The bank said that thanks to higher trading income and lower impairment losses, csi china mainland banks index will deliver a stable operation performance in the third quarter of 2024.

According to the Securities Times app, CICC released a report stating that under the high market sentiment driven by stimulus policies, a revaluation of china mainland banking valuation was carried out. The bank stated that due to higher trading income and lower impairment losses, csi china mainland banks index is expected to deliver stable operating performance in the third quarter of 2024.

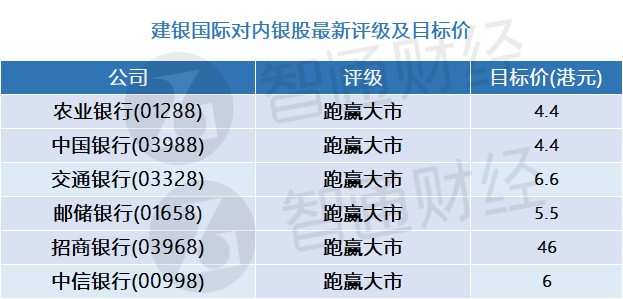

The bank predicted that industrial bank (601166.SH) will achieve the best profit growth of 3%, followed by agricultural bank of china (01288), bank of communications (03328), and china citic bank corporation (00998). In addition, the bank believes that the net interest margin for the third quarter will drop by 15 basis points year-on-year to 151 basis points. The bank stated a continued preference for state-owned banks, especially agricultural bank of china and bank of china (03988).