In the current unprecedented global changes, the pace of Chinese enterprises' "going global" is accelerating, and more and more companies are emerging in the international market, demonstrating strong competitiveness and influence. Especially in the Southeast Asia region, with the deepening of the Belt and Road Initiative concept, the economic and trade cooperation between China and Southeast Asian countries is becoming increasingly closer, providing broad development space for Chinese enterprises and bringing development opportunities to countries along the route.

As the largest economy in Southeast Asia, India's GDP in 2023 reached $1.37 trillion, making it the only country in Southeast Asia with an economic total exceeding $1 trillion. Coupled with a total population of 270 million and the huge demographic dividend brought by a median population age of 30, India has become one of the hottest investment destinations.

A few visionary companies have early layouts in this area and are now entering the harvest period. On September 26, Nanshan Aluminium International, a subsidiary of Shandong Nanshan Aluminium, officially submitted its listing application to the Hong Kong Stock Exchange for listing on the main board.

As one of the three largest aluminum oxide production companies in Southeast Asia, what are the highlights of Nanshan Aluminium International?

As one of the three largest aluminum oxide production companies in Southeast Asia, what are the highlights of Nanshan Aluminium International?

1. Behind the high growth is win-win cooperation.

In 2019, Nanshan Aluminium International officially started the construction of alumina with PT. BAI as the operating entity in Indonesia, and quickly grew to become one of the leaders in the Southeast Asian aluminum industry in just a few years, thanks to two advantages of the Indonesian market.

First, Indonesia has unique resource endowments.

As is well-known, bauxite is one of the core raw materials for alumina production, and the abundant supply of bauxite is a prerequisite for the rapid expansion of alumina production scale. By the end of 2023, Indonesia had proven bauxite reserves of approximately 1 billion tons, ranking sixth globally and second in Southeast Asia.

Coal is the core energy source in the production process of alumina, and also one of the important advantages in the Indonesian market. As of 2023, Indonesia's confirmed coal reserves have reached approximately 37 billion tons, leading in Southeast Asia and ranking sixth globally.

In addition, in recent years, Indonesia's economy has been developing rapidly, especially with the continuous advancement of infrastructure construction and industrialization, directly increasing the demand for alumina and other aluminum products. At the same time, the Indonesian government actively promotes industrial transformation and upgrading, encourages the development of downstream alumina and electrolytic aluminum industry chains. Previously, President Joko Widodo visited the production base of PT.BAI (PT.BAI is the main operating entity of Nanshan Aluminium International in Indonesia), and stated that "PT.BAI is one of the models for boosting the economy of downstream businesses." This undoubtedly injected a dose of confidence into local aluminum industry projects for foreign investors, including Chinese companies.

In addition to Indonesia's comparative advantage in resources, Nanshan Aluminium International's parent company, shandong nanshan aluminium, is firmly promoting its internationalization strategy, which is also an adjustment in response to changes in the domestic market.

China is the world's largest producer of alumina and electrolytic aluminum, with a number of companies having rich operational experience and technological reserves in aluminum production. However, under the guidance of the dual carbon goals, supply-side reforms in the electrolytic aluminum industry have placed a ceiling on industry capacity, which is equivalent to adding a restriction to alumina from the demand side.

Domestic capacity needs to be transferred, and Indonesia precisely needs this force to help with its industrial upgrading. Relying on mature techniques and complete industry operation experience, Nanshan Aluminium International has achieved breakthrough growth.

According to the prospectus, the company's revenue for fiscal years 2021 to 2023 was 0.173 billion, 0.467 billion, and 0.678 billion (in USD), with a compound annual growth rate of 98% for the period. The good performance growth is mainly driven by the continuous increase in the company's alumina production. From fiscal year 2021 to fiscal year 2023, the company's alumina production increased from 0.47 million tons to 1.9 million tons, with a compound annual growth rate of 100.2%.

