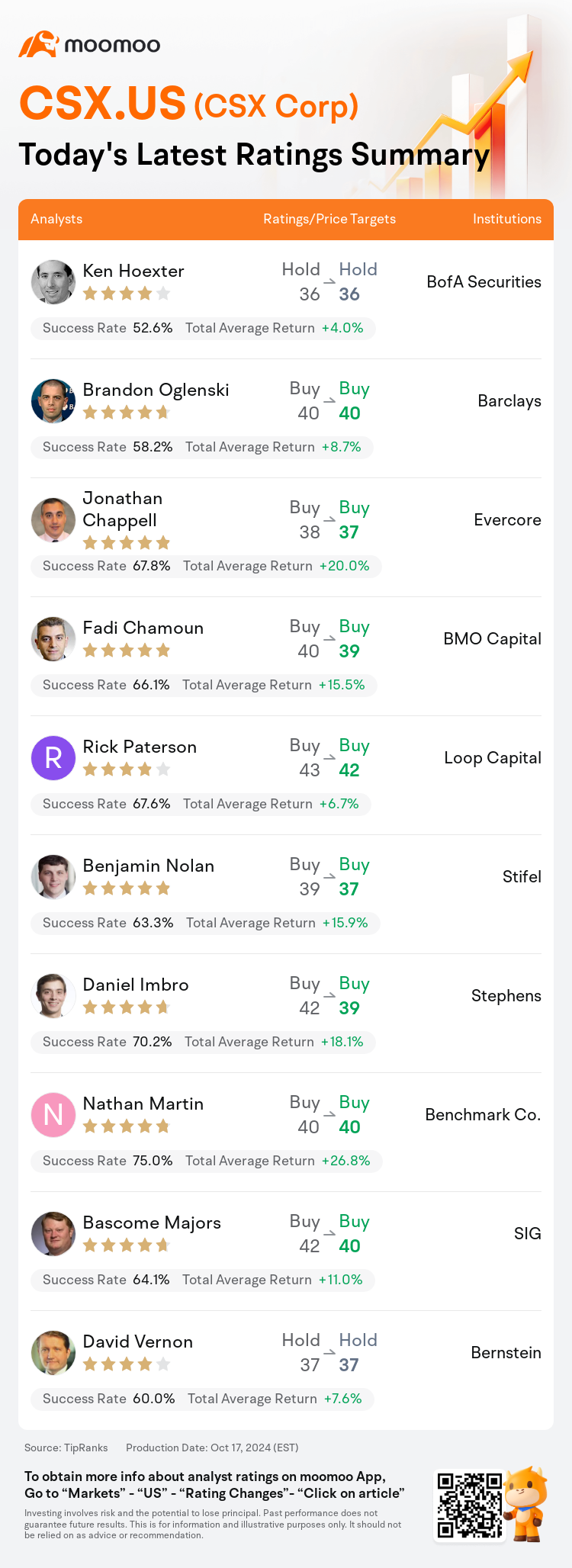

On Oct 17, major Wall Street analysts update their ratings for $CSX Corp (CSX.US)$, with price targets ranging from $36 to $42.

BofA Securities analyst Ken Hoexter maintains with a hold rating, and maintains the target price at $36.

Barclays analyst Brandon Oglenski maintains with a buy rating, and maintains the target price at $40.

Evercore analyst Jonathan Chappell maintains with a buy rating, and adjusts the target price from $38 to $37.

Evercore analyst Jonathan Chappell maintains with a buy rating, and adjusts the target price from $38 to $37.

BMO Capital analyst Fadi Chamoun maintains with a buy rating, and adjusts the target price from $40 to $39.

Loop Capital analyst Rick Paterson maintains with a buy rating, and adjusts the target price from $43 to $42.

Furthermore, according to the comprehensive report, the opinions of $CSX Corp (CSX.US)$'s main analysts recently are as follows:

The company's Q3 earnings were reported below expectations, influenced by a difficult macroeconomic environment and an unfavorable product mix. Despite the anticipation of a demand upturn, the clarity regarding the timing of this change remains uncertain. Additionally, future earnings projections have been modestly adjusted.

The company's third-quarter earnings shortfall and suggested reduced outlook were mainly due to adverse weather conditions, with expectations for the fourth quarter to experience an amplified impact from recent hurricane events. This outlook indicates minimal positive change in the short term. It is anticipated that the company's management will highlight long-term prospects at the forthcoming Investor Day, yet there is a belief that shares may face downward pressure in the immediate future.

After CSX reported Q3 results that were marginally below expectations, and provided guidance indicating a challenging Q4 partly due to hurricane impact as well as difficulties in achieving higher pricing, the shares' valuation remains the most attractive among rail equities. The recovery in trucking rates is anticipated to be a key driver for a near-term increase in the share price.

The company reported Q3 earnings per share that aligned with the lowest estimate on the street but fell short of the average forecast. The outlook for Q4 indicates challenges ahead, including diminished international coal and fuel prices coupled with the adverse effects of Hurricanes Helene and Milton. Consequently, this has led to a revision of the previously lowest Q4 earnings per share prediction. Despite potential weakness in the stock and possible volume deficiencies hindering significant catalysts by the year's end, it is assessed that the current valuation represents a floor, with the potential for gains now surpassing the risks of further declines.

Hurricanes were highlighted as a significant factor during the company's Q3 results, with expectations for increased costs in Q4 due to the aftermath. The company's focus continues to be on regaining a track record of service with customers after the industry-wide challenges faced in 2022.

