Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Jiangxi Guoke Defence GroupLtd (SHSE:688543). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Jiangxi Guoke Defence GroupLtd with the means to add long-term value to shareholders.

How Fast Is Jiangxi Guoke Defence GroupLtd Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Jiangxi Guoke Defence GroupLtd has grown EPS by 21% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

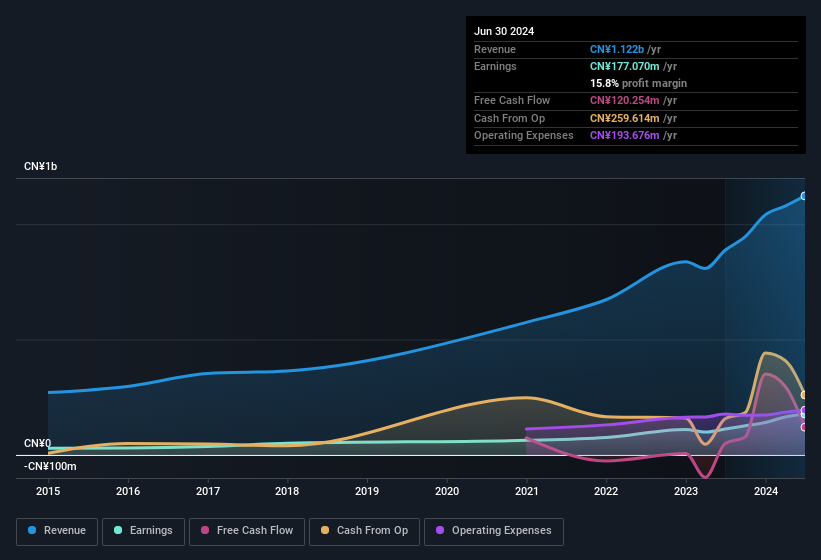

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Jiangxi Guoke Defence GroupLtd achieved similar EBIT margins to last year, revenue grew by a solid 27% to CN¥1.1b. That's a real positive.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Jiangxi Guoke Defence GroupLtd achieved similar EBIT margins to last year, revenue grew by a solid 27% to CN¥1.1b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Jiangxi Guoke Defence GroupLtd's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Jiangxi Guoke Defence GroupLtd Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. For companies with market capitalisations between CN¥2.8b and CN¥11b, like Jiangxi Guoke Defence GroupLtd, the median CEO pay is around CN¥1.0m.

The Jiangxi Guoke Defence GroupLtd CEO received CN¥757k in compensation for the year ending December 2023. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Jiangxi Guoke Defence GroupLtd To Your Watchlist?

For growth investors, Jiangxi Guoke Defence GroupLtd's raw rate of earnings growth is a beacon in the night. Strong EPS growth is a great look for the company and reasonable CEO compensation sweetens the deal for investors ass it alludes to management being conscious of frivolous spending. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. What about risks? Every company has them, and we've spotted 2 warning signs for Jiangxi Guoke Defence GroupLtd you should know about.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.