Whales with a lot of money to spend have taken a noticeably bullish stance on Oracle.

Looking at options history for Oracle (NYSE:ORCL) we detected 39 trades.

If we consider the specifics of each trade, it is accurate to state that 48% of the investors opened trades with bullish expectations and 38% with bearish.

From the overall spotted trades, 11 are puts, for a total amount of $669,392 and 28, calls, for a total amount of $3,106,386.

From the overall spotted trades, 11 are puts, for a total amount of $669,392 and 28, calls, for a total amount of $3,106,386.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $140.0 to $220.0 for Oracle during the past quarter.

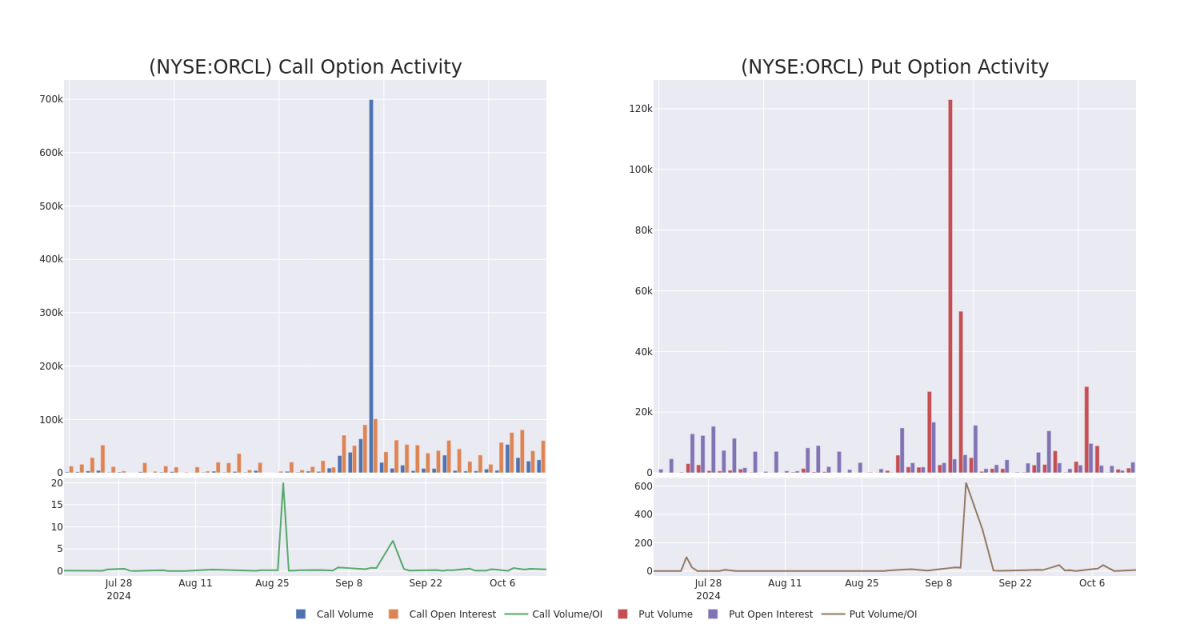

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Oracle options trades today is 2557.36 with a total volume of 25,593.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Oracle's big money trades within a strike price range of $140.0 to $220.0 over the last 30 days.

Oracle Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | CALL | SWEEP | NEUTRAL | 10/18/24 | $4.55 | $3.9 | $4.1 | $172.50 | $410.1K | 6.8K | 2.5K |

| ORCL | CALL | SWEEP | BULLISH | 10/18/24 | $4.3 | $3.8 | $4.3 | $172.50 | $387.0K | 6.8K | 1.5K |

| ORCL | CALL | SWEEP | NEUTRAL | 10/18/24 | $4.0 | $3.95 | $4.0 | $172.50 | $336.8K | 6.8K | 3.3K |

| ORCL | CALL | SWEEP | BULLISH | 10/18/24 | $4.5 | $4.25 | $4.5 | $172.50 | $270.0K | 6.8K | 600 |

| ORCL | CALL | SWEEP | NEUTRAL | 10/18/24 | $4.9 | $4.7 | $4.71 | $172.50 | $236.6K | 6.8K | 4.3K |

About Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Present Market Standing of Oracle

- With a volume of 2,725,253, the price of ORCL is up 0.32% at $176.33.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 56 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.