On the cusp of a wave.

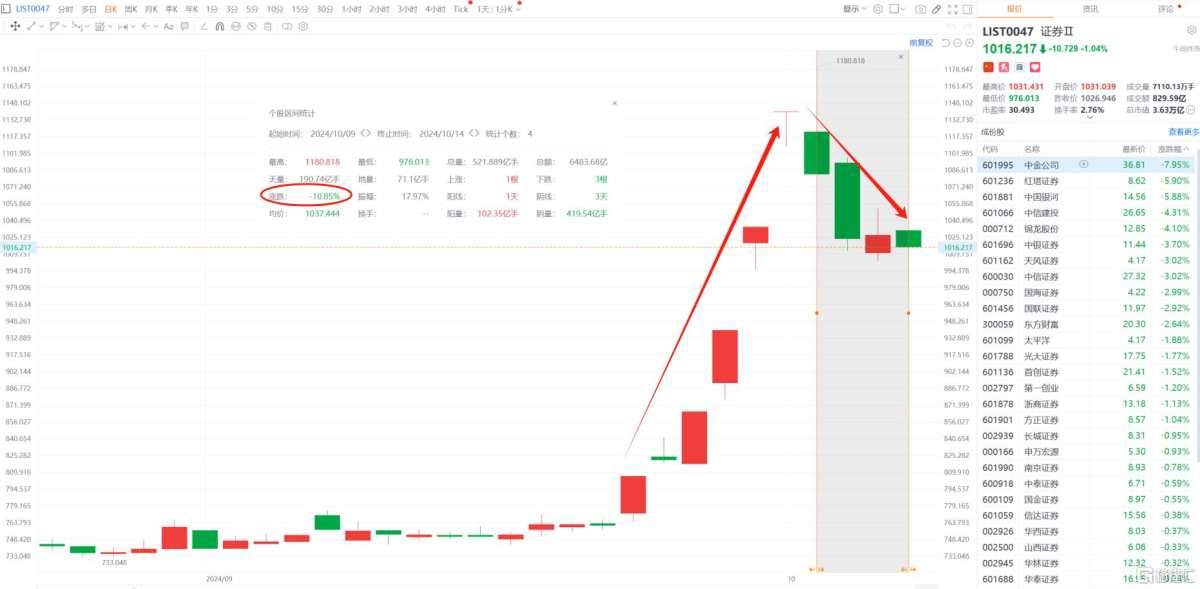

After experiencing a round of fierce battles, the "vanguard of the bull market" has been continuously retreating in recent days.

On Monday, Hong Kong A-shares failed to rebound as expected, with brokerage stocks collectively plunging. Among them, the A-share securities sector once fell by over 4%. Since last Wednesday, this sector has sharply retreated from its high point, currently accumulating a decline of more than 10%.

Previously, in the six trading days starting from September 24, the sector had accumulated a surge of over 40%.

Previously, in the six trading days starting from September 24, the sector had accumulated a surge of over 40%.

Among individual stocks, the top brokerage China International Capital Corporation (CITIC Securities) is under investigation by the China Securities Regulatory Commission for the fraud issue of SiEn (Thinking Entity) Technology. Today, CITIC A-shares swiftly hit the limit down during intraday trading.

As of midday trading, the decline narrowed to 7.95%, closing at 36.81 yuan, with a total market value of 177.691 billion yuan; CITIC H-shares fell by over 4% to 14.02 Hong Kong dollars.

Zhongjin is at the forefront of the trend.

It is worth mentioning that on the previous trading day (October 11th), Zhongjin just hit the daily limit up.

At that time, according to market news, CITIC Securities and China International Capital Corporation had already reported to SFISF, and only these two securities companies had obtained the qualification as first-tier trading dealers in the open market business of the central bank.

However, on the evening of the daily limit up, China International Capital Corporation was suddenly investigated by the CSRC due to failure to fulfill its duties diligently in the Seresin IPO.

