On Thursday, the stock price of AI chip leader NVIDIA hit a historical high with strong financial results driven by Taiwan Semiconductor.

Under the frenzy of global AI deployment, Taiwan Semiconductor (TSM.US), known as the 'king of chip manufacturing', released an incredibly strong performance report for the third quarter, propelling the entire chip sector to 'take off' in the U.S. stock market. On Tuesday, chip stocks collectively plummeted due to the unexpected performance failure of lithography giant ASML.US. In early Thursday's U.S. stock market, Taiwan Semiconductor's U.S. ADR surged over 12%, the Philadelphia Semiconductor Index, a benchmark for chip stocks, rose by nearly 3%, and AI chip leader NVIDIA set a historical high with the strong financial results of Taiwan Semiconductor.

Although ASML's performance failure hit global chip stock prices, from a rational investment perspective, this blow to chip stocks by ASML's performance does not indicate that the global frenzy of AI deployment is dissipating or cooling down. ASML's performance actually reveals a continuous surge in demand for AI chips. However, this failure of the financial report does reveal the latest dynamics of the global chip industry, that is: the AI boom is still ongoing, especially the demand for all types of AI chips focusing on B-end data centers remains very strong, while areas unrelated to AI are still experiencing weak or significantly declining demand.

ASML CFO Roger Dassen has supported this market view in the performance statement. The ASML executive stated that the demand for AI-related chips is indeed increasing rapidly. However, the recovery process in other parts of the semiconductor market is weaker than expected, leading to some logic chip manufacturers postponing lithography machine orders.

ASML CFO Roger Dassen has supported this market view in the performance statement. The ASML executive stated that the demand for AI-related chips is indeed increasing rapidly. However, the recovery process in other parts of the semiconductor market is weaker than expected, leading to some logic chip manufacturers postponing lithography machine orders.

Taiwan Semiconductor's latest performance significantly reinforces the investment viewpoint that the AI boom is still in full swing and the demand for AI chips remains incredibly high. Speaking of the market demand for AI chips, Wei Zhejia, the helm of Taiwan Semiconductor, stated during the earnings conference that the outlook for AI chip demand is very optimistic, emphasizing that the demand of Taiwan Semiconductor's customers for CoWoS advanced packaging far exceeds the company's supply.

"The company will fully meet the demand for CoWoS advanced packaging capacity from customers. Even with a doubling of capacity this year and continuing to double next year, it is still far from enough." Wei Zhejia stated during the earnings conference. CoWoS advanced packaging capacity is crucial for a wider range of AI chips such as NVIDIA's Blackwell AI GPU. "Nearly all AI innovators are collaborating with Taiwan Semiconductor, and the demand related to AI is real, and I believe this is just the beginning."

Taiwan Semiconductor's management expects the company's full-year revenue to grow by nearly 30%, exceeding the general analyst expectation of 20%-25% and the company's expectation in the previous quarter. The management also anticipates that this year, the company's revenue related to data center AI server chips (including NVIDIA AI GPU, Broadcom AI ASIC, and a wide range of AI chips) will more than double.

After the's ASML financial failure, some analysts even shout out, even if ASML's performance is so bad, it actually benefits NVIDIA and other 'AI shovelers' like global AI chip demand are still strong. From the stock price trend, ASML, which holds the lifeline of chip capacity, has significantly underperformed NVIDIA. Unconsciously, the market has given a clear answer in terms of who is the biggest winner of chip stocks with real silver and gold.

Therefore, the performance of ASML Holding and Taiwan Semiconductor, the two core giants of the semiconductor industry chain, together demonstrates that the stock logic closely related to AI chips can be described as extremely hardcore, with the rising trend of leaders in AI chips like NVIDIA possibly far from stopping. Especially in the datacenter AI chip sector, where NVIDIA dominates with a market share of 80%-90%, the stock price may continue to hit historic highs, breaking the widely expected $150 target price from analysts, which is likely just a matter of time.

The AI boom continues to sweep across the globe.

The latest performance results of ASML Holding indicate a significant differentiation in the fate of global chip companies: the soaring demand for AI GPUs like NVIDIA's in data center server-side AI chips, capable of handling massive parallel computational patterns and high computing density for artificial intelligence applications such as ChatGPT and Sora, has overshadowed the extremely low demand in other segmented areas of this industry.

Jefferies Financial analyst Janardan Menon from Wall Street stated in a report on Wednesday: "ASML's financial report shows that although demand for chips related to artificial intelligence remains very strong, recovery in other areas is exceptionally lagging, and this trend may continue until 2025."

The global fervent demand for AI chips is very evident in South Korea's chip inventory and the scale of chip exports, which is the home to the world's two largest storage chip manufacturers - SK Hynix and Samsung.

Data released by the South Korean government shows that despite a slowdown in growth, semiconductor exports in September still surged by 37% year-on-year, marking the 11th consecutive month of growth. Within the ongoing increase in chip exports, one-third of the growth contribution is from HBM memory systems. HBM memory systems, used in conjunction with NVIDIA's core hardware offerings like H100/H200/GB200 AI GPUs and a wide range of AI ASIC chips (such as Google TPU), are essential for driving heavyweight AI applications like ChatGPT and Sora. The stronger the demand for HBM, the more intense the demand for AI chips.

