Tesla Transfers $765 Million in Bitcoin to New Wallets: Analyzing Potential Strategies

Tesla Transfers $765 Million in Bitcoin to New Wallets: Analyzing Potential Strategies

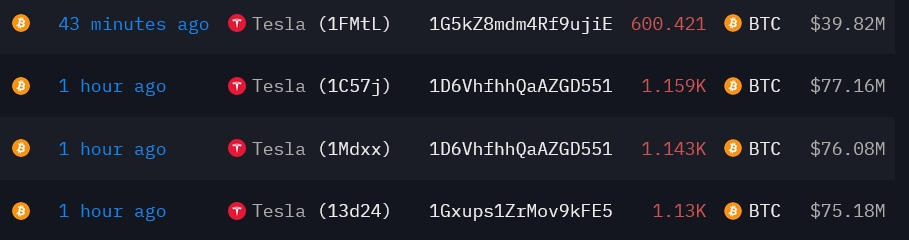

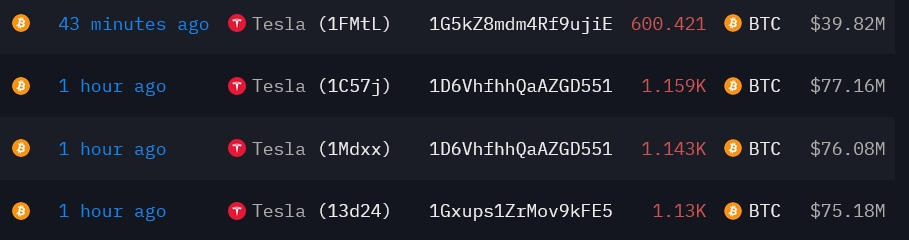

Tesla has transferred its entire Bitcoin stash, valued at over $765 million, to several unknown wallets. This move raises questions about the company's plans regarding cryptocurrency. On October 15th, Tesla conducted 26 transactions, moving approximately 11,500 Bitcoin to unknown wallets. Notably, this included initial test transfers to ensure the process's safety and accuracy. Arkham Intelligence monitored these transfers, noting that the first test occurred at 8:41 pm UTC, with the wallet now retaining a mere $6.68 in Bitcoin.

Historical Context

Tesla's involvement with Bitcoin began in February 2021 when it purchased $1.5 billion. Despite selling a substantial portion of its holdings in the following months—4,320 BTC in March 2021 and 29,160 BTC in 2022—Tesla has continued to be a significant player in cryptocurrency.

The company briefly accepted Bitcoin as payment for its vehicles in March 2021 but reversed this decision due to concerns over the environmental impact of Bitcoin mining. Although Elon Musk has hinted at potentially resuming Bitcoin payments if mining becomes more sustainable, no official plans have been announced.

Future Speculations

The recent transfer of Tesla's Bitcoin to unknown wallets is not linked to any immediate plans to sell the cryptocurrency. The wallets are not associated with any crypto exchanges, suggesting that Tesla may be reorganizing its digital asset management strategy rather than offloading its holdings.

The recent transfer of Tesla's Bitcoin to unknown wallets is not linked to any immediate plans to sell the cryptocurrency. The wallets are not associated with any crypto exchanges, suggesting that Tesla may be reorganizing its digital asset management strategy rather than offloading its holdings.

This action comes amidst discussions within the cryptocurrency community about increasing the use of renewable energy for Bitcoin mining. Tesla's past decisions have often aligned with its broader environmental goals, indicating that future cryptocurrency transactions could also follow this trend.

Conclusion

As Tesla remains tight-lipped about the specifics of these transfers, the cryptocurrency community and Tesla investors eagerly await the company's third-quarter financial results, which may provide more clarity on these moves. Despite the significant transfers, the price of Bitcoin has remained relatively stable, showing a slight increase of 1% over the last 24 hours. This stability suggests that the market may have anticipated these moves or viewed them as part of a broader strategic realignment by Tesla within the cryptocurrency space.

In conclusion, Tesla's recent activities highlight its ongoing engagement with cryptocurrency, albeit with a cautious approach influenced by broader market conditions and environmental considerations. As the landscape of digital currencies continues to evolve, Tesla's actions will likely play a significant role in shaping the dialogue around corporate involvement in cryptocurrency investments.

特斯拉已将其价值超过7.65亿美元的全部比特币储备转移到了几个未知的钱包中。此举引发了人们对该公司有关加密货币的计划的质疑。10月15日,特斯拉进行了26笔交易,向未知钱包转移了约11,500个比特币。值得注意的是,这包括为确保过程的安全性和准确性而进行的初步测试转移。Arkham Intelligence监控了这些转账,指出第一次测试发生在世界标准时间晚上 8:41,钱包现在仅保留了6.68美元的比特币。

历史背景

特斯拉对比特币的参与始于2021年2月,当时它购买了15亿美元。尽管特斯拉在接下来的几个月中出售了其持有的很大一部分——2021年3月出售了4,320枚比特币,2022年出售了29,160枚比特币——但特斯拉仍然是加密货币的重要参与者。

该公司在2021年3月曾短暂接受比特币作为其车辆的付款,但由于担心比特币采矿对环境的影响,该公司推翻了这一决定。尽管埃隆·马斯克暗示,如果采矿变得更加可持续,可能会恢复比特币支付,但尚未公布任何官方计划。

未来猜测

特斯拉最近将比特币转移到未知钱包与任何立即出售该加密货币的计划无关。这些钱包与任何加密货币交易所都不相关,这表明特斯拉可能正在重组其数字资产管理战略,而不是转移其持有的资产。

特斯拉最近将比特币转移到未知钱包与任何立即出售该加密货币的计划无关。这些钱包与任何加密货币交易所都不相关,这表明特斯拉可能正在重组其数字资产管理战略,而不是转移其持有的资产。

这一行动是在加密货币社区内部讨论增加比特币采矿中使用可再生能源之际采取的。特斯拉过去的决定通常与其更广泛的环境目标一致,这表明未来的加密货币交易也可能遵循这一趋势。

结论

由于特斯拉对这些转账的细节保持沉默,加密货币社区和特斯拉投资者热切地等待着该公司第三季度的财务业绩,这可能会使这些举措更加清晰。尽管进行了大量转账,但比特币的价格一直保持相对稳定,在过去24小时内略有上涨1%。这种稳定性表明,市场可能已经预料到了这些举动,或者将其视为特斯拉在加密货币领域更广泛的战略调整的一部分。

总之,特斯拉最近的活动凸显了其对加密货币的持续参与,尽管受更广泛的市场条件和环境考虑的影响采取了谨慎的态度。随着数字货币格局的持续发展,特斯拉的行动可能会在塑造围绕企业参与加密货币投资的对话方面发挥重要作用。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Moomoo Securities Australia Limited提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Moomoo Securities Australia Limited, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Moomoo Securities Australia Limited提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Moomoo Securities Australia Limited, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