The internal division of the chip industry is reflected behind the cold and heat. Analysts believe that with the exception of TSMC, ASML customers, Intel and Samsung all face their own difficulties, while demand from TSMC customers such as Nvidia is still strong, and TSMC's performance is a better weather vane for AI demand.

The chip industry has experienced a turbulent week that can be called a “double day of ice and fire.” First, ASML's performance thunderstorm dragged semiconductor stocks down sharply, followed by TSMC's dazzling financial reports, which rekindled the market's optimism that demand for AI will not abate.

The internal division of the chip industry is reflected behind the cold and heat. Analysts believe that with the exception of TSMC, ASML customers, Intel and Samsung all face their own difficulties, while demand from TSMC customers such as Nvidia is still strong, and TSMC's performance is a better weather vane for AI demand.

In short, the boom in AI-powered chips isn't over yet, but only technology leaders will be the final winners.

In short, the boom in AI-powered chips isn't over yet, but only technology leaders will be the final winners.

ASML “flash crash”, TSMC “explodes”

The direct cause of the stock price turmoil was the performance of the two giants.

On Tuesday, Dutch lithography giant ASML “accidentally” released its three-quarter report ahead of schedule. The data showed that the company's on-hand orders fell far short of expectations, returning to a low of nearly three years, throwing cold water on the market.

On the same day, ASML's US stock plummeted 17%, the biggest one-day decline since 1998, and dragged down the collective decline of chip stocks, resulting in a total loss of more than 420 billion US dollars in market value for chip manufacturers listed in the US and chip stocks with large market capitalization in Asia.

Giants are raging, and the market is beginning to question whether AI demand is OK? Fortunately, TSMC's earnings report, which was released just a day later, did not disappoint investors.

TSMC's three-quarter report released on Thursday generally exceeded expectations. Revenue rose 39.0% year on year to a record high, net profit surged 54% year on year, gross margin also reached a record high. TSMC also raised its performance guidelines.

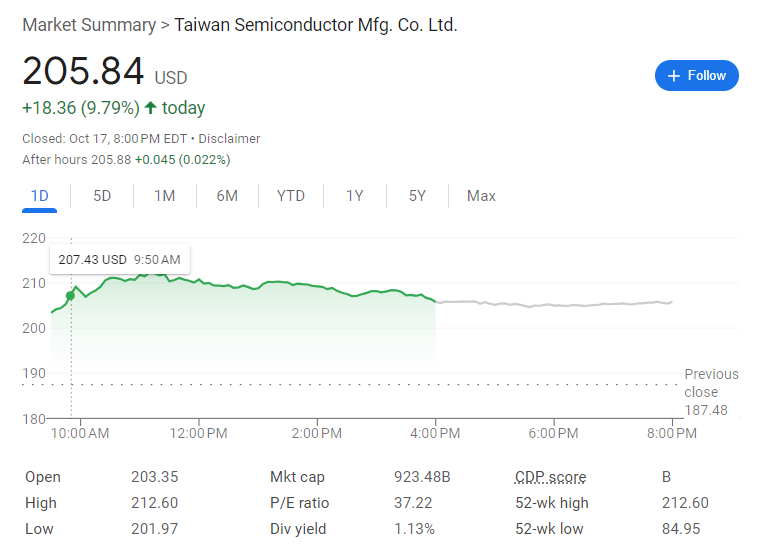

Overnight in the US stock market, TSMC rose more than 12% at one point, with a total market capitalization exceeding trillion US dollars, and the closing increase fell back to 9.79%.

TSMC is a better weather vane for AI needs

They are also upstream and downstream giants in the chip industry, and the performance gap is so big. This requires a close look at the customers behind ASML and TSMC.

ASML sells large lithographs to chipmakers including TSMC, Samsung, and Intel. But with the exception of TSMC, both Intel and Samsung are facing their own difficulties.

Intel, which once led the technological trend, missed opportunities in emerging fields such as mobile internet and AI due to strategic mistakes, is being abandoned by the times, and has already outsourced orders for processes below 3 nm to TSMC OEM.

Samsung Electronics also “missed” the AI wave, failed to seize the opportunities of high-end memory chips such as cutting-edge process chips and HBM, and lagged far behind TSMC in terms of OEM market share. This month, Samsung Electronics issued a rare apology statement because operating profit fell short of market expectations.

Only TSMC is running wild in advanced technology. The latest financial report shows that TSMC's advanced process revenue share has further increased. Among them, the 3 nm and 5 nm processes together contributed 52% of revenue in the third quarter.

Looking at TSMC's customers, including Nvidia, which is leading the AI chip boom, and AMD and Qualcomm, demand from these companies is still strong. Analysts believe that TSMC is a better weather vane for measuring AI demand.

Morningstar stock analyst Javier Correonero told Business Insider: “From a technical perspective, Intel and Samsung are lagging behind TSMC. This is just a customer-specific issue because Intel and Samsung are unable to properly upgrade the new nodes, but this is unrelated to demand.”

In a conference call on Thursday, TSMC CEO Wei Zhejia said that AI demand is real and denied that artificial intelligence is in a bubble.

Kate Leaman, chief market analyst at AvaTrade, said: “In the short to medium term, AI applications, data centers, and advanced chips will still drive strong demand... So while ASML may experience a temporary slowdown, companies such as TSMC are likely to continue to achieve strong results in these high-growth areas.”

As other chip companies such as Qualcomm and Intel announce their results in the coming weeks, the market will have a sharper picture.

简而言之,AI 驱动的芯片热潮尚未结束,但只有技术领先者才能成为最后的赢家。

简而言之,AI 驱动的芯片热潮尚未结束,但只有技术领先者才能成为最后的赢家。