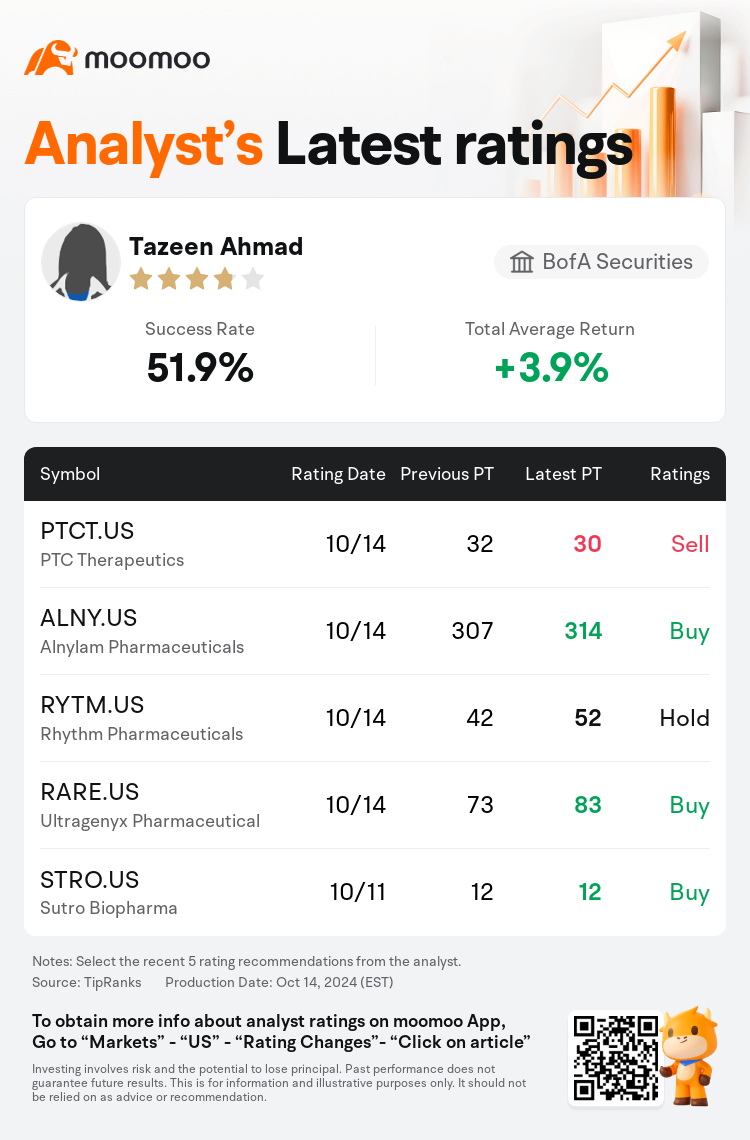

BofA Securities analyst Tazeen Ahmad maintains $PTC Therapeutics (PTCT.US)$ with a sell rating, and adjusts the target price from $32 to $30.

According to TipRanks data, the analyst has a success rate of 51.9% and a total average return of 3.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $PTC Therapeutics (PTCT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $PTC Therapeutics (PTCT.US)$'s main analysts recently are as follows:

PTC Therapeutics recently disclosed Q2 results, indicating sales of Translarna at $70.4M and Emflaza also at $70.4M. There is ongoing uncertainty regarding Translarna's continued availability in EU markets following several unfavorable opinions from the Committee for Medicinal Products for Human Use (CHMP). A decisive CHMP opinion is anticipated by mid-October, which could lead to Translarna's withdrawal from EU markets within 67 days if the opinion is adverse. The company's pipeline programs are believed to require further risk reduction.

