain, unlocking new financial opportunities in the bitcoin ecosystem.

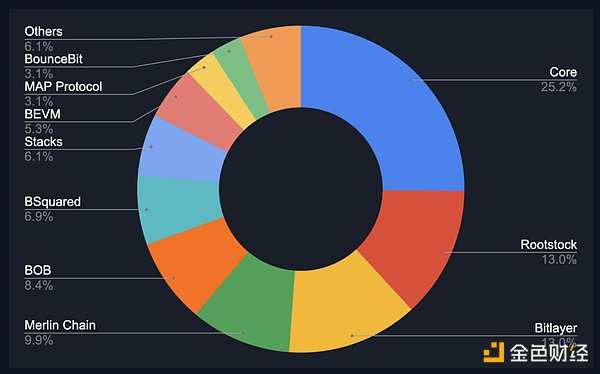

These projects highlight the dynamics and rapid development of the bitcoin defi field, with each project contributing unique features to expand the ecosystem's coverage. As of September 8, 2024, Core holds a leading position in the bitcoin defi space, with its project count accounting for 25.2% of active projects, further solidifying its core role in the ecosystem. Rootstock and Bitlayer, as significant participants, each support 13.0% of projects, reflecting their importance in enhancing liquidity and capital efficiency in the bitcoin defi ecosystem. Merlin Chain also plays a key role in expanding bitcoin defi functionality with a 9.9% project share. Other platforms such as BOB (8.4%), BSquared (6.9%), and Stacks (6.1%) contribute to the diversity of the ecosystem, while BEVM (5.3%), BounceBit (3.1%), and MAP Protocol (3.1%) drive overall growth through their specialized solutions.

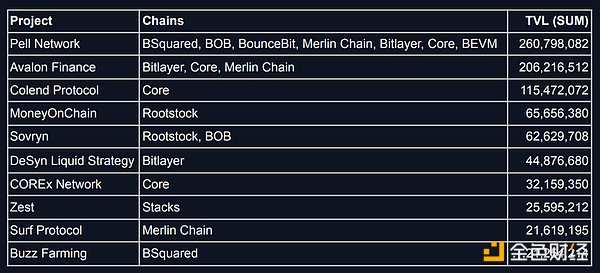

Pell Network leads the defi projects with a total locked value (TVL) of 0.2608 billion USD, establishing its leadership position in the NFT financial sector. Avalon Finance and Colend Protocol have TVLs of 0.2062 billion USD and 0.1155 billion USD respectively, making them important participants. Other notable projects include MoneyOnChain and Sovryn, showcasing the diversity of the BTCFi field, covering areas from yield farming to stablecoins.

Key Narratives in Major BTCFi Projects

Security and Decentralization First: The bitcoin defi ecosystem prioritizes security and decentralization as core principles. Bitcoin's unmatched security framework forms the foundation of the BTCFi ecosystem, ensuring that all innovations adhere to these fundamental principles.

Bitcoin as a Programmable Token: BTCFi is transforming the role of bitcoin, making it not just a store of value but a programmable token. This shift, through the use of smart contracts, enables the possibility of a new generation of complex financial applications. For example, Solv Protocol's SolvBTC is referred to as the 'first interest-bearing bitcoin,' offering returns through a neutral trading strategy in the yield farming protocols of ethereum, Arbitrum, and Merlin Chain.

Interoperability with ethereum: BTCFi establishes a bridge with the Ethereum DeFi ecosystem through an EVM-compatible solution, fully leveraging the strengths of both networks. This interoperability creates a powerful synergistic effect, combining the security of Bitcoin with the flexible smart contract capabilities of Ethereum. For example, Core executes smart contracts through EVM, which means decentralized applications (dApps) developed for Ethereum can easily transition to the Core blockchain without significant modifications.

Unlocking capital for Bitcoin: The BTCFi ecosystem is releasing a significant amount of capital for DeFi purposes, providing yield opportunities while allowing users to retain their Bitcoin investment exposure, thereby enhancing the utility and attractiveness of Bitcoin in DeFi.

