①中集車輛和潤澤科技兩家創業板公司同日披露遭多傢俬募基金股東預計減持,相關主體均與中國平安存在關聯。②險資近期加快調倉步伐,本輪行情以來已至少6家A股公司遭到險資減持。③10月9日,多家頭部險企發聲,將進一步發揮好資本市場「穩定器」和「助推器」的作用。

財聯社10月11日訊(記者 鄒俊濤)A股本輪行情啓動以來,越來越多險資趁機加快調倉步伐。

10月10日晚,中集車輛(301039.SZ)和潤澤科技(300442.SZ)兩家創業板公司同時發佈關於大股東減持預披露公告。其中,中集車輛公告披露,兩家股東計劃合計減持公司A股股份不超過10,000,000股,佔總股本不超過0.53%;潤澤科技公告披露,四家股東計劃合計減持公司不超過4,100,000股股份,佔公司總股本不超過0.24%。

財聯社記者注意到,上述兩家公司披露相關減持主體均與中國平安間接關聯,且均爲股權私募基金。中集車輛公告,兩家減持主體均爲中國平安保險(集團)股份有限公司(簡稱「中國平安」)間接持有100%權益的企業;潤澤科技公告,四家減持主體實際控制人爲中國平安或執行事務合夥人受中國平安控制而構成一致行動人關係。

財聯社記者注意到,上述兩家公司披露相關減持主體均與中國平安間接關聯,且均爲股權私募基金。中集車輛公告,兩家減持主體均爲中國平安保險(集團)股份有限公司(簡稱「中國平安」)間接持有100%權益的企業;潤澤科技公告,四家減持主體實際控制人爲中國平安或執行事務合夥人受中國平安控制而構成一致行動人關係。

財聯社記者注意到,趁此輪行情調倉的險資不在少數。據不完全統計,本輪行情以來至少已有6家A股公司遭到險資減持,涉及中國人壽、泰康人壽、陽光人壽等多家險企。業內人士指出,險資減持行爲主要系險資資產配置及戰略調整需要,並非行業統一性調整。

