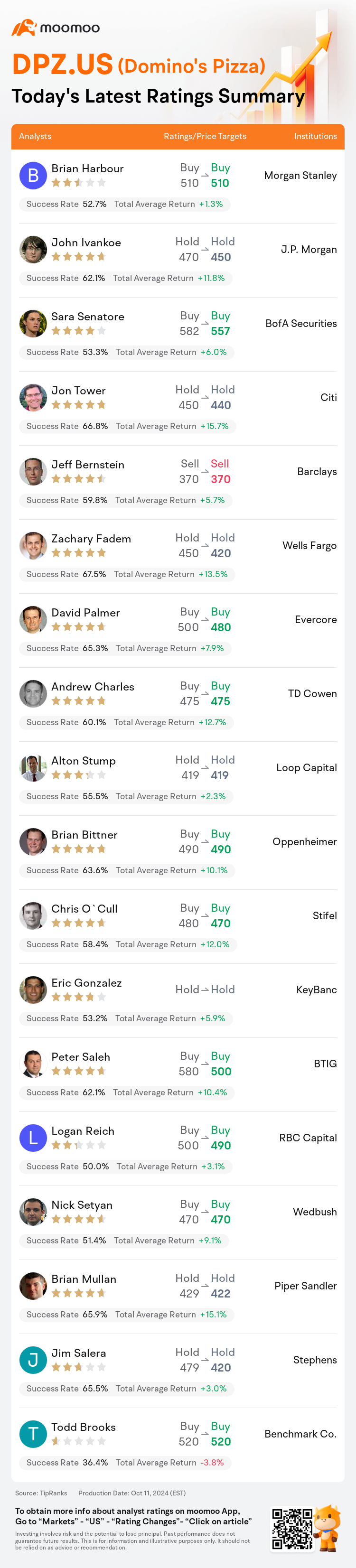

On Oct 11, major Wall Street analysts update their ratings for $Domino's Pizza (DPZ.US)$, with price targets ranging from $370 to $557.

Morgan Stanley analyst Brian Harbour maintains with a buy rating, and maintains the target price at $510.

J.P. Morgan analyst John Ivankoe maintains with a hold rating, and adjusts the target price from $470 to $450.

BofA Securities analyst Sara Senatore maintains with a buy rating, and adjusts the target price from $582 to $557.

BofA Securities analyst Sara Senatore maintains with a buy rating, and adjusts the target price from $582 to $557.

Citi analyst Jon Tower maintains with a hold rating, and adjusts the target price from $450 to $440.

Barclays analyst Jeff Bernstein maintains with a sell rating, and maintains the target price at $370.

Furthermore, according to the comprehensive report, the opinions of $Domino's Pizza (DPZ.US)$'s main analysts recently are as follows:

The evaluation of Domino's Pizza's recent quarter could be seen as varied, with domestic performance aligning with expectations, while international sectors primarily influenced a subdued revenue forecast. Looking ahead to 2025, the current projections might reflect a cautious stance potentially serving as a buffer against risks. However, there is still some ambiguity surrounding the conservative nature of these projections and the factors that will sustain domestic same-store sales growth exceeding 3% in FY25.

The company's reported U.S. comparable sales of 3.0% consisted of a notable 2.7% contribution from partnerships with Uber and other third-party channels, coupled with a 1.6% increase due to pricing. Overall, the results demonstrate that the company is facing challenges from an increasingly competitive marketplace.

Domino's Pizza's Q3 results and commentary suggest that the U.S. pizza sector is reverting to its pre-pandemic norms. The industry remains intensely competitive, with Domino's positioned as the leader and a consistent long-term market share gainer. However, same-store sales on a quarterly basis are influenced by the current success in value propositions, promotional battles, and innovative offerings.

Following the Q3 report, expectations for Domino's Pizza's FY24 earnings per share have been adjusted to reflect a more conservative stance, taking into account a moderated pace in international system growth and U.S. system comps, though this is somewhat balanced by reductions in supply chain costs and general & administrative expenses. Additionally, projections for FY25 earnings per share have been similarly revised, incorporating a tempered outlook on global system sales growth.

Domino's Pizza's third quarter presented a mix of outcomes, with U.S. and International comparable sales not meeting expectations, although adjusted EBITDA and EPS matched projections. Moving forward, the guidance for 2024 net unit growth has been moderated, particularly due to International factors, resulting in a more conservative outlook on global sales and profits. It is anticipated that these difficulties will extend into 2025.