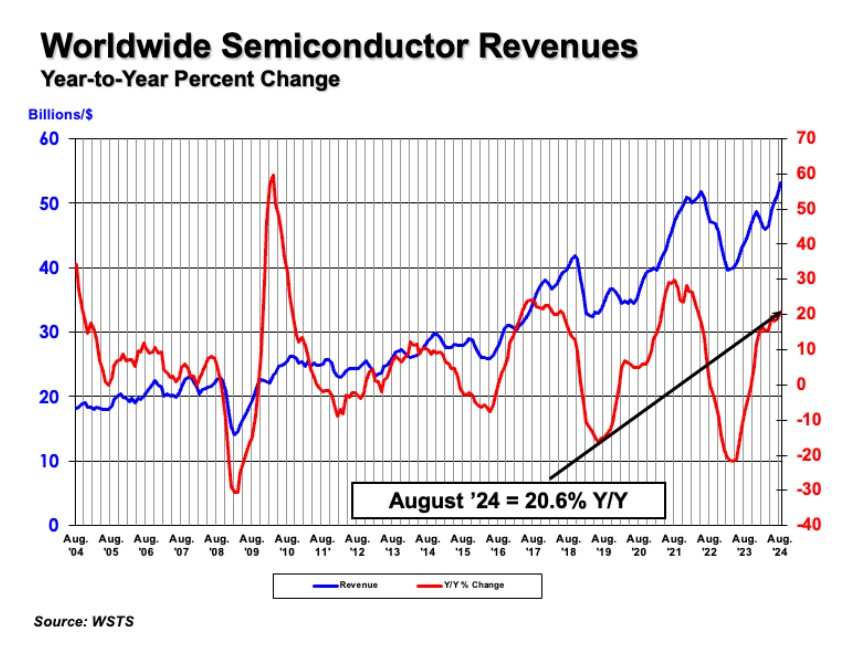

The current demand for AI chips is incredibly strong, and it is likely to remain so for a long time in the future. Data recently released by the Semiconductor Industry Association (SIA) shows that driven by the robust demand for AI chips, global semiconductor sales reached approximately $53.1 billion in August 2024, a 20.6% growth compared to $44 billion in August 2023, and a 3.5% increase compared to the already robust $51.3 billion in sales in July.

AMD CEO Lisa Su recently stated at a new product launch event that the demand for datacenter AI chips, including AI GPUs, far exceeds expectations. It is expected that by 2027, the market size of datacenter AI chips will reach $400 billion, and will further increase to $500 billion in 2028, implying a potential compound annual growth rate of over 60% for the global datacenter AI chip market from 2023 to 2028.

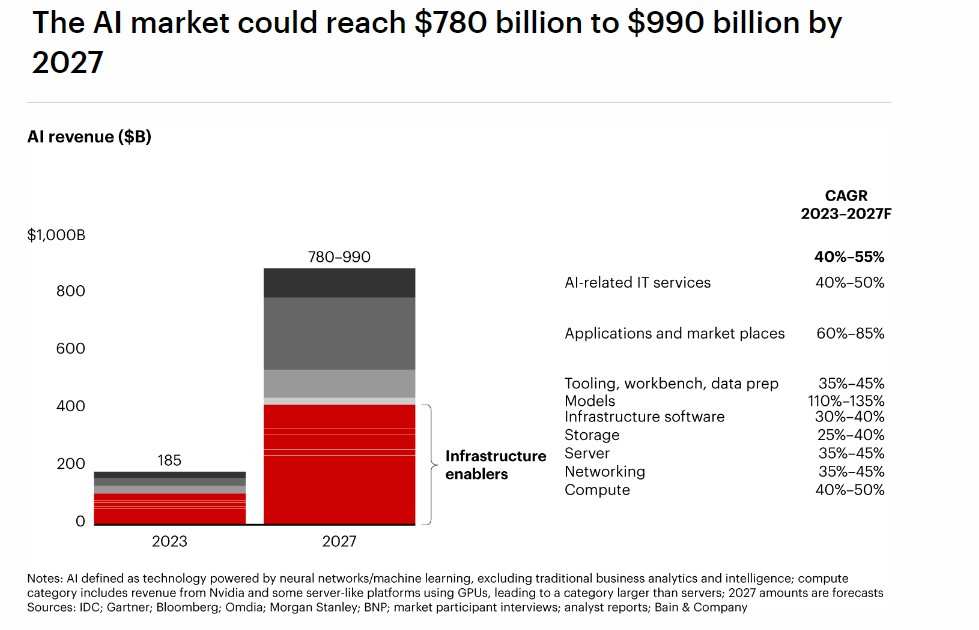

Global renowned strategic consulting firm Bain predicts that as artificial intelligence (AI) technology rapidly disrupts enterprises and economies, all markets related to AI are expanding, reaching $990 billion by 2027. This consulting firm pointed out in its fifth annual "Global Tech Report" released on Wednesday that the overall AI market size, including AI-related services and core hardware like AI GPU, will grow at a rate of 40% to 55% annually from the base of $185 billion last year. This means a massive revenue of $780 billion to $990 billion by 2027.

