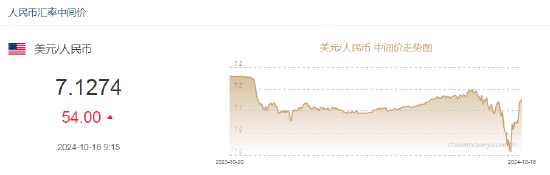

On October 18, the renminbi central parity rate was reported at 7.1274, down 54 basis points from the previous trading day's central parity rate of 7.1220.

European Central Bank announces: interest rate cut by 25 basis points!

On the evening of October 17th Beijing time, the European Central Bank announced the reduction of all three major interest rates by 25 basis points, with the main refinancing rate, marginal lending rate, and deposit facility rate lowered to 3.4%, 3.65%, and 3.25% respectively, in line with market expectations. This is the European Central Bank's third interest rate cut this year.

Analysts say the reason for the European Central Bank's consecutive rate cuts is the victory in the 'anti-inflation battle' in the euro area, but the economy remains stagnant, with even risks of recession. The 'locomotive' of the euro area economy, Germany, is facing the risk of second consecutive year of economic decline. The German Ministry of Economy stated that Germany's economy is expected to decline by 0.2% in 2024, a significant downward revision compared to the previous forecast of 0.3% growth.

Analysts say the reason for the European Central Bank's consecutive rate cuts is the victory in the 'anti-inflation battle' in the euro area, but the economy remains stagnant, with even risks of recession. The 'locomotive' of the euro area economy, Germany, is facing the risk of second consecutive year of economic decline. The German Ministry of Economy stated that Germany's economy is expected to decline by 0.2% in 2024, a significant downward revision compared to the previous forecast of 0.3% growth.

UBS Group: Investors should manage their exposure to the US dollar.

UBS report predicts that the US interest rate cuts and concerns about the fiscal deficit will weaken the US dollar in the medium term. Looking ahead, the US dollar is expected to continue to weaken. The report also predicts that the Swiss National Bank will cut interest rates twice in this cycle, and the Fed still has considerable room for rate cuts. Therefore, investors should hedge some of their dollar assets, increase international exposure, convert dollar cash and fixed income exposures into other G10 currencies, or use options to reduce dollar exposure. The report also believes that gold can be an effective diversification of investments.

The report also anticipates that the Swiss National Bank will cut interest rates twice in this cycle, and the Fed has significant room for rate cuts. Therefore, investors should hedge some of their dollar assets, increase international exposure, convert dollar cash and fixed income exposures into other G10 currencies, or use options to reduce dollar exposure. The report also believes that gold can be an effective diversification of investments.

In the medium term, the dollar is expected to continue to weaken. From the peak at the end of June to the end of September, the USD index fell by more than 5.35% before a sharp rebound at the beginning of October. Due to the further narrowing of the interest rate advantage of the USD against other currencies in the next year, UBS Group predicts that the USD will continue to depreciate.

分析称,欧洲央行连续降息的原因是,欧元区的“抗通胀之战”胜利,但经济却停滞不前,甚至有衰退风险。其中,欧元区经济“火车头”——德国正面临连续第二年经济下滑的风险。德国经济部表示,2024年德国经济预计将下降0.2%,与此前预测的增长0.3%相比大幅下调。

分析称,欧洲央行连续降息的原因是,欧元区的“抗通胀之战”胜利,但经济却停滞不前,甚至有衰退风险。其中,欧元区经济“火车头”——德国正面临连续第二年经济下滑的风险。德国经济部表示,2024年德国经济预计将下降0.2%,与此前预测的增长0.3%相比大幅下调。