中國平安關聯私募基金減持兩家A股公司

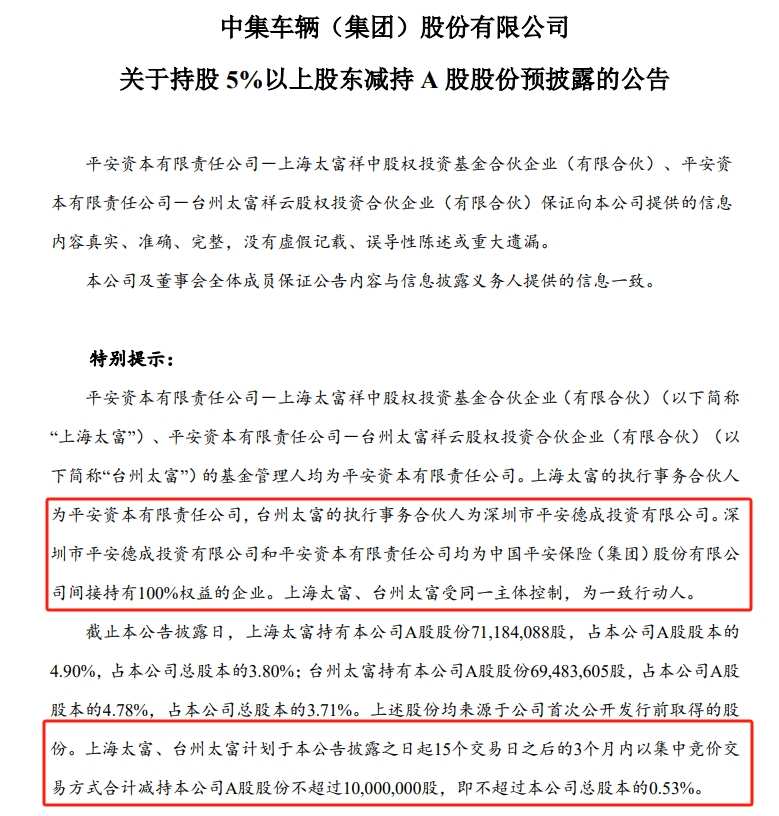

據中集車輛10日晚公告,近日收到平安資本有限責任公司-上海太富祥中股權投資基金合夥企業(有限合夥)(簡稱「上海太富」)、平安資本有限責任公司-台州太富祥雲股權投資合夥企業(有限合夥)(簡稱「台州太富」)出具的《減持計劃告知函》,兩傢俬募股權基金計劃於本公告披露之日起15個交易日之後的3個月內以集中競價交易方式合計減持本公司A股股份不超過10,000,000股,即不超過本公司總股本的0.53%。

公告中稱,兩家基金的基金管理人均爲平安資本有限責任公司。上海太富的執行事務合夥人爲平安資本有限責任公司,台州太富的執行事務合夥人爲深圳市平安德成投資有限公司。深圳市平安德成投資有限公司和平安資本有限責任公司均爲中國平安間接持有100%權益的企業。上海太富、台州太富受同一主體控制,爲一致行動人。

△截圖來自中集車輛公告

公告顯示,上述股份均來源於公司首次公開發行前取得的股份。截止該公告披露日,上海太富持有中集車輛A股股份71,184,088股,佔A股股本的4.90%,佔公司總股本的3.80%;台州太富持有中集車輛A股股份69,483,605股,佔公司A股股本的4.78%,佔本公司總股本的3.71%。

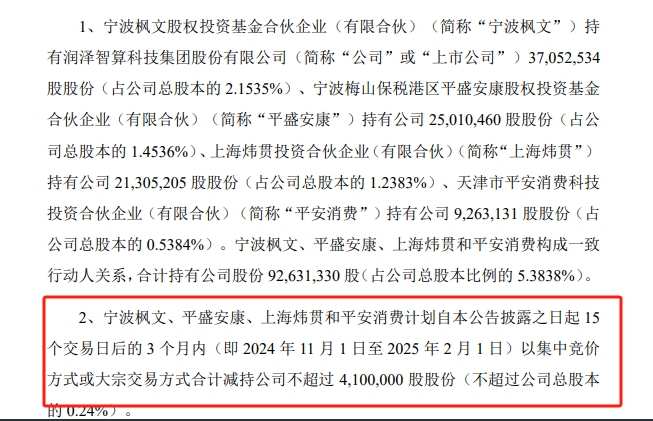

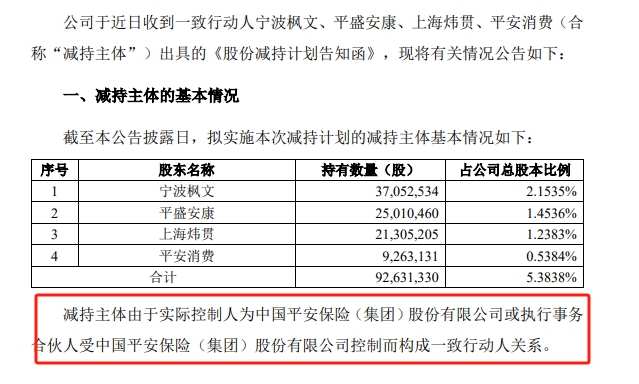

同日晚,潤澤科技發佈公告,近日收到一致行動人寧波楓文股權投資基金合夥企業(有限合夥)(簡稱「寧波楓文」)、寧波梅山保稅港區平盛安康股權投資基金合夥企業(有限合夥)(簡稱「平盛安康」)、上海煒貫投資合夥企業(有限合夥)(簡稱「上海煒貫」)、天津市平安消費科技投資合夥企業(有限合夥)(簡稱「平安消費」)出具的《股份減持計劃告知函》,計劃自本公告披露之日起15個交易日後的3個月內(即2024年11月1日至2025年2月1日)以集中競價方式或大宗交易方式合計減持公司不超過4,100,000股股份(不超過公司總股本的 0.24%)。

