Amazon.com Inc (NASDAQ:AMZN) inked a five-year deal with data and AI startup Databricks to provide businesses with cost-effective AI-building capabilities. The financial terms of the contract remain undisclosed.

The partnership centers around Amazon's Trainium AI chips, which offer a less expensive alternative to Nvidia Corp's (NASDAQ:NVDA) popular GPUs for companies looking to customize or build their AI models.

Also Read: Amazon and Oracle Partnership Unlocks Major Cloud Growth Opportunity, Analyst Suggests

Databricks proposed to pass on the savings from using Amazon's chips to customers to break into Nvidia's moat.

Databricks proposed to pass on the savings from using Amazon's chips to customers to break into Nvidia's moat.

Databricks customers include W.W. Grainger, Inc (NYSE:GWW) and the car-shopping site Edmunds.com. Both companies are eying the enterprise AI space intensifying rivalry with Microsoft Corp (NASDAQ:MSFT) and Snowflake Inc (NYSE:SNOW).

Databricks, valued at $43 billion as of 2023, is already deeply involved in the AI market, having acquired AI startup MosaicML for $1.3 billion.

Databricks' existing partnership with Amazon allows customers to access its data services through Amazon Web Services (AWS).

As part of the agreement, Databricks will also increase its use of Nvidia GPUs rented through AWS. According to Naveen Rao of Databricks, AWS has generated more than $1 billion in revenue for Databricks and remains the company's fastest-growing cloud partner.

Rao of Databricks told the WSJ that the collaboration with Amazon allows Databricks to pass cost savings to customers by leveraging Amazon's AI chips.

Dave Brown of Amazon Web Services told the WSJ that Amazon's Trainium chips, specifically designed for AI tasks, can help businesses cut their AI development costs by up to 40%.

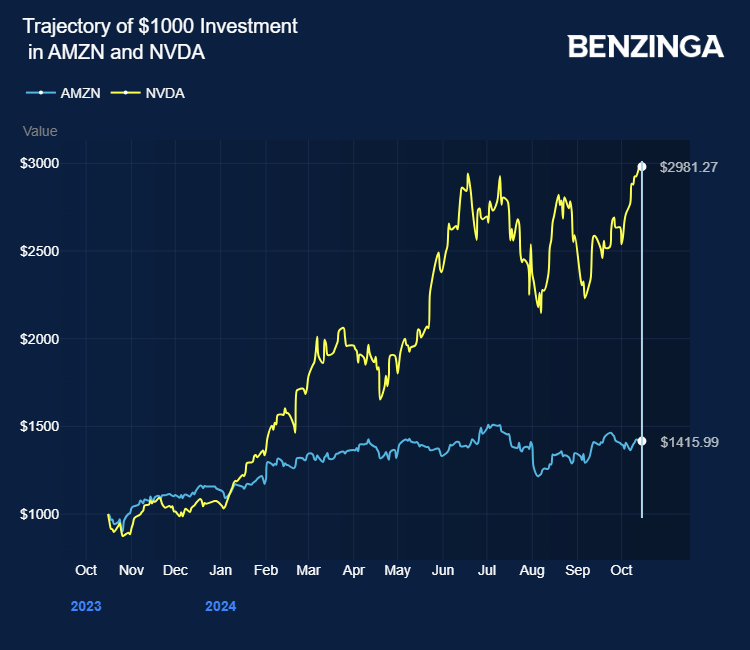

Amazon stock is up over 41% in the last 12 months. Nvidia is up 195% thanks to the AI wave.

JMP Securities analyst Nicholas Jones expects Amazon AWS to outpace Microsoft Azure, citing the latter's softness in some European geographies and capacity constraints.

Scotiabank's Nat Schindler and JP Morgan's Doug Anmuth flagged AWS AI's focus on providing flexible, cost-effective AI solutions, positioning it as a critical partner for companies leveraging AI.

Price Actions: AMZN stock is down 1.34% to $185.52 at the last check on Tuesday.

Also Read:

- Amazon's Profitable Essential Merchandise, Efficiency Gains Set To Drive Growth: Analyst

Photo via Company