热点方面,重点关注政策催化力度较大的化债概念股;其次是地产,继六大行之后,全国12家股份行及部分城、农商行存量房贷利率调整细则也接连出炉。

【主编观市】

行情退潮来得比较突然,港股上周只维持了一天热度,之后持续调整。主线品种均出现较大回撤,高股息类如煤炭、电力及中字头相对坚挺。

周日财政部发布会虽然没有具体的数据,但整体超预期,财政部部长蓝佛安表示,拟一次性增加较大规模债务限额,置换地方政府存量隐性债务,加大力度支持地方化解债务风险。这是近年来最大的支持化债措施。发行特别国债支持国有大型商业银行补充核心一级资本。叠加运用地方政府专项债券、专项资金、税收政策等工具,支持推动房地产市场止跌回稳。另外强调,中央财政还有较大的举债空间和赤字提升空间。

周日财政部发布会虽然没有具体的数据,但整体超预期,财政部部长蓝佛安表示,拟一次性增加较大规模债务限额,置换地方政府存量隐性债务,加大力度支持地方化解债务风险。这是近年来最大的支持化债措施。发行特别国债支持国有大型商业银行补充核心一级资本。叠加运用地方政府专项债券、专项资金、税收政策等工具,支持推动房地产市场止跌回稳。另外强调,中央财政还有较大的举债空间和赤字提升空间。

香港特区行政长官李家超将于10月16日(周三)上午11点发表2024年《施政报告》,或将在振兴香港经济方面推出一系列新举措。观察有哪些提振市场信心的内容。

在经过大幅调整之后,预计本周恒指将迎来较好的反弹窗口。因为无论从政策面还是技术面都将形成共振。

热点方面,重点关注政策催化力度较大的化债概念股;其次是地产,继六大行之后,全国12家股份行及部分城、农商行存量房贷利率调整细则也接连出炉。再是消费类,京东“双11”提前至10月14日晚8点开启;直接现货开卖;天猫"双11”也将于10月14日晚上8点准点开启。

【本周金股】

中环新能源(01735)

近日,据国家能源局网站,国家能源局召开全国可再生能源开发建设调度视频会。会议要求,加大开发建设力度,进一步落实好风电光伏大基地项目,输电通道及电网接入能力等硬任务建设,补齐制约新能源发展面临的短板。公司上半年实现收益约为25.32亿港元,同比增长52.52%;公司拥有人应占溢利约为6005.7万港元,同比增长1.49倍;每股盈利0.96港仙。

此次国家能源局会议精神对风电光伏产业带来较大刺激,结合财政部的加大投入,下半年预计项目会出现提速。公司上半年纯利增加主要由于报告期间6GW光伏N型电池全容量投产导致凤台县新光伏项目产生收益及溢利增加所致。上半年,公司新能源业务全线增长,其中新能源及EPC分部的收益同比增加150%至约16.814亿港元,收入占比从约40.5%增长至66.4%;智慧能源管理服务分部收益同比增加3218%至约3650万港元,成为增长最快的板块。

公司继续在凤台县及桐城市寻求新绿色能源商机并发展高效N型电池及先进光伏组件供应业务。凤台县三期建设6GW电池预计将于2024年第四季度完工投产。在短短一年半的时间里,公司连续四次实现了N型TOPCon电池转换效率的重大飞跃,从26.06%,26.31%,26.66%再稳步提升至今天的26.72%,得益于中环低碳新能源研发的“星耀”“星闪”“星盾”三大技术,进一步扩大了在光伏行业内的知名度和影响力。

【产业观察】

工具出海受益于美国降息

长期来看,美国住房市场供给严重不足。次贷危机后进入长去库周期叠加千禧一代形成核心购房群体,住宅缺口不断扩大,23年底独栋住宅的累计供应缺口已扩大至724万套,新屋建设长景气存在强支撑。

短期来看,高利率导致"利率锁定”,加剧成屋供给不足问题,房价缩量上涨。当前美国住房空置率低位、租金大幅上涨叠加全款购房占比高位,验证刚需旺盛亟待满足。降息后有望激活成屋市场流动性、提升居民购买力,边际向上动力强.。

美国住房市场景气度对家具、五金工具、OPE(户外动力设备)等品类消费具备显著正向带动作用。分品类弹性来看,OPE>家具>五金工具>家电。

工具出口链或将迎来戴维斯双击:一是工具行业存在市占率提升。下游美国商超渠道集中度高,核心出海品牌绑定程度较深,存在渠道及品牌壁垒,并不断取代国际品牌份额,市场格局好。二是美国降息有望带来成屋交易;新屋建造长景气周期,手工具、电动工具、OPE等品类直接受益,增长优势突出。三是渠道库存底部,订单有望与终端需求同步,业绩回暖确定性增强。

港股重点关注电动工具龙头创科实业(00669)、锂电OPE龙头品牌泉峰控股(02285)。

【数据看盘】

港交所公布数据显示,恒生期指(十月)未平仓合约总数为122622张,未平仓净数39979张。恒生期指结算日2024年10月30号。

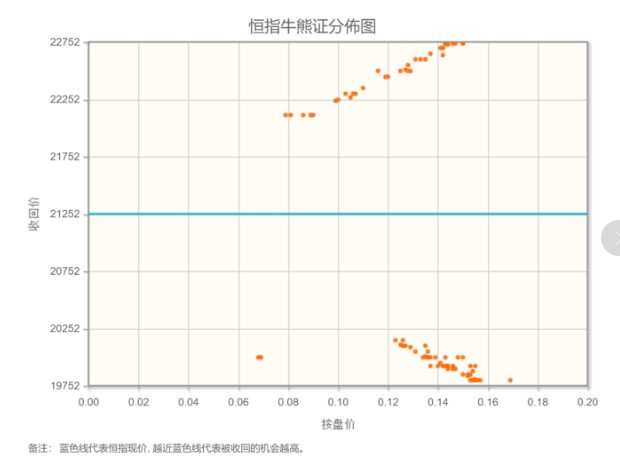

从恒生指数牛熊街货分布情况看,21252点位置,牛熊证密集区比上周明显减弱。和两个月前相比,国际市场对美联储大码减息的预期基本消失。中国政府快速推出一系列重磅刺激政策,海外基金重新建仓。恒生指数本周看涨。

【主编感言】

经历近期回调后,市场情绪有所降温,估值也回到了相对低位。去年李家超发布《施政报告》之前,港股市场迎来了一波迅猛上涨;今年也预计会宣布多项措施,巩固香港作为全球金融中心的地位。增量政策还将陆续出台,市场会有新的催化剂。

在牛熊预期产生分化的时刻,最能考验投资者持股的坚定性,选择正确的将迎来丰收,选择错误的将错过收获。这些都不算真正的危险。真正危险的是那些最初看空、等到了高点转而看多的,摇摆不定最要命。