△截圖來自潤澤科技公告

公告顯示,減持股份來源爲潤澤科技2022年實施重大資產置換、發行股份購買資產並募集配套資金暨關聯交易時爲向上述四家公司購買其持有的潤澤科技發展有限公司(簡稱「潤澤發展」)股權而向其發行的有限售條件股份。截止該公告披露日,上述四家公司合計持有潤澤科技92,631,330股股份(佔公司總股本比例的5.3838%)。

中集車輛和潤澤科技在公告中表示,本次減持計劃實施不會導致公司控制權發生變更,不會對公司的持續經營產生影響。此外,本次減持計劃的實施存在不確定性,相關減持主體將根據市場情況、本公司股價情況等情況擇機決定是否全部或部分實施本次股份減持計劃。

本輪行情以來至少6家A股公司遭險資減持

關於減持理由,中集車輛公告中披露爲「退出需要」,潤澤科技公告中披露爲「自身資金需求」。分析人士指出,近期A股情緒明顯好轉,不少上市公司的股價漲幅較大,成交量也明顯上來,部分股東選擇在此時套現在所難免。前海開源基金首席經濟學家楊德龍表示,伴隨着市場行情上漲,上市公司的市值也隨之增加,一些公司發佈減持計劃,說明了市場對於這輪行情上漲存在一定分歧。

資料顯示,中集車輛爲半掛車生產企業,公司在全球主要市場開展七大類半掛車的生產、銷售和售後市場服務;潤澤科技爲大數據科技企業,公司以算力爲基礎、數字技術爲手段、智慧應用爲示範,爲各行業提供新一代數字經濟產業技術、產品、服務和系統解決方案。

最新半年報顯示,中集車輛上半年總營收107億元,同比下降20.56%,歸母淨利潤5.63億元,同比下降70.33%;潤澤科技上半年總營收35.75億元,同比增長112.47%,歸母淨利潤9.67億元,同比增長37.64%

儘管業績差異較大,但兩家公司股價在本輪行情驅動下均出現較大幅度上漲。Wind數據顯示,截止10月11日收盤,中集車輛近30日股價漲幅爲20%,潤澤科技近30日漲幅爲31.75%。拉長週期來看,中集車輛年初至今股價漲幅僅爲9.38%,潤澤科技年初至今漲幅爲20.18%。

財聯社記者注意到,自本輪行情啓動以來,已至少有6家A股公司披露遭到險資減持。

除了中集車輛和潤澤科技,華熙生物10月8日披露中國人壽旗下私募基金國壽成達將減持其不超過2.50%股權,萬豐奧威10月8日披露百年人壽於2024年8月2日至2024年9月27日通過集中競價交易方式減持公司1%股權,招商公路10月7日披露泰康人壽將減持其不超過0.4%股權,華康醫療9月24日披露陽光人壽將減持其不超過3%股權。

10月9日,中國人保、中國人壽、中國太平等多家頭部險企通過媒體發聲,表示作爲長期、穩定的資金來源,保險資金對於資本市場的健康發展具有重要意義,將進一步發揮好資本市場「穩定器」和「助推器」的作用。

财联社记者注意到,上述两家公司披露相关减持主体均与中国平安间接关联,且均为股权私募基金。中集车辆公告,两家减持主体均为中国平安保险(集团)股份有限公司(简称“中国平安”)间接持有100%权益的企业;润泽科技公告,四家减持主体实际控制人为中国平安或执行事务合伙人受中国平安控制而构成一致行动人关系。

财联社记者注意到,上述两家公司披露相关减持主体均与中国平安间接关联,且均为股权私募基金。中集车辆公告,两家减持主体均为中国平安保险(集团)股份有限公司(简称“中国平安”)间接持有100%权益的企业;润泽科技公告,四家减持主体实际控制人为中国平安或执行事务合伙人受中国平安控制而构成一致行动人关系。