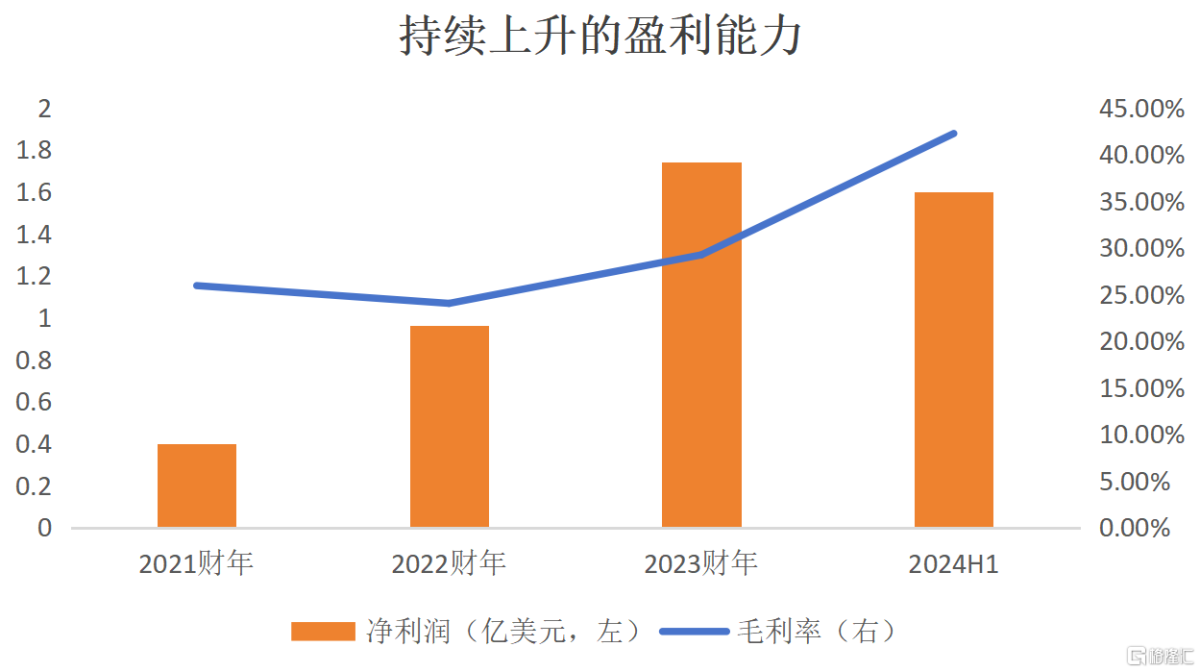

Profitability has also shown remarkable performance. From fiscal years 2021 to 2023, the company's net income increased from 39.71 million USD to 0.174 billion USD, with a compound annual growth rate of 109.04% for the period.

Against the backdrop of global economic pressure in recent years, Nanshan Aluminium International has once again delivered an impressive report card, reaffirming the correctness of its decision to go global.

Two, the four major advantages build core competitiveness.

Choosing the right battlefield is important, but without strong capabilities, Shandong Nanshan Aluminium International would not have rapidly become a giant in just a few years. Fundamentally, there are four key advantages worth noting.

1) Strong shareholder advantage.

Shandong Nanshan Aluminium International's parent company, Nanshan Aluminium, is an A-share listed company with a market cap of about 50 billion RMB, deeply cultivating the aluminum industry for over 20 years. It has the advantage of a complete industry chain, with business operations covering thermal power, alumina, electrolytic aluminum, casting, aluminum profiles/hot rolling-cold rolling-foil rolling, and aluminum scrap recycling (reutilization), the deep industry know-how contributes to Nanshan Aluminium International's business expansion.

As a leading comprehensive aluminum company in Southeast Asia, Press Metal has entered into a 10-year alumina purchase arrangement with Shandong Nanshan Aluminium International. Press Metal's annual demand for alumina exceeds 2 million tons, capable of consuming the vast majority of Nanshan Aluminium International's production capacity, contributing to the company's steady growth in performance.

Redstone Alumina International Pte. Ltd., controlled by shareholder Santony family, has been deeply cultivating in Indonesia for many years, operating several bauxite mines, and has a strong local raw material procurement network, which can provide Shandong Nanshan Aluminium International with stable high-quality bauxite resources.

2) Unique geographical advantage.