Here are the latest investment ratings and price targets for $Domino's Pizza (DPZ.US)$ from 18 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

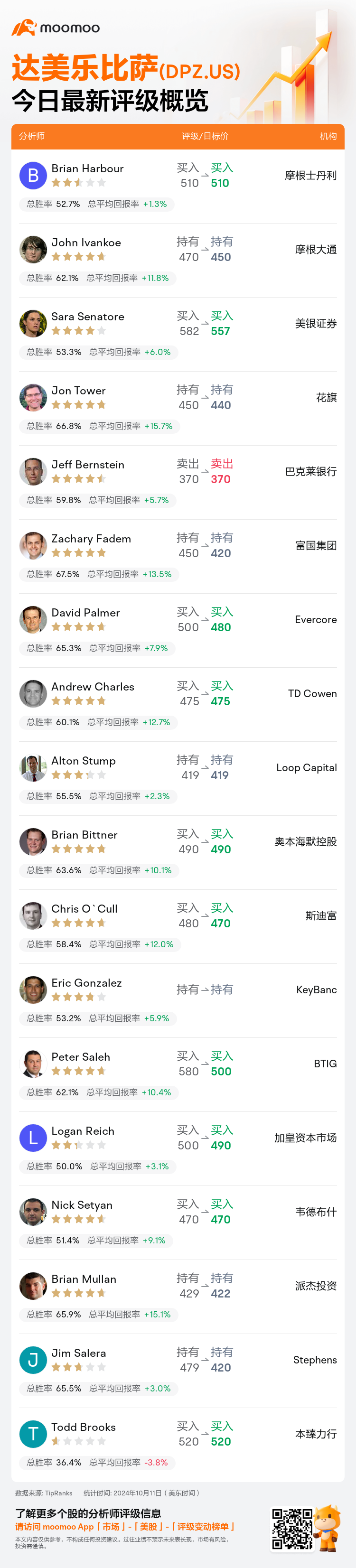

美东时间10月11日,多家华尔街大行更新了$达美乐比萨 (DPZ.US)$的评级,目标价介于370美元至557美元。

摩根士丹利分析师Brian Harbour维持买入评级,维持目标价510美元。

摩根大通分析师John Ivankoe维持持有评级,并将目标价从470美元下调至450美元。

美银证券分析师Sara Senatore维持买入评级,并将目标价从582美元下调至557美元。

美银证券分析师Sara Senatore维持买入评级,并将目标价从582美元下调至557美元。

花旗分析师Jon Tower维持持有评级,并将目标价从450美元下调至440美元。

巴克莱银行分析师Jeff Bernstein维持卖出评级,维持目标价370美元。

此外,综合报道,$达美乐比萨 (DPZ.US)$近期主要分析师观点如下:

达美乐披萨最近一个季度的评估可能被视为多样化,国内业绩符合预期,而国际板块主要影响了低迷的营业收入预测。展望2025年,当前的预测可能反映了一种谨慎态度,可能作为对风险的一种缓冲。然而,关于这些预测的保守性质和将支撑国内同店销售增长超过3%的因素仍存在一些不确定性。

公司报告的美国可比销售增长为3.0%,其中有着来自与优步和其他第三方渠道合作的显著2.7%的贡献,加上因定价而增加的1.6%。总体上,结果表明公司正面临日益竞争激烈的市场挑战。

达美乐披萨的第三季度业绩和评论表明,美国比萨板块正在恢复到疫情前的常态。该行业仍然竞争激烈,达美乐定位为领导者和长期市场份额增长者。然而,基于现阶段在价值主张、促销竞争和创新产品方面的成功,每季度同店销售受当前情况影响。

在第三季度报告后,调整了对达美乐披萨2024财年每股收益的预期,反映出一种更加谨慎的立场,考虑到国际体系增长和美国体系同店销售节奏减缓,尽管这在一定程度上被供应链成本和一般行政费用的降低所抵消。另外,对于2025财年每股收益的预测也进行了类似调整,包括对全球体系销售增长的温和展望。

达美乐披萨的第三季度呈现出多种结果,美国和国际可比销售未达预期,尽管调整后的EBITDA和每股收益与预期相符。展望未来,2024年净单位增长的指引已经调整,特别是由于国际因素,导致对全球销售和利润的更加保守前景。预计这些困难将延续至2025年。

以下为今日18位分析师对$达美乐比萨 (DPZ.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Sara Senatore维持买入评级,并将目标价从582美元下调至557美元。

美银证券分析师Sara Senatore维持买入评级,并将目标价从582美元下调至557美元。

BofA Securities analyst Sara Senatore maintains with a buy rating, and adjusts the target price from $582 to $557.

BofA Securities analyst Sara Senatore maintains with a buy rating, and adjusts the target price from $582 to $557.