The National Retail Federation predicts that while the total spending for the upcoming holiday shopping season will reach a new high, high inflation continues to erode consumer purchasing power. The growth rate of this year's most important holiday sales will be lower than last year, and household spending will be more cautious. Consumer spending is a key pillar of the US economy, and insufficient consumer purchasing power may lead to a pessimistic outlook on the economy.

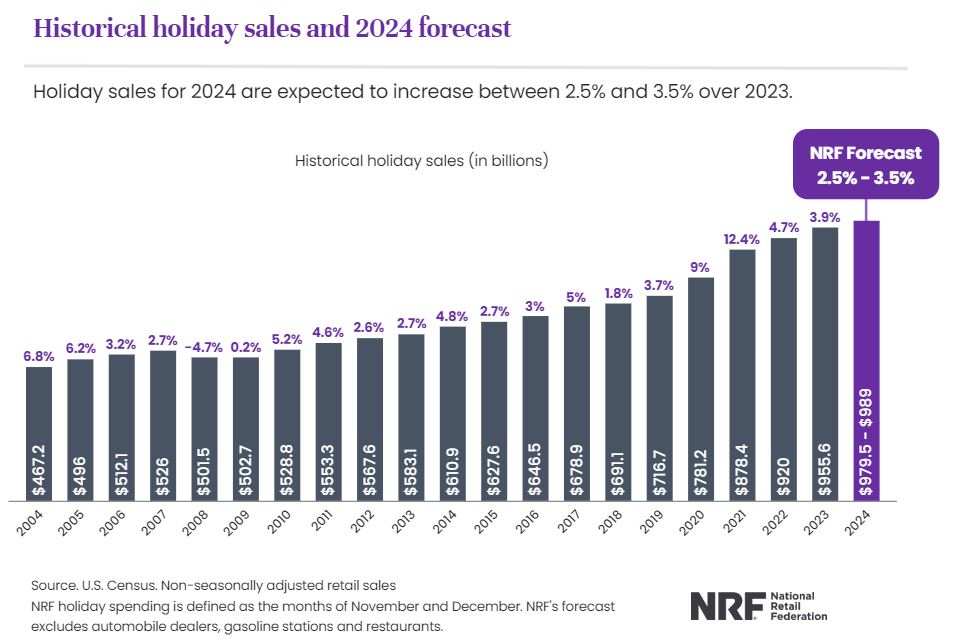

On Tuesday, October 15, the National Retail Federation (NRF), the largest retail industry organization in the United States, released a forecast stating that during the holiday shopping season from November to December, American consumers' holiday spending will continue to increase, pushing the total holiday sales to a historical high, but the sales growth rate will be slower than last year.

The 'holiday season' defined by the National Retail Federation runs from November 1 to December 31. It is expected that the retail sales for these two months this year will grow by 2.5% to 3.5% compared to last year's 3.9%. However, in terms of US dollars, the total retail spending for the winter holidays will be in the range of $979.5 billion to $989 billion, exceeding last year's $955.6 billion and setting a new record high.

Online shopping will continue to be the main driver of overall holiday retail sales growth, with online and other non-brick-and-mortar store sales expected to increase by 8% to 9% year-on-year, reaching $295.1 billion to $297.9 billion, higher than last year's $273.3 billion, but with a slower year-on-year growth rate of 10.7% compared to last year. This year, US retailers may recruit 0.4 million to 0.5 million seasonal workers to meet the growing consumer demand during the end-of-year holiday season, but even the highest value in the range is lower than last year's seasonal recruitment of 0.509 million.

Online shopping will continue to be the main driver of overall holiday retail sales growth, with online and other non-brick-and-mortar store sales expected to increase by 8% to 9% year-on-year, reaching $295.1 billion to $297.9 billion, higher than last year's $273.3 billion, but with a slower year-on-year growth rate of 10.7% compared to last year. This year, US retailers may recruit 0.4 million to 0.5 million seasonal workers to meet the growing consumer demand during the end-of-year holiday season, but even the highest value in the range is lower than last year's seasonal recruitment of 0.509 million.

The end-of-year holiday shopping season is important because holiday season sales typically account for more than half of US retailers' annual income, and consumer spending is a key pillar of the US economy. Insufficient consumer spending may lead to pessimistic economic outlooks. NRF's calculations are based on government data such as employment, wages, consumer confidence, disposable income, consumer credit, retail sales, targeting 'core retail' indicators.

NRF President and CEO Matthew Shay described the retail sales trend for the 2024 holiday season as 'steady growth', stating that the economic fundamentals remain healthy and will continue this momentum until the end of the year. The winter holidays are an important tradition for American families, and a strong job market and wage growth will continue to support Americans' spending power.

However, the organization's Chief Economist Jack Kleinhenz acknowledges that despite strong household finances providing the impetus for robust spending during the holiday peak season, American households will be more cautious with their spending. Matthew Shay also noted that US interest rates remain relatively high.

Consumers are indeed considering interest rates and persistent inflation issues, so it is expected that they will pay more attention to prices and be more practical when making consumption decisions.

At the end of this year, Americans' purchasing power is not as strong as in previous years, as evidenced by the Thanksgiving purchases made in October.