US banking giant Bank of America recently released a research report stating that the global AI boom is still in its early stages, similar to the development path of the internet in the 1990s. It can be likened to the '1996 moment' of the flourishing development of the internet. According to the Bank of America analysis team, the AI boom is still in a very early stage.

Nvidia's stock price is challenging $150.

Referred to as the 'most important stock on earth' by Goldman Sachs, Nvidia's stock price once firmly held the title of 'the world's highest market capitalization listed company' this year, but in the second half of the year, it experienced a pullback due to the unclear prospects of AI monetization and the significant global macroeconomic policy turmoil, causing the stock price to plummet at one point.

Recently, many global technology companies cannot avoid showcasing Nvidia's cutting-edge AI GPU server systems when demonstrating their business progress. Coupled with Wall Street's optimistic forecasts for data center spending and Nvidia's stock price, Nvidia's stock price broke through the previous high during Thursday's regular trading hours, reaching a new all-time high of $140.89 per share, and is poised to once again challenge the title of "highest market cap company".

According to the latest forecast data from Citigroup, a Wall Street financial giant, by 2025, the capital expenditure related to datacenters of the four largest-scale technology giants in the USA is expected to grow by at least 40% year-on-year. These huge capital expenditures are mostly associated with generative artificial intelligence, meaning that the computational power demand for applications like ChatGPT in AI remains significant. Citigroup indicates that this implies that the spending scale of giants on datacenters is expected to continue to expand significantly on top of the already strong 2024 spending scale. The institution expects this trend to provide very significant positive catalysts for the AI GPU dominator Nvidia as well as the datacenter interconnect (DCI) technology providers.

In a research report, Citigroup refers to the four major technology giants as global cloud computing giants Amazon, Google, Microsoft, along with social media Facebook and Instagram's parent company. In this latest research report, Citigroup forecasts that by 2025, the capital expenditure scale of these four technology giants' data centers will grow by 40% to 50% year-on-year. The incremental expenditure of technology giants in datacenters is expected to continuously attract international capital to dominate Nvidia, Arista Networks, and other datacenter network technology giants in the field of AI infrastructure.

In the latest research report, Citigroup's analysis team states that Nvidia's server GPUs and NVIDIA's whole-machine servers in the field of AI infrastructure, and the absolute leading position in terms of Total Cost of Ownership (TCO) and Return on Investment (ROI), are emphasized as core factors valued by datacenter operators. They value the higher-level performance running various applications (including AI training/inference applications) on Nvidia's hardware and CUDA cooperative accelerated software platform.

The CUDA ecosystem barrier can be described as Nvidia's "most powerful moat". Nvidia has deeply cultivated the global high-performance computing field for many years, especially its CUDA computing platform created single-handedly that has become popular worldwide, serving as the preferred software-hardware collaborative system for high-performance computing in AI training/inference and other fields. The CUDA acceleration computing ecosystem is an exclusively developed parallel computing acceleration platform and programming assistant software by Nvidia, allowing software developers and engineers to use Nvidia GPU for parallel general-purpose computing acceleration (only supporting Nvidia GPUs, not compatible with mainstream GPUs like AMD or Intel).

Citigroup's analysis team recently reiterated the institution's $150 target price for Nvidia within the next 12 months, along with a 'Buy' rating. Data compiled by TIPRANKS shows that 42 Wall Street analysts have an average target price expectation of $152.86 for Nvidia within the next 12 months, indicating a potential upside of nearly 10%.

Wedbush, a renowned Wall Street investment firm, recently released a research report stating that the top three tech giants in the US stock market - namely Apple (AAPL.US), Nvidia (NVDA.US), and Microsoft (MSFT.US) - are expected to have one of the three tech giants reach a total market cap of $4 trillion within the next six to nine months.

Wedbush analysts led by Daniel Ives have made bold and optimistic predictions about future artificial intelligence spendings and infrastructure. Ives stated in an investor report, 'We believe that with the establishment of next-generation artificial intelligence infrastructure, the scale of the entire artificial intelligence infrastructure market dominated by Nvidia's AI GPUs may increase significantly by as much as 10 times from today to 2027. We estimate that in the next three years, capital expenditures in the field of artificial intelligence could reach $1 trillion.'

阿斯麦首席财务官Roger Dassen在业绩声明中可谓支撑了这一市场观点。这位阿斯麦高管表示,人工智能相关的芯片需求确实不断激增,但半导体市场其他部分的需求复苏进程比我们所预期的更为疲弱,导致一些逻辑芯片制造商推迟光刻机订单。

阿斯麦首席财务官Roger Dassen在业绩声明中可谓支撑了这一市场观点。这位阿斯麦高管表示,人工智能相关的芯片需求确实不断激增,但半导体市场其他部分的需求复苏进程比我们所预期的更为疲弱,导致一些逻辑芯片制造商推迟光刻机订单。