$Bank of Queensland Ltd (BOQ.AU)$'s stock surged 6.22%, following the release of its financial results for the year ending 31 August 2024, which exceeded analyst forecasts.

FY24 financial results

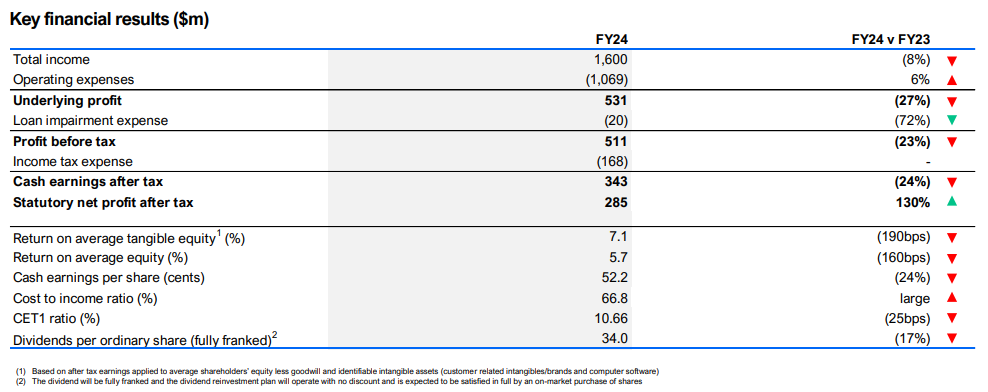

Total income of $1.60 billion, down 8% from FY23

Operating expenses of $1.069 billion, up 6% from FY 2023

Operating expenses of $1.069 billion, up 6% from FY 2023Cash earnings after tax of $343 million, down 24% from FY23

Net interest margin decline by 0.13% to 1.56%

Fully franked final dividend of A$17 per share, down from A$0.21 a year earlier.

Despite a 20% reduction in the final dividend to A$0.17 from A$0.21, this was higher than Citi's projection of A$0.15 and matched Macquarie's estimate. The bank's full-year net interest margin was 1.56%, surpassing the market's 1.54% expectation.

Financial Outlook

As for FY25 outlook, management anticipates stable margins and revenue benefits from business bank growth in specialist areas, and branch conversion. However, these will be partially offset by further reductions in mortgage balances. Expense growth is forecast to be broadly flat, with the transformation investment spend coming down materially. Capital is expected to remain within management's target range of 10.25% to 10.75%.

Also, Bank of Queensland states that it is transforming to a simpler, specialist bank with an enhanced customer experience, and it aims to deliver FY26 ROE target of 8%, with strategy to deliver further uplift in the medium term.

Source: ASX, Market Index