Looking back, let's review the timeline of the Seresin fraudulent issuance case:

In August 2021, Seresin submitted an initial public offering (IPO) application to the STAR Market, with China International Capital Corporation as the sponsoring institution.

In April 2022, the General Office issued the "Opinions on Promoting the High-Quality Development of Building the Social Credit System and Promoting the Formation of a New Development Pattern", proposing to adhere to "strict supervision, zero tolerance", and to strictly, quickly, and severely investigate and deal with major illegal cases such as fraudulent issuances according to law.

In July 2022, Seresin withdrew its application for issuance and listing.

After investigation, SUIRXIN fabricated significant false information in its prospectus, with a total inflated revenue of 15.3672 million yuan in 2020, accounting for 11.55% of the annual revenue, and a total inflated profit of 12.4617 million yuan, accounting for 118.48% of the total annual profit.

In February of this year, the China Securities Regulatory Commission announced an administrative penalty for SUIRXIN's fraudulent issuance, with a total fine of up to 16.5 million yuan.

Seven months after SUIRXIN was fined, China International Capital Corporation was also under investigation.

On September 25th, the China Securities Regulatory Commission decided to file a case against China International Capital Corporation; on October 11th, CICC received the "Notice of Case Filing" from the China Securities Regulatory Commission.

In response, CICC stated that it will actively cooperate with the regulatory work of the China Securities Regulatory Commission, and strictly fulfill the obligation of information disclosure in accordance with regulatory requirements.

"The company will adhere to the principle of putting investors first, continuously strengthen the quality control of its practice process, control the 'gate' of the capital market, solidify the responsibility of being the 'gatekeeper,' further enhance the practice quality, and better serve the high-quality development of the capital market."

Brokerage Industry 'Warning'

As part of the 'investment banking aristocracy,' China International Capital Corporation, which used to compete with CITIC Securities, its investment banking business has always been a 'golden sign.'

However, in recent years, the business of China International Capital Corporation has started to come under pressure, and its ranking as the lead underwriter has also continued to decline.

In 2021, China International Capital Corporation's IPO underwriting scale only ranked behind Citic Securities, placing second.

In 2022, China International Capital Corporation was overtaken by China Securities Co., Ltd., falling to third place in the ranking.

In 2023, China International Capital Corporation was surpassed by Haitong Securities again, dropping to the fourth in the industry.

This year, China International Capital Corporation's ranking continued to decline; as of October 12, it dropped to seventh place in the industry.

According to Wind data, as of the first half of this year, a total of 294 companies terminated their A-share IPO processes, more than the 285 companies for the full year of 2023.

Among them, China International Capital Corporation withdrew 22 IPO sponsorship projects, ranking fourth in the industry, and its withdrawal rate reached 48.89%.

In addition, China International Capital Corporation has been receiving continuous regulatory fines this year.

At the end of September, China International Capital Corporation was just warned by the Beijing Securities Regulatory Bureau for issues such as inadequate compensation management system and inaccurate disclosure of compensation information.

In late August, the Shenzhen Stock Exchange took self-regulatory measures by issuing written warnings to parties related to the Yao Ma Zi IPO, including China International Capital Corporation.

As a "gatekeeper", the investigation of China International Capital Corporation undoubtedly sends a strong warning to the brokerage business.

Since the end of September, a series of bullish signals in policies have been clear, and the brokerage market has experienced a rapid surge followed by a correction.

Huaxi Securities believes that a moderate pullback is benign and a necessary condition for a prolonged bullish market.

Currently, the sector's PB ratio has retraced from around 1.8 times the short-term high to 1.5 times. Perhaps the pullback is nearing its end. Coupled with the substantial improvement in third-quarter performance, there is an optimistic outlook for the third-quarter earnings season.

此前,自9月24日起的6个交易日,板块曾累计暴涨超40%。

此前,自9月24日起的6个交易日,板块曾累计暴涨超40%。