Bichamp Cutting Technology (Hunan) Co., Ltd. (SZSE:002843) shareholders have had their patience rewarded with a 39% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

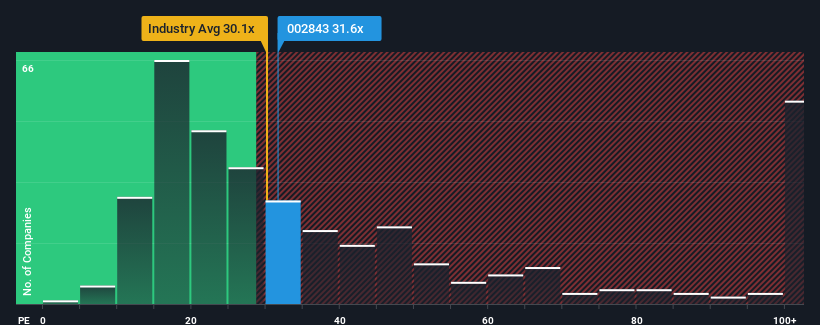

Although its price has surged higher, there still wouldn't be many who think Bichamp Cutting Technology (Hunan)'s price-to-earnings (or "P/E") ratio of 31.6x is worth a mention when the median P/E in China is similar at about 31x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings that are retreating more than the market's of late, Bichamp Cutting Technology (Hunan) has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Is There Some Growth For Bichamp Cutting Technology (Hunan)?

The only time you'd be comfortable seeing a P/E like Bichamp Cutting Technology (Hunan)'s is when the company's growth is tracking the market closely.

The only time you'd be comfortable seeing a P/E like Bichamp Cutting Technology (Hunan)'s is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 109% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 25% per year over the next three years. With the market only predicted to deliver 19% per year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Bichamp Cutting Technology (Hunan)'s P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Bichamp Cutting Technology (Hunan)'s P/E

Bichamp Cutting Technology (Hunan)'s stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Bichamp Cutting Technology (Hunan)'s analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Bichamp Cutting Technology (Hunan), and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.