$Woodside Energy Group Ltd (WDS.AU)$ stock rose 1.05% on Wednesday, with trading volume expanding to A$81.37 million. Woodside has fallen 5.32% in the past week, with a cumulative loss of 11.81% year-to-date.

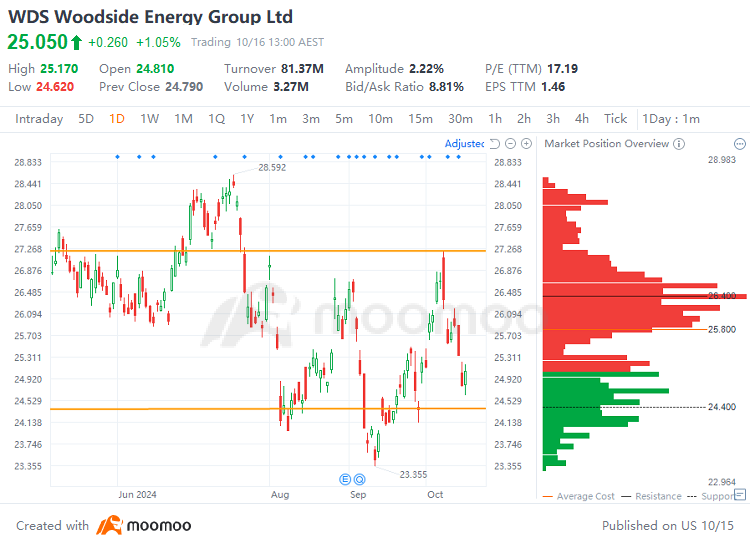

Woodside's technical analysis chart:

Technical Analysis:

Support: A$24.4

Support: A$24.4

Resistance: A$27.2

Price range A$24.4 to A$27.2: The trading range indicates a high concentration of sell orders, with the stock price exhibiting a short-term downward trend. There is a significant amount of trapped capital within the trading range, which creates substantial resistance to price increases. The stock price declined near the resistance level of around A$27.2, and it repeatedly touched near the level of A$24.4, forming a certain support. Going forward, we need to observe whether the support at around A$24.4 holds and whether the resistance at around A$27.2 can be effectively breached.

Market News :

Woodside announced its Q3 2024 results on October 16, 2024, reporting record-breaking production fueled by Sangomar. The company achieved a record quarterly production of 53.1 MMboe (577 Mboe/day), a 20% increase from Q2 2024, primarily due to the ramp-up at Sangomar. This production figure surpassed the consensus estimate of 50.1 MMboe. Additionally, the company reported quarterly revenue of US$3.679 billion, which is a 21% increase from Q2 2024, mainly due to Sangomar cargo sales and higher average LNG prices.

Woodside reviewed its current listing structure and decided to delist from the London Stock Exchange (LSE). Woodside shares represented by depositary interests account for approximately 1% of Woodside’s issued share capital. Trading volumes of Woodside shares on the LSE are low and delisting from the LSE will reduce Woodside’s administration costs.

Overall Analysis:

Fundamentally, focus on the company's performance and operational status. Technically, pay attention to whether the support levels hold and if the resistance levels can be effectively breached.

In this scenario, investors should adopt a cautious strategy, setting stop-loss points to manage risk and maintaining ongoing vigilance regarding company developments and market conditions.