3) Comparative Analysis with Ethereum DeFi

As Bitcoin DeFi continues to evolve, it becomes increasingly important to compare it with Ethereum DeFi. Especially important is to focus on how Bitcoin operates in the Ethereum ecosystem through wrapped assets like wBTC and renBTC, as well as what lessons we can learn from Ethereum's development journey.

4) Ethereum DeFi VS Bitcoin and Native Bitcoin DeFi

The integration between Bitcoin and Ethereum DeFi ecosystems is mainly achieved through wrapped assets like wBTC and renBTC. These tokens enable Bitcoin holders to convert BTC to ERC-20 Tokens, thus gaining access to Ethereum's vast DeFi ecosystem, which can be utilized on platforms like MakerDAO, Aave, and Uniswap.

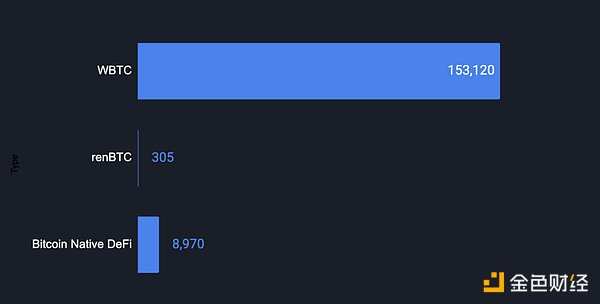

There are significant differences in the use of BTC between these two ecosystems. As of September 8th, the amount of BTC locked in Ethereum DeFi protocols is 0.1534 million, far exceeding the 0.00897 million in Bitcoin's native DeFi ecosystem. This trend is due to Ethereum's mature and diversified DeFi infrastructure, offering a wider range of financial products including lending, trading, and yield farming.

Although wrapped Bitcoin tokens like WBTC can provide users with liquidity and more advanced DeFi functions, they also rely on custodians and cross-chain bridges, which may increase risks. In contrast, native Bitcoin DeFi projects, although smaller in scale, operate within Bitcoin's own security framework, avoiding many risks associated with cross-chain transfers. However, Bitcoin DeFi is still in its early stages, and the range of financial services it offers is still limited compared to Ethereum.

06. Insights from Ethereum's development compared to Bitcoin and vice versa.

1) Experiences Bitcoin can learn from Ethereum:

Product diversity: Ethereum's success in DeFi is largely due to its wide range of financial products and services, such as DEXs and synthetic assets. To drive the development of Bitcoin DeFi, it is necessary to expand the range of its products beyond just borrowing and stablecoin services. Developing more complex financial tools and interoperability solutions may attract more users.

Developer ecosystem: Ethereum has cultivated an active developer community, continuously innovating and building new projects on the platform. Bitcoin DeFi projects can also promote a more active developer ecosystem, encouraging the creation of new protocols and applications to leverage Bitcoin's strengths.

Interoperability: Ethereum's DeFi ecosystem performs well in both internal interoperability and with other blockchains. Enhancing Bitcoin DeFi's interoperability with other chains (including Ethereum) may bring new opportunities for users to leverage the advantages of both ecosystems.

2) Experiences Ethereum can learn from Bitcoin:

Security and decentralization: Bitcoin's emphasis on security and decentralization is unparalleled. Ethereum projects can gain insights from Bitcoin's conservative approach to ensure that these core principles are not compromised while innovating rapidly. This is particularly crucial as Ethereum transitions to more scalable solutions like Layer 2, where security issues must be handled with caution.

Simplicity and robustness: Although bitcoin's scripting function is relatively simple and robust, its lack of flexibility results in fewer vulnerabilities compared to the complex smart contracts on ethereum. Ethereum developers can prioritize maintaining simplicity and robustness in smart contract design to reduce security risks.

