Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Air Products and Chemicals (NYSE:APD), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Air Products and Chemicals' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Air Products and Chemicals managed to grow EPS by 9.3% per year, over three years. That's a good rate of growth, if it can be sustained.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. We note that while EBIT margins have improved from 20% to 23%, the company has actually reported a fall in revenue by 6.7%. While not disastrous, these figures could be better.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. We note that while EBIT margins have improved from 20% to 23%, the company has actually reported a fall in revenue by 6.7%. While not disastrous, these figures could be better.

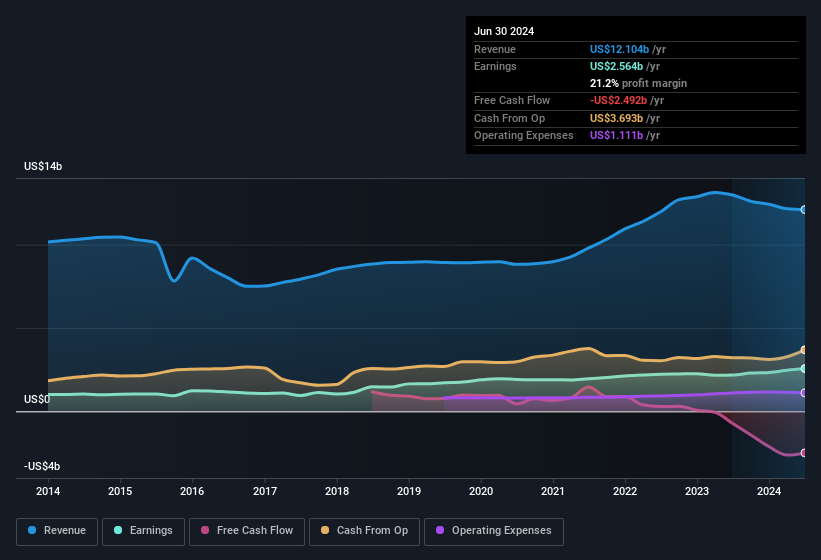

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Air Products and Chemicals' future profits.

Are Air Products and Chemicals Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping US$5.4m that the Chairman, Seifollah Ghasemi spent acquiring shares. We should note the average purchase price was around US$259. Insider buying like this is a rare occurrence and should stoke the interest of the market and shareholders alike.

Along with the insider buying, another encouraging sign for Air Products and Chemicals is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth US$273m. We note that this amounts to 0.4% of the company, which may be small owing to the sheer size of Air Products and Chemicals but it's still worth mentioning. This should still be a great incentive for management to maximise shareholder value.

Is Air Products and Chemicals Worth Keeping An Eye On?

As previously touched on, Air Products and Chemicals is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. That makes the company a prime candidate for your watchlist - and arguably a research priority. It is worth noting though that we have found 2 warning signs for Air Products and Chemicals that you need to take into consideration.

The good news is that Air Products and Chemicals is not the only stock with insider buying. Here's a list of small cap, undervalued companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.