Earnings prospects for US companies are unusually divided: although analysts lowered expectations, the company's guidance points to another strong quarter.

The Zhitong Finance App notes that the profit prospects of US companies are unusually divided: although analysts lowered their expectations, the company's guidance points to another strong quarter. Analysts expect third-quarter earnings of S&P 500 companies to increase 4.2% over the same period last year, lower than the 7% forecast in mid-July. On the other hand, these companies' guidelines suggest an increase of around 16%.

BI chief stock strategist Gina Martin Adams (Gina Martin Adams) said that the difference was “unusually large,” and that the clearly stronger outlook suggests that “companies should easily exceed expectations.”

“Profit margins should continue to rise as businesses emphasize efficiency in the face of economic uncertainty,” she wrote in a report. The trend of the earnings per share guide also turned positive. The BI model showed that for the three months up to September, the earnings per share guide score was 0.14, compared to the average value of 0.03 after the COVID-19 pandemic.

“Profit margins should continue to rise as businesses emphasize efficiency in the face of economic uncertainty,” she wrote in a report. The trend of the earnings per share guide also turned positive. The BI model showed that for the three months up to September, the earnings per share guide score was 0.14, compared to the average value of 0.03 after the COVID-19 pandemic.

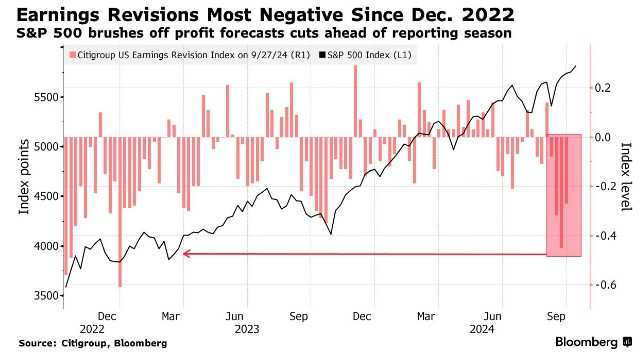

Meanwhile, Citi's revised earnings index for September showed strong negative momentum, falling to its lowest level since December 2022. Despite analysts' concerns, the S&P 500 reached a new high last Friday, with a cumulative increase of 22% since 2024, setting the record for the best start of the year since 1997.

This shows that investors are not deterred by the downgraded forecasts, but are betting that the quarter's earnings will once again be a positive surprise, just like in the first quarter, when they expected a 3.8% increase, and the result was 7.9%.

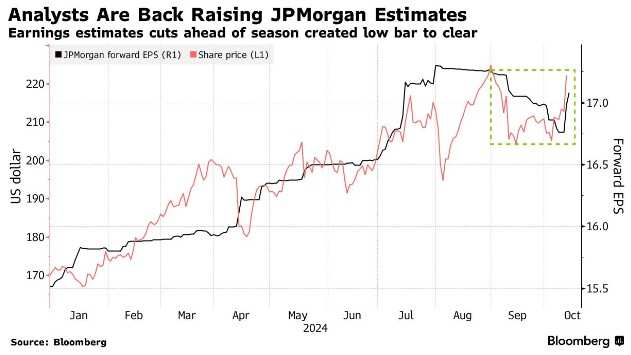

The new earnings season is off to a good start. J.P. Morgan reported an unexpected increase in net interest revenue for the third quarter and raised expectations for this major revenue source. The stock rose about 4.5% after reporting earnings on Friday, and Wells Fargo rose 5.6%, indicating that the impact of falling interest rates was not as bad as people feared.

Daimo strategist Michael Wilson (Michael Wilson) wrote in a report on Monday: “Before the earnings season began, several large bank stocks had already been de-risked in mid-September. This has led to lower performance expectations for this quarter. Preliminary results for the earnings season suggest that banks are breaking through this expectation.”

Of course, there are some warning signs. Earlier this month, Nike (NKE) readjusted Wall Street expectations and withdrew full-year sales guidance before new CEO Elliott Hill took office. At the end of September, FedEx shares plummeted after warning that business would slow down in the coming year.

Bank of America strategists Ohsung Kwon and Savita Subramanian wrote in a report last week: “Now that the easing cycle has begun, the main focus is on the company's prospects at the other end of the curve.” They cut their 2024 earnings per share forecast for the S&P 500 index from $250 to $243. “Expectations aren't high. As long as companies can overcome macro headwinds and see early signs of improvement brought about by interest rate cuts, stocks should reap rewards.”

Investors' attention will eventually turn to the “Big 7” stocks that are driving the stock market upward this year, including Apple and Nvidia. The market generally expects the profits of these companies to increase by about 18% compared to the same period last year, and the growth rate will slow down (36% in the second quarter). The shares of these companies have been underperforming since the second quarter earnings season, and have been trading sideways recently as the S&P 500 gains have expanded.

Wilson said, “The root cause of the poor performance of the 'Big Seven' may simply be a slowdown in earnings per share growth from last year's strong growth.” “If the earnings correction shows that tech giants are relatively strong, these stocks may once again perform well, and the S&P 500 lead may shrink — as was the case in the second quarter and throughout 2023.”

她在一份报告中写道:“随着企业在经济不确定的情况下强调效率,利润率应该会继续走高。”每股收益指引的势头也转为积极,BI模型显示,截至9月份的三个月,每股收益指引的得分为0.14,而新冠肺炎疫情后的平均值为0.03。

她在一份报告中写道:“随着企业在经济不确定的情况下强调效率,利润率应该会继续走高。”每股收益指引的势头也转为积极,BI模型显示,截至9月份的三个月,每股收益指引的得分为0.14,而新冠肺炎疫情后的平均值为0.03。