Focus on value storage: While ethereum is known for its smart contract functionality, bitcoin still maintains a strong position in the area of value storage. The ethereum ecosystem can explore methods to enhance its value storage functionality, possibly by integrating more bitcoin-based assets to attract users who prioritize security and asset preservation.

Although bitcoin defi is still in its early stages, it has significant growth potential if it draws on the experience of ethereum's mature ecosystem. At the same time, ethereum can learn from bitcoin's advantages in security and decentralization to further strengthen its defi products. As these two ecosystems evolve, their collaboration and mutual learning could drive the next growth phase of DeFi.

Challenges and Opportunities

As this field continues to develop, it is necessary to address technological and regulatory barriers, while technological advancements and emerging growth areas also bring significant expansion opportunities.

1) Technological Barriers

Developing DeFi on bitcoin faces many technological challenges. Scalability is a major concern, as bitcoin's base layer has limited transaction processing capabilities due to block size and block time constraints. Unlike ethereum, which already has multiple mature Layer 2 solutions, bitcoin's Layer 2 and sidechain ecosystems are still in their early stages, limiting the range of DeFi applications that can be effectively supported.

Secondly, interoperability presents a significant challenge. Connecting bitcoin with other blockchain ecosystems without compromising security or decentralization is quite complex and requires innovative solutions.

Regulatory Concerns

With the continuous development of bitcoin defi, it is expected that regulatory scrutiny will intensify. Governments and financial regulatory agencies may impose stricter regulations on defi services, especially in terms of AML and KYC. The decentralization and pseudo-anonymous nature of bitcoin make compliance complex, which may affect the adoption and development of bitcoin defi. Therefore, finding a balance in these regulatory environments is crucial for the sustainable growth of bitcoin defi.

08, Future Opportunities

1) Technological Progress

Bitcoin defi has a lot of room for technological advancement. Improvements in Layer 2 solutions, such as more efficient and secure sidechains, as well as the development of more scalable and interoperable frameworks, could significantly enhance the capabilities of the bitcoin defi ecosystem. In addition, advancements in discreet log contracts (DLCs) and privacy protection technologies (such as zero-knowledge proofs) could make more complex and secure financial applications a reality.

2) Predictions for Future Growth Areas

As the bitcoin defi ecosystem continues to mature, several areas show strong growth potential. Products, DEXs, and cross-chain liquidity pools that generate revenue are expected to attract increasing attention. At the same time, with the growing interest of institutions in bitcoin, there is expected to be higher demand for defi products tailored to institutional needs, such as custody solutions, compliant financial tools, and bitcoin-supported stablecoins. These developments provide early adopters and innovators in the bitcoin defi space with opportunities for high investment returns.

09, Conclusion

Looking ahead, the bitcoin defi ecosystem will continue to expand with the advancement of technology and increasing institutional interest. Developing more scalable Layer2 solutions, enhancing interoperability, and introducing more complex financial products are crucial for this expansion. As the ecosystem matures, products, DEX, and institutional defi services expected to generate revenue will attract significant attention and funds.

However, this growth will also face challenges, especially in dealing with the ever-changing regulatory environment and overcoming technical challenges related to scalability and security. Addressing these issues is crucial for maintaining the growth momentum of bitcoin defi and ensuring its long-term success.

In summary, the future of bitcoin defi looks promising, with abundant opportunities for innovation and growth. As the ecosystem continues to evolve, it has the potential to have a profound impact on the entire defi ecosystem, making bitcoin a core player in DeFi.

2008年,中本聪推出了比特币,最初的设计目的是作为一种点对点的电子现金系统。虽然这一架构在加密资产领域具有革命性意义,但在更复杂的金融应用(比如 DeFi)方面却存在明显的局限性。

2008年,中本聪推出了比特币,最初的设计目的是作为一种点对点的电子现金系统。虽然这一架构在加密资产领域具有革命性意义,但在更复杂的金融应用(比如 DeFi)方面却存在明显的局限性。