Here are the latest investment ratings and price targets for $CSX Corp (CSX.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

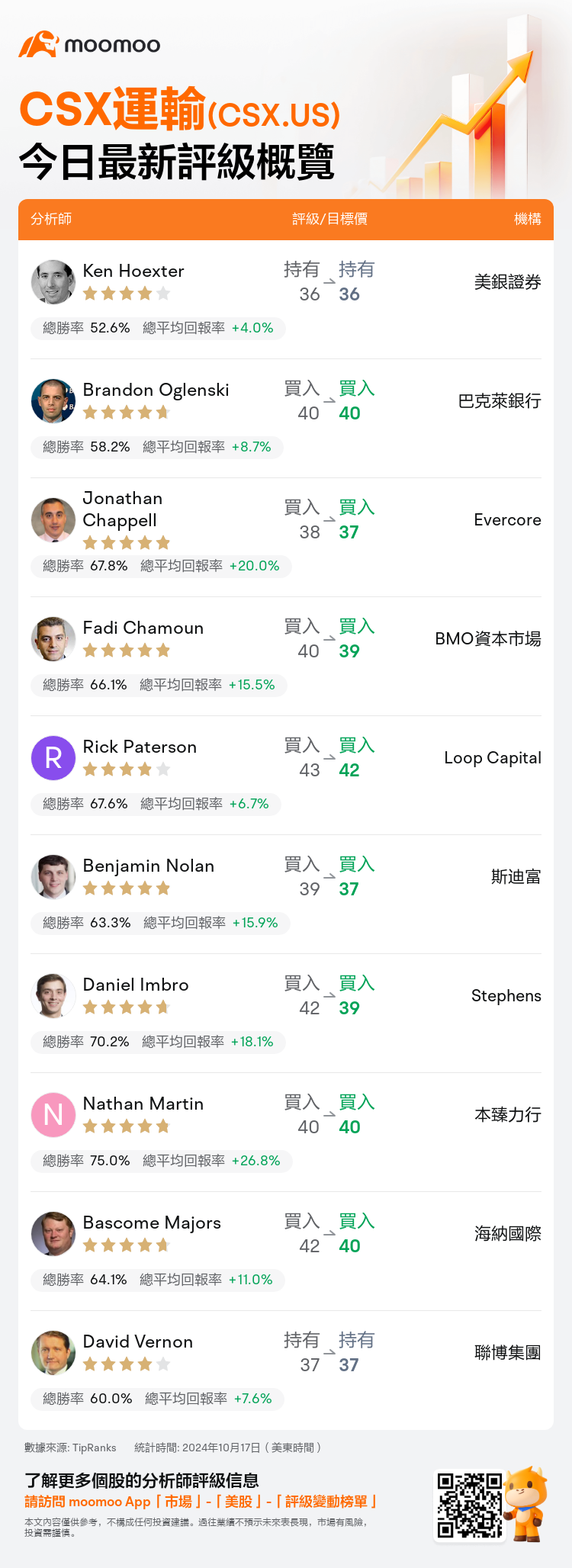

美東時間10月17日,多家華爾街大行更新了$CSX運輸 (CSX.US)$的評級,目標價介於36美元至42美元。

美銀證券分析師Ken Hoexter維持持有評級,維持目標價36美元。

巴克萊銀行分析師Brandon Oglenski維持買入評級,維持目標價40美元。

Evercore分析師Jonathan Chappell維持買入評級,並將目標價從38美元下調至37美元。

Evercore分析師Jonathan Chappell維持買入評級,並將目標價從38美元下調至37美元。

BMO資本市場分析師Fadi Chamoun維持買入評級,並將目標價從40美元下調至39美元。

Loop Capital分析師Rick Paterson維持買入評級,並將目標價從43美元下調至42美元。

此外,綜合報道,$CSX運輸 (CSX.US)$近期主要分析師觀點如下:

公司的第三季度收益低於預期,受困於複雜的宏觀經濟環境和不利的產品組合影響。儘管預計需求會有所增長,但關於這一變化的時間仍然不確定。此外,未來的收益預測已經略有調整。

公司第三季度收益短缺和建議減少的前景主要是由於不利的天氣條件,預計第四季度將受到最近颶風事件的影響。這一前景表明短期內變化微乎其微。預計公司管理層將在即將到來的投資者日強調長期前景,但人們認爲股票可能會在不久的將來面臨下行壓力。

在CSX公佈略低於預期的第三季度業績報告,並提供表明第四季度的挑戰的指導,部分原因是颶風影響以及實現更高定價的困難,該公司股票的估值仍然是所有鐵路股中最有吸引力的。公路運輸費率的恢復預計將成爲短期內股價增長的主要推動因素。

公司報告的第三季度每股收益與街頭最低估計相符,但低於平均預測。第四季度的展望表明前方存在挑戰,包括國際煤炭和燃料價格的下降以及颶風海倫和彌爾頓的不利影響。因此,這導致之前最低第四季度每股收益預測的修訂。儘管股票可能存在弱勢,可能的成交量不足阻礙了年底重大催化劑,但當前的估值被認爲至少有保障,並且現在的獲利潛力已經超過了進一步下降的風險。

颶風在公司第三季度業績中被突出爲一個重要因素,預計由於後續影響,第四季度成本將增加。該公司的重點繼續放在重建與客戶的服務記錄上,以應對2022年全行業面臨的挑戰。

以下爲今日10位分析師對$CSX運輸 (CSX.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Evercore分析師Jonathan Chappell維持買入評級,並將目標價從38美元下調至37美元。

Evercore分析師Jonathan Chappell維持買入評級,並將目標價從38美元下調至37美元。

Evercore analyst Jonathan Chappell maintains with a buy rating, and adjusts the target price from $38 to $37.

Evercore analyst Jonathan Chappell maintains with a buy rating, and adjusts the target price from $38 to $37.