Estimates on PTC Therapeutics are modestly surpassing the consensus regarding Translarna net product revenues while aligning with expectations on Emflaza net product revenue, according to an analyst overview. The focus for the upcoming discussion will include details about the CHMP re-examination procedures and insights on the submission of further information demanded by the FDA pertaining to the NDA re-submission.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

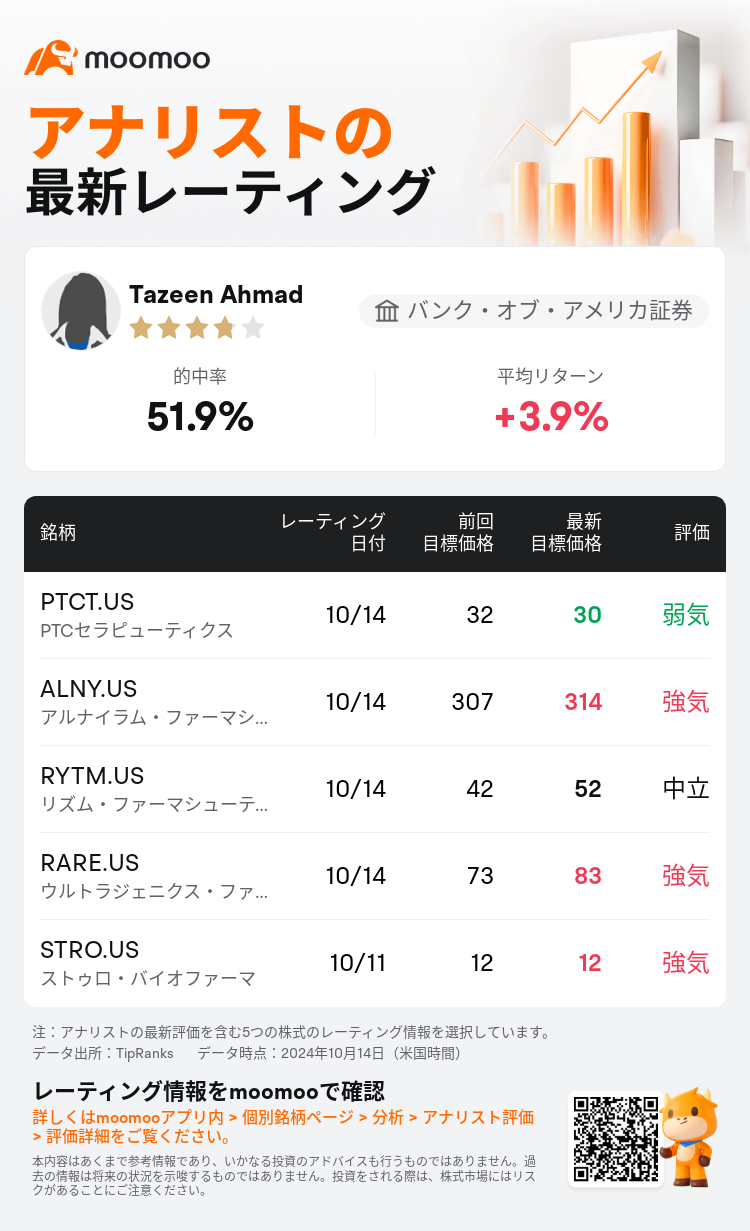

バンク・オブ・アメリカ証券のアナリストTazeen Ahmadは$PTCセラピューティクス (PTCT.US)$のレーティングを弱気に据え置き、目標株価を32ドルから30ドルに引き下げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は51.9%、平均リターンは3.9%である。

また、$PTCセラピューティクス (PTCT.US)$の最近の主なアナリストの観点は以下の通りである:

また、$PTCセラピューティクス (PTCT.US)$の最近の主なアナリストの観点は以下の通りである:

PTC Therapeuticsは最近、第2四半期の結果を発表しました。Translarnaの売上高は7,040万ドル、Emflazaの売上高も7億40万ドルでした。ヒト用医薬品委員会(CHMP)からのいくつかの不利な意見を受けて、TranslarnaのEU市場での継続的な販売については不確実性が続いています。CHMPの決定的な意見は10月中旬までに発表される予定です。反対意見が出た場合、Translarnaは67日以内にEU市場から撤退する可能性があります。同社のパイプラインプログラムには、さらなるリスク軽減が必要だと考えられています。

アナリストの概要によると、PTC Therapeuticsの見積もりは、Translarnaの純製品収益に関するコンセンサスをわずかに上回っていますが、Emflazaの純製品収益に対する予想と一致しています。今後の議論の焦点は、CHMPの再審査手続きの詳細と、NDA再提出に関してFDAが要求する詳細情報の提出に関する洞察です。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$PTCセラピューティクス (PTCT.US)$の最近の主なアナリストの観点は以下の通りである:

また、$PTCセラピューティクス (PTCT.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of