Financial giants have made a conspicuous bullish move on Occidental Petroleum. Our analysis of options history for Occidental Petroleum (NYSE:OXY) revealed 24 unusual trades.

Delving into the details, we found 54% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $427,065, and 16 were calls, valued at $910,331.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.0 to $60.0 for Occidental Petroleum over the recent three months.

Analyzing Volume & Open Interest

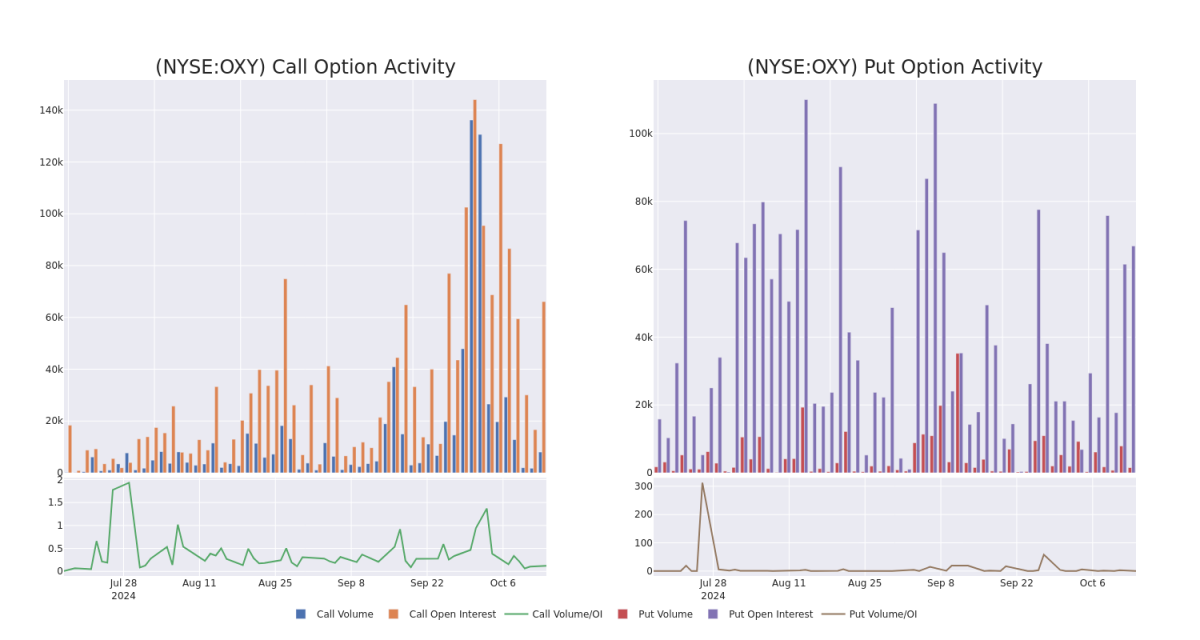

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Occidental Petroleum's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Occidental Petroleum's significant trades, within a strike price range of $30.0 to $60.0, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Occidental Petroleum's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Occidental Petroleum's significant trades, within a strike price range of $30.0 to $60.0, over the past month.

Occidental Petroleum 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | CALL | SWEEP | BEARISH | 06/20/25 | $8.15 | $8.05 | $8.05 | $50.00 | $176.3K | 1.3K | 221 |

| OXY | CALL | SWEEP | BULLISH | 12/20/24 | $3.65 | $3.6 | $3.65 | $52.50 | $102.5K | 1.7K | 301 |

| OXY | PUT | SWEEP | BEARISH | 11/15/24 | $4.25 | $4.15 | $4.25 | $57.50 | $98.1K | 2.3K | 233 |

| OXY | CALL | SWEEP | BEARISH | 06/20/25 | $6.7 | $6.6 | $6.6 | $52.50 | $91.0K | 1.0K | 140 |

| OXY | CALL | SWEEP | BULLISH | 11/15/24 | $3.2 | $3.15 | $3.2 | $52.50 | $89.9K | 3.2K | 305 |

About Occidental Petroleum

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

In light of the recent options history for Occidental Petroleum, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Occidental Petroleum Standing Right Now?

- Trading volume stands at 2,618,631, with OXY's price down by -1.07%, positioned at $54.17.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 29 days.

Expert Opinions on Occidental Petroleum

In the last month, 5 experts released ratings on this stock with an average target price of $64.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for Occidental Petroleum, targeting a price of $72. * Consistent in their evaluation, an analyst from BMO Capital keeps a Market Perform rating on Occidental Petroleum with a target price of $65. * An analyst from Goldman Sachs downgraded its action to Neutral with a price target of $55. * An analyst from Scotiabank persists with their Sector Outperform rating on Occidental Petroleum, maintaining a target price of $65. * An analyst from Evercore ISI Group has decided to maintain their Underperform rating on Occidental Petroleum, which currently sits at a price target of $63.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Occidental Petroleum options trades with real-time alerts from Benzinga Pro.