Transportation is a crucial factor throughout the alumina production process. Shandong Nanshan Aluminium International's production and supporting facilities are located on the southeast side of the Riau Islands in Indonesia, situated at the gateway between the Pacific and Indian Oceans, controlling the traffic artery of the Malacca Strait, capable of loading goods on large ships weighing up to 35,000 tons. Compared to alumina producers in other countries who often rely on importing bauxite from Australia, Guinea, the geographical advantage of Shandong Nanshan Aluminium International allows it to directly obtain high-quality bauxite within Indonesia, significantly shortening the transportation distance, enhancing transportation convenience, and reducing transportation costs.

This has also made 'raw materials just in time' and 'alumina production and transportation' become the distinctive labels of Nanshan Aluminium International.

3) Perfect supporting facilities

In addition to building its own wharf, Nanshan Aluminium International also built its own power plant and reservoir, achieving self-sufficiency in water and electricity. This ensures stable daily production operations, reduces production costs, and maintains ample profit margins.

4) Cost advantage

Bauxite and coal, as the two core materials for alumina production, have a significant impact on enterprise production costs.

Local bauxite supply in Indonesia is excessive, with relatively low prices. Nanshan Aluminium International uses high-grade bauxite with high aluminum content and low impurities, which is conducive to more efficient aluminum extraction by manufacturers. High-grade bauxite is suitable for the low-temperature Bayer process, with a calcination temperature about 90 degrees lower than the standard Bayer process, saving energy consumption, simplifying production processes, and reducing production costs.

Coal is also subject to government control in Indonesia, requiring at least 25% of the total production to be sold in the domestic market annually, helping to keep coal prices low.

Combined with the low transportation costs due to short transportation distances, and the low operating costs from self-sufficiency in water and electricity, Nanshan Aluminium International has achieved a leading cost advantage in the industry, which ultimately translates into powerful profitability for the company.

From the fiscal year 2021 to the fiscal year 2023, the company's gross margin was 25.9%, 24.0%, and 29.2% respectively. In the first half of 2024, it even reached 42.2%, far exceeding the industry average. At the same time, from the fiscal year 2021 to the fiscal year 2023, the company's net income increased from $39.71 million to $0.174 billion, with a compound growth rate of 109.04% during the period.

(Data source: Nanshan Aluminium International prospectus)

It can be seen that from production, transportation to sales delivery, Shandong Nanshan Aluminium has a complete layout, which firmly occupies the leading position in the Southeast Asian alumina market.

At the same time, facing the growing market demand, Shandong Nanshan Aluminium International is also continuously expanding its supply capacity, increasing its own growth ceiling.

Based on the current 2 million ton design basis, the company plans to double it to 4 million tons to achieve a stronger economies of scale, further reduce unit costs, and enhance profitability. It is reported that the new alumina production project is expected to increase capacity by 1 million tons in the second half of 2025 and the second half of 2026, providing greater room for the company's performance growth in the next two to three years.

III. Conclusion

Shandong Nanshan Aluminium International has long foresaw the trend of China's aluminum production capacity shifting to Indonesia strategically, and actively seized the early market dividends by this trend, thus consolidating its leading position in the Southeast Asian market. This achievement is not only due to the rapid growth of the Indonesian economy and the optimization of the market environment but also the inevitable result of Shandong Nanshan Aluminium International's deep strength and strategic layout.

Of course, the vast opportunities in the Indonesian market will naturally attract more and more companies. In the future, the competition level of Indonesian aluminum products will gradually strengthen. However, Nanshan Aluminium International, with a first-mover advantage, has established certain advantages in production, transportation, and sales. These advantages not only provide it with a sustained market leadership position but also lay a solid foundation for the company's future growth.

If Nanshan Aluminium International successfully lands on the Hong Kong Stock Exchange in the future, its brand influence and financial strength will be significantly enhanced. This will provide strong support for expanding production capacity and exploring new markets.

作为东南亚三大氧化铝生产企业之一,Nanshan Aluminium International究竟有哪些看点?

作为东南亚三大氧化铝生产企业之一,Nanshan Aluminium International究竟有哪些看点?