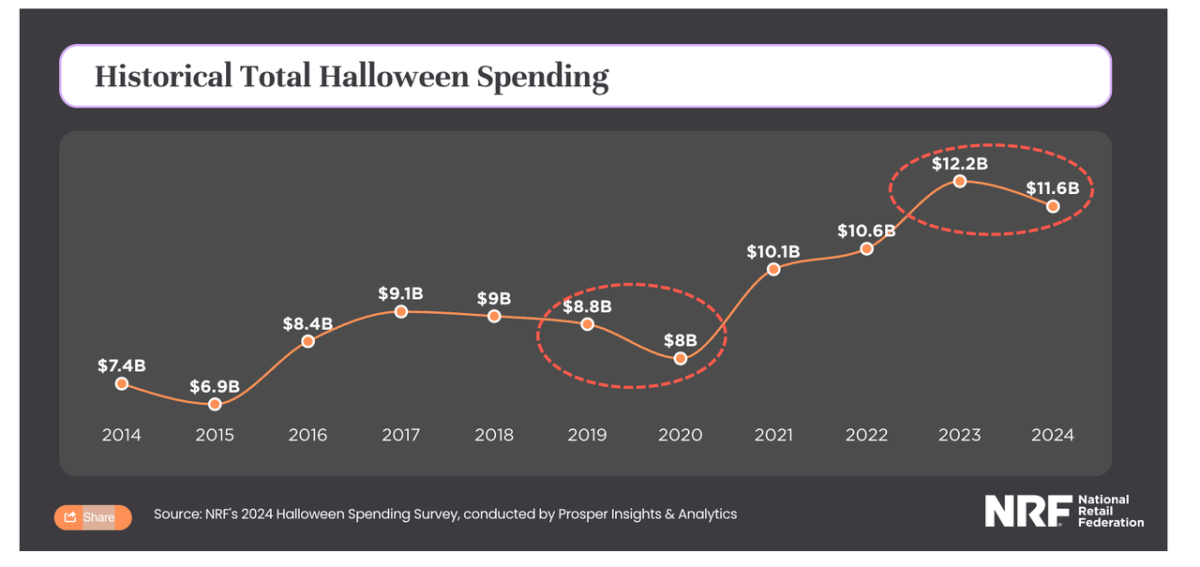

The NRF-commissioned annual survey conducted by the retail market research company, Prosper Insights & Analytics, showed that nearly 8,000 consumers surveyed in the first week of September regarding Halloween shopping plans indicated an average expenditure of around $103.63, which is approximately $4.62 less than the record $108.24 spent last year. This could result in a year-on-year decrease of 5% to $11.6 billion in total Halloween spending this year, breaking away from historical highs.

The financially critical blog Zerohedge, known for its caustic commentary, suggests that some working-class families are reducing their purchases of Halloween costumes, decorations, and party supplies. Halloween has historically been a beloved and highly participated all-people autumn celebration in the United States. Due to persistently high inflation and interest rates, it is expected that lower- to middle-income consumers will reduce these seasonal expenditures this year, leading to a slight decline in participation rates in various Halloween activities.

"The last time Halloween spending decreased year-on-year was during the (consumer confidence-shaken early stages of the pandemic) in 2020.

The bleak outlook for Halloween spending may indicate a continued deterioration of the American consumption environment, which is likely to worsen in the future, becoming a negative indicator for major shopping events such as 'Black Friday' and 'Cyber Monday' in late November.

In addition to mainstream industry organizations like NRF, other analysts also believe that American holiday season shoppers' sentiment will be more restrained this year.

For example, management consulting firm Bain expects retail sales in November and December to increase by 3% year-on-year, lower than last year's growth rate of 4.2%. Consulting firm AlixPartners forecasts sales growth of 2% to 5% from October to December, below last year's 6% growth rate. Consultancy and research firm Customer Growth Partners predicts a 4% increase in sales during the holiday period, also slightly lower than last year's growth rate.

Deloitte even predicts that due to cautious shopping behavior, the growth rate of holiday sales in 2024 will be the lowest in six years (since 2018). Its latest holiday consumption forecast released on Tuesday indicates that high prices have weakened consumer brand loyalty, and spending on experiences, decorations, and entertainment will be the driving force for consumption this year.

Overall, the growth rate of holiday shopping expenditures in the United States has slowed down this year, which can be considered as a historical return to the average growth rate of 3.6% from 2010 to 2019 during the unusually high growth period of the epidemic. During the COVID-19 pandemic, holiday season sales reported by NRF in 2020 increased sharply by 9% year-on-year, and in 2021, it soared by 12.4%.

In addition, this holiday shopping season faces multiple challenges this year, including Thanksgiving coming later, making the shopping season six days shorter than last year, the impact of hurricanes Helen and Milton on the economy, and the potential temporary inhibition of consumer behavior due to the November U.S. presidential election. Some analysis also points out that although U.S. retail gasoline prices are lower than last year, many food prices are much higher than a few years ago, dampening consumer enthusiasm.

Financial blog Zerohedge also found that the U.S. personal savings rate has plummeted from over 5% to 2.9% within a year, the lowest level since the Lehman Brothers bankruptcy, as the excess savings during the pandemic disappear. Many Americans choose to use credit cards to support consumption as their savings decline, impacting consumers across all income levels and suggesting a bleak outlook.

其中,在线购物仍将是整体假日零售额增长的主要推动力,在线和其他非实体店的销售额预计同比增长8%至9%,达到2951元至2979亿美元,高于去年同期的2733亿美元,但同比增速将较去年的10.7%放缓。今年美国零售商或招聘40万至50万名季节工人来应对年末假日季消费者需求的增长,但区间最高值也低于去年的季节招聘人数50.9万。

其中,在线购物仍将是整体假日零售额增长的主要推动力,在线和其他非实体店的销售额预计同比增长8%至9%,达到2951元至2979亿美元,高于去年同期的2733亿美元,但同比增速将较去年的10.7%放缓。今年美国零售商或招聘40万至50万名季节工人来应对年末假日季消费者需求的增长,但区间最高值也低于去年的季节招聘人数50.9万。