①The Agricultural Bank of China announced that the transfer of Bonds Market Treasure bonds for individual investors is not subject to quota restrictions; ② This is the second bank to adjust the transfer-out limit for bond custody business recently, following Minsheng Bank. From publicly available information, Agricultural Bank of China is also the first state-owned major bank to make adjustments; ③ Currently, the main participants in the bond market are institutional investors, with the market share and influence of individual investors being very limited.

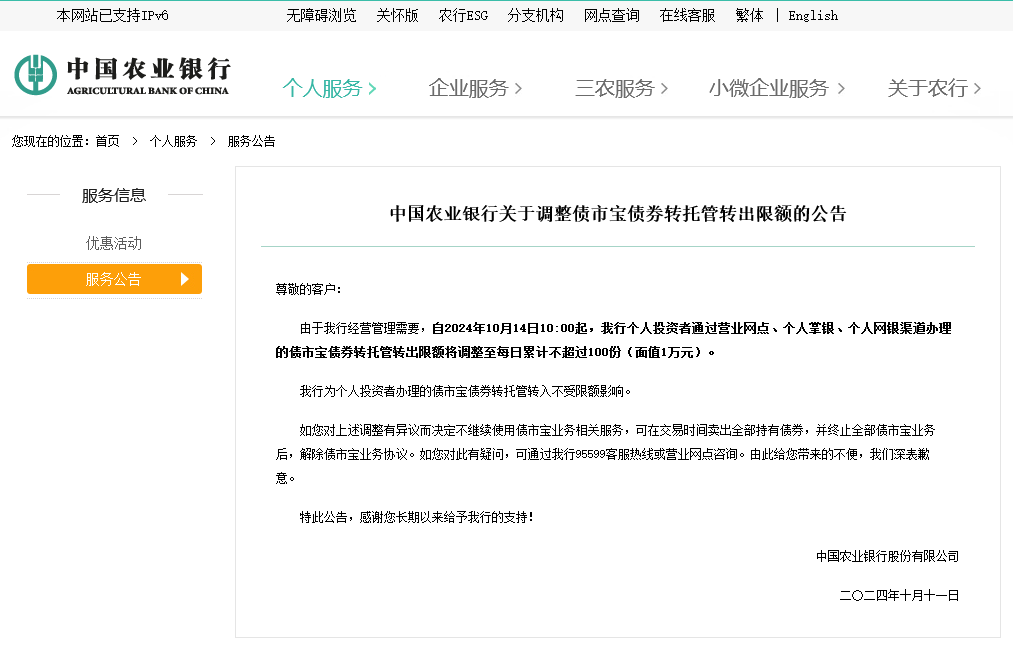

On October 11th, Caixin reporters learned that starting from 10:00 on October 14, 2024, the daily cumulative limit for individual investors of Agricultural Bank to transfer out Bonds Market Treasure bonds through branch offices, personal mobile banking app, and personal online banking channels will be adjusted to not exceed 100 units per day (face value of 0.01 million yuan).

The Agricultural Bank of China announcement also emphasizes that the transfer-in of Bonds Market Treasure bonds for individual investors handled by the bank is not affected by quotas.

Caixin reporters noted that this is the second bank in recent times to adjust the transfer-out limit of the bond custody business following Minsheng Bank. From publicly available information, Agricultural Bank of China is also the first state-owned major bank to make adjustments.

Caixin reporters noted that this is the second bank in recent times to adjust the transfer-out limit of the bond custody business following Minsheng Bank. From publicly available information, Agricultural Bank of China is also the first state-owned major bank to make adjustments.

Regarding the impact of the adjustment to related business rules, a fixed income industry analyst told Caixin reporters that currently, institutional investors are the main participants in the bond market, with the market share and influence of individual investors being very limited.

According to publicly available information, bond custody transfer business is a common operation in the bond market. It generally refers to the transfer of bonds held by bond investors from one custody account to another (usually between two financial institutions). The purpose of the transfer is to allow investors to flexibly manage and trade their bonds between different custodians, aiming to achieve more profits.

Today, reporters found on the Agricultural Bank of China official website that Bonds Market Treasure mobile banking was launched no later than 2018. This service provides individual customers with a series of comprehensive bond investment services including signing contracts, bond subscription and trading, transfer of custody, etc. Individual customers can directly participate in bond market investment transactions by logging into the Agricultural Bank of China mobile banking app.

Minsheng Bank has also made adjustments to the bond custody business, similarly limiting the transfer amount.

It is worth noting that on the morning of September 18, Minsheng Bank's official website announced that, starting from today, the daily transfer limit for the counter account-style bond custody business will be adjusted to not exceed 0.01 million yuan (inclusive of equivalent face value bonds).

According to public information, counter account-style bonds refer to RMB-denominated bond investment products provided by banks to customers through electronic banking channels and domestic business outlets. Currently, the bond types of counter account-style bonds mainly include nationally issued bonds approved by the issuer, local government bonds, China Development Bank bonds, policy bank bonds, and new bonds issued to counter business investors.

A comparison by Cailian Society reporters of the announcements of the two banks found that both have a daily transfer limit of 0.01 million yuan.

财联社记者注意到,这是此前民生银行之后,近期第二家对债券转托管业务转出限额进行调整的银行。从公开信息来看,农行也是首家做出调整的国有大行。

财联社记者注意到,这是此前民生银行之后,近期第二家对债券转托管业务转出限额进行调整的银行。从公开信息来看,农行也是首家做出调整的国有大行。