Macro trend

In September 2024, the inflation rate in the USA exceeded expectations.

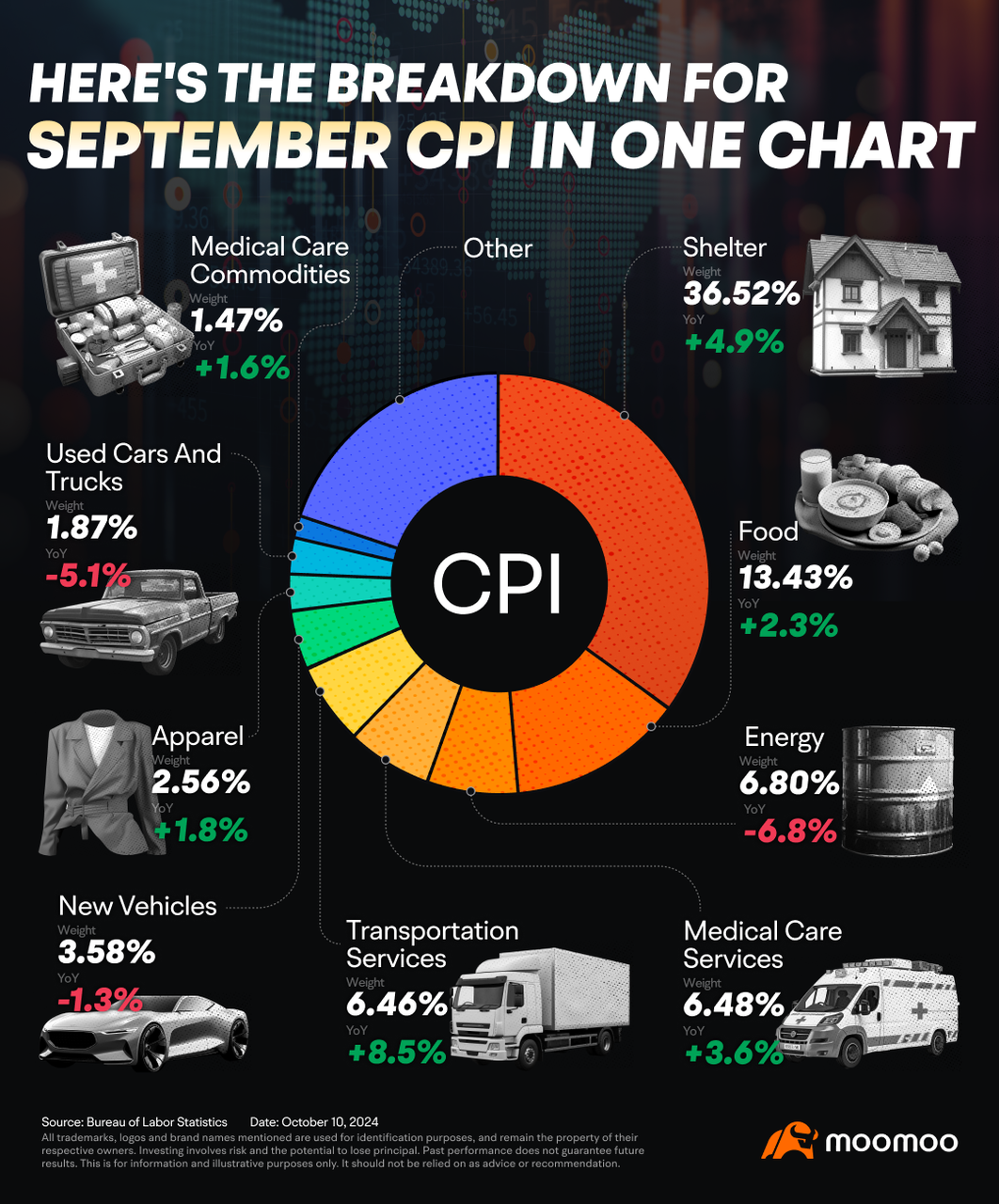

In September 2024, the US annual CPI continued its sixth consecutive month of decline, reaching 2.4% - the lowest level since February 2021 and lower than August's 2.5%. This number is slightly higher than the expected 2.3%. On a monthly basis, CPI increased by 0.2%, exceeding the expected increase of 0.1%.

The annual core inflation rate, excluding volatile items such as food and energy, rose from 3.2% in the previous two months to 3.3%, despite forecasts to remain unchanged.

The number of US unemployment benefit claimants hit a 14-month high, influenced by Hurricane Helen.

The number of US unemployment benefit claimants hit a 14-month high, influenced by Hurricane Helen.

The initial claims for US unemployment benefits surged by 33,000 people in the week ending October 5, reaching 258,000 people, exceeding the expected 230,000. This is the largest increase in 14 months and is significantly impacted by the sharp rise in Michigan and states affected by Hurricane Helen.

Fund Flows.

Private clients of Bank of America reduced their cash holdings, which still remained below the long-term average level, while increasing their exposure to stocks.

Recent downward revision of the estimated EPS for 2024-25 of the S&P 500 index reflects analysts' cautious attitude, mainly due to economic uncertainties.

According to Goldman Sachs' data, hedge funds sold record amounts of Chinese stocks on Tuesday.

"Hedge funds not only closed out long positions, but also increased short positions, with the quantity of long sales being twice that of short sales."

Company news.

Elon Musk bragged that the price of self-driving robot taxis is below 0.03 million US dollars.

Elon Musk has unveiled two self-driving cars: the Cyber taxi, a two-seater self-driving ride-sharing vehicle designed for carpooling, and the Robovan, which can carry up to 20 people. The cost of the Cyber taxi is expected to be below 30,000 US dollars, with plans in the future to have Uber and Lyft drivers manage fleets like 'shepherds.'

A series of content lacks practical details announced in his 20-minute speech, leading to the stock falling by nearly 9% at the close on Friday to $217.80.

Meanwhile, the stocks of ride-hailing companies Uber (UBER.N) and Lyft (LYFT.O) each rose by about 11% and 10%. Analysts stated that the lack of details on Tesla's siasun robot&automation rental car alleviated concerns about competition for these two companies.

After the unveiling of AMD chips, the stock plummeted, and the AI pricing level is worth watching.

AMD's stock price fell by 4% on Thursday as the chip manufacturer's new AI lineup failed to excite investors who were eager to see the company compete with Nvidia.

AMD's next-generation MI350 chip is designed to compete with Nvidia's new Blackwell system and is scheduled for shipment in the second half of 2025. The MI350 will support FP4 and FP6, and will be a 3-nanometer component. It will also provide CDNA 4, following the CDNA 3 era of MI300X and MI325X.

Analysts suggest that investors may have been seeking clearer signs, improved prospects, or new customer announcements to compete with the darling AI investor Nvidia.

Important economic data of the week

This content is for informational and educational purposes only and does not constitute a recommendation or endorsement of any particular security or investment strategy. The information contained in this content is for illustrative purposes only and may not be suitable for all investors. This content does not consider the investment objectives, financial situation, or needs of any specific person and should not be regarded as individual investment advice. It is recommended that you consider the suitability of the information for your individual circumstance before making any investment decisions in any capital market product. Past investment performance is not indicative of future results. Investment involves risk and the possibility of loss of principal.

On moomoo, investment products and services in the United States are provided by Moomoo Financial Inc, a licensed entity regulated by the US Securities and Exchange Commission (SEC). Moomoo Financial Inc. is a member of Financial Industry Regulatory Authority (FINRA) and of Securities Investor Protection Corporation (SIPC).