Shanghai Xinnanyang Only Education & Technology Co.,Ltd (SHSE:600661) shares have continued their recent momentum with a 32% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 59% in the last year.

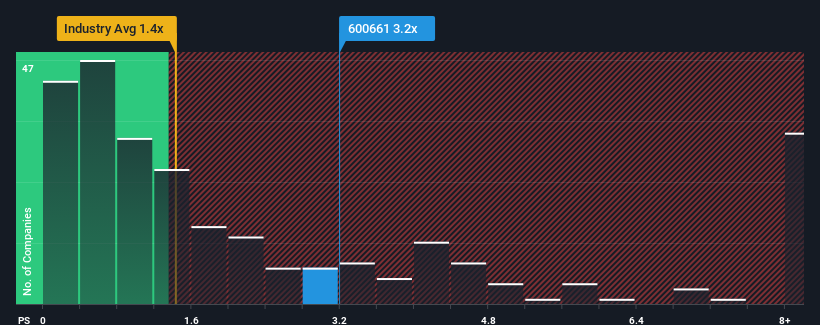

Even after such a large jump in price, Shanghai Xinnanyang Only Education & TechnologyLtd's price-to-sales (or "P/S") ratio of 3.2x might still make it look like a buy right now compared to the Consumer Services industry in China, where around half of the companies have P/S ratios above 4x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Shanghai Xinnanyang Only Education & TechnologyLtd Has Been Performing

Shanghai Xinnanyang Only Education & TechnologyLtd certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Shanghai Xinnanyang Only Education & TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Shanghai Xinnanyang Only Education & TechnologyLtd?

In order to justify its P/S ratio, Shanghai Xinnanyang Only Education & TechnologyLtd would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Shanghai Xinnanyang Only Education & TechnologyLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 37% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 42% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 38% over the next year. Meanwhile, the rest of the industry is forecast to expand by 35%, which is not materially different.

With this in consideration, we find it intriguing that Shanghai Xinnanyang Only Education & TechnologyLtd's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Shanghai Xinnanyang Only Education & TechnologyLtd's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Shanghai Xinnanyang Only Education & TechnologyLtd currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Shanghai Xinnanyang Only Education & TechnologyLtd.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.