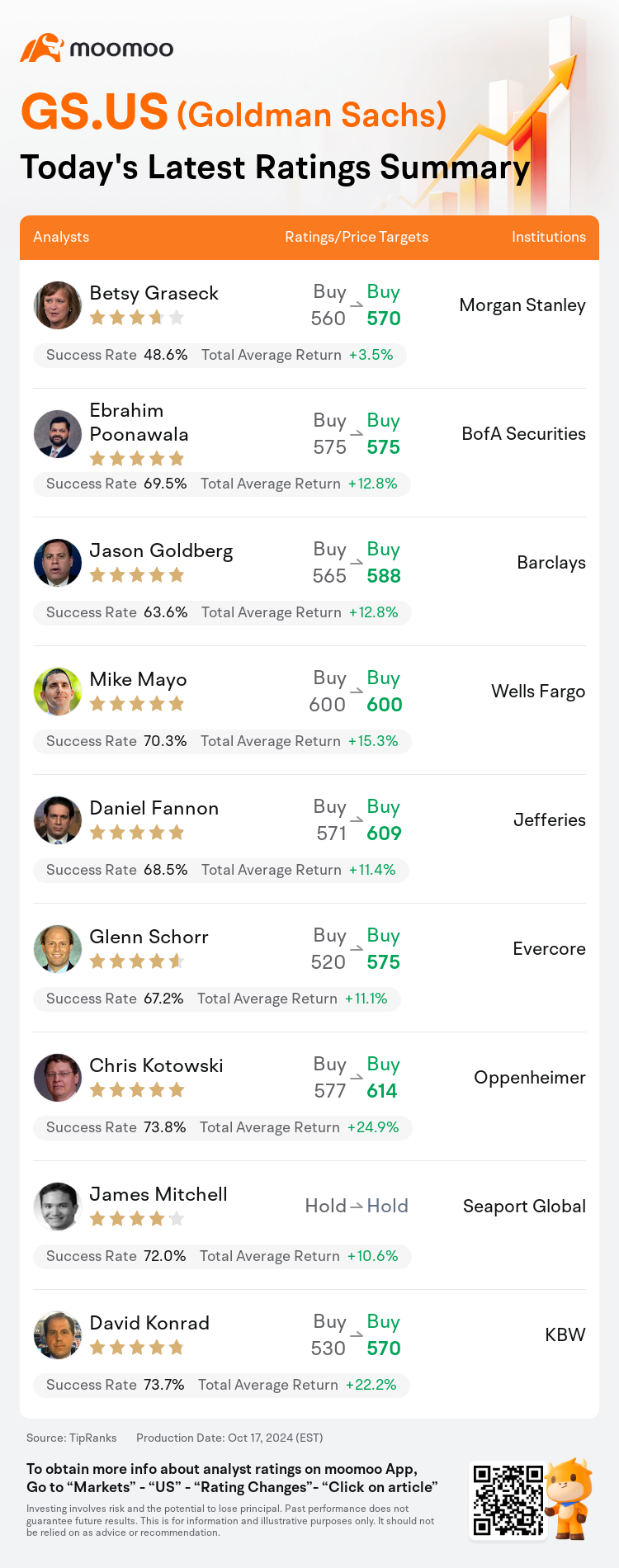

On Oct 17, major Wall Street analysts update their ratings for $Goldman Sachs (GS.US)$, with price targets ranging from $570 to $614.

Morgan Stanley analyst Betsy Graseck maintains with a buy rating, and adjusts the target price from $560 to $570.

BofA Securities analyst Ebrahim Poonawala maintains with a buy rating, and maintains the target price at $575.

Barclays analyst Jason Goldberg maintains with a buy rating, and adjusts the target price from $565 to $588.

Barclays analyst Jason Goldberg maintains with a buy rating, and adjusts the target price from $565 to $588.

Wells Fargo analyst Mike Mayo maintains with a buy rating, and maintains the target price at $600.

Jefferies analyst Daniel Fannon maintains with a buy rating, and adjusts the target price from $571 to $609.

Furthermore, according to the comprehensive report, the opinions of $Goldman Sachs (GS.US)$'s main analysts recently are as follows:

Following a notable third quarter earnings per share beat, largely attributed to robust capital markets results, there was a positive adjustment in earnings expectations. Specifically, investment banking revenues saw a year-over-year increase of 20%, trading revenues rose by 2%, and asset management fees grew by 8%. These upward trends have led to an uplift in the projected earnings per share for the fourth quarter and the full year of fiscal 2025.

The recent quarterly performance of Goldman Sachs has been described as a 'high quality beat' against the consensus, serving as a prime example of the anticipated rebound in capital markets. An increase in the forecasted 2025 EPS is predicated on expectations of augmented revenues from Equities and FICC markets, as well as improved returns from private banking and lending, spurred by enhanced loan growth and elevated management fees. The observation that 2025 investment banking revenue projections significantly exceed the consensus reinforces confidence in projections that anticipate industry volumes to outpace the consensus.

The bank's third-quarter earnings surpassed expectations, with the majority of its major revenue streams outperforming the consensus, an analyst reported.

Following the release of third-quarter earnings, an observation has been made that Goldman Sachs recorded a notable $8.40 in earnings per share, surpassing both the anticipated $6.42 and the consensus of $6.89. After accounting for some minor special items, primarily associated with the wind-down charge of the GM Card business, the core operating EPS could arguably stand at $9.02. This adjustment suggests a core return on tangible common equity (ROTCE) of 11.7% for the quarter, which is considered quite robust, especially in light of the current assessment of the investment banking sector which is perceived to be somewhat subdued.

The company's third-quarter earnings surpassed expectations, with the potential to enhance its Return on Tangible Common Equity to the mid-teens from an estimated core of 12%. Strong capital markets and better margins have contributed to the firm's performance exceeding consensus estimates for the third quarter.

Here are the latest investment ratings and price targets for $Goldman Sachs (GS.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月17日,多家华尔街大行更新了$高盛 (GS.US)$的评级,目标价介于570美元至614美元。

摩根士丹利分析师Betsy Graseck维持买入评级,并将目标价从560美元上调至570美元。

美银证券分析师Ebrahim Poonawala维持买入评级,维持目标价575美元。

巴克莱银行分析师Jason Goldberg维持买入评级,并将目标价从565美元上调至588美元。

巴克莱银行分析师Jason Goldberg维持买入评级,并将目标价从565美元上调至588美元。

富国集团分析师Mike Mayo维持买入评级,维持目标价600美元。

富瑞集团分析师Daniel Fannon维持买入评级,并将目标价从571美元上调至609美元。

此外,综合报道,$高盛 (GS.US)$近期主要分析师观点如下:

在值得注意的第三季度每股收益超出预期的情况下,主要归因于资本市场业绩强劲,盈利预期出现积极调整。具体而言,投资银行收入同比增长20%,交易收入上涨2%,资产管理费收入增长8%。这些上升趋势导致了对财年2025年第四季度和全年的预计每股收益的提升。

高盛最近的季度业绩被描述为与共识相比的“高质量超预期”,是对资本市场预期反弹的一个典范。预计2025年的每股收益增长取决于对股票和固定收益市场收入的增加预期,以及私人银行和贷款回报的改善,受到增强的贷款增长和提高的管理费的推动。观察表明,2025年投资银行收入预测大幅超出共识,加强了对行业预期超越共识的信心。

据一位分析师报道,该银行第三季度的盈利超出预期,其大部分主要营收流向均表现优于共识。

在公布第三季度盈利后,有观察指出,高盛录得显著的8.40美元每股收益,超出预期的6.42美元和共识的6.89美元。考虑到与Gm卡业务清理费用等少量特殊项目相关的主要因素,核心营业每股收益可能可达9.02美元。此调整意味着该季度的核心有形公共股权回报率(ROTCE)为11.7%,在目前对投资银行业务板块评估相对沉静的情况下,这被认为相当强劲。

该公司第三季度的盈利超出预期,有潜力将其有形公共股权回报率从预估的12%提升至中等水平。强劲的资本市场和更好的利润率推动了该公司在第三季度超出共识预期的表现。

以下为今日9位分析师对$高盛 (GS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Jason Goldberg维持买入评级,并将目标价从565美元上调至588美元。

巴克莱银行分析师Jason Goldberg维持买入评级,并将目标价从565美元上调至588美元。

Barclays analyst Jason Goldberg maintains with a buy rating, and adjusts the target price from $565 to $588.

Barclays analyst Jason Goldberg maintains with a buy rating, and adjusts the target price from $565 to $588.