Due to the closure of core hospital customer self-pay pharmacies, luye pharma's non-reimbursable product, paclitaxel micelles for injection, which is not yet included in medical insurance, cannot gain access to hospitals, impacting its first-half earnings. Shanghai Yizhong is preparing for the paclitaxel micelles to participate in this year's medical insurance negotiations. In response to this, the chairman stated that the national medical insurance negotiations progress for paclitaxel micelles is normal, and the final negotiation results will be subject to future announcements.

For Shanghai Yizhong (688091.SH), which only has one core product, "paclitaxel polymer micelles for injection," on the market and not yet included in the national medical insurance catalog, 2024 is evidently a challenging year.

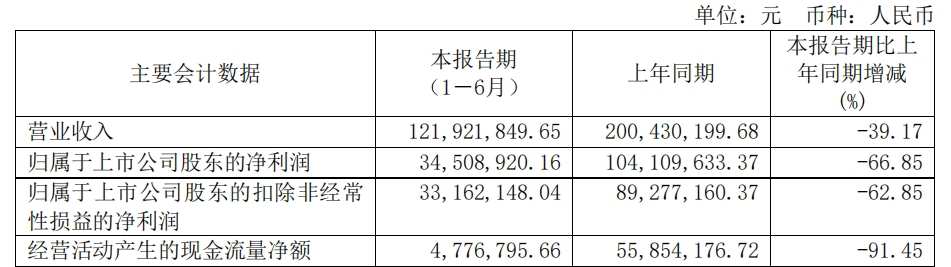

The reason being, due to the policy impact on Shanghai Yizhong's main core customer (hospitals), the closure of self-pay pharmacies has prevented paclitaxel micelles from gaining access to hospitals, severely affecting the actual sales volume of the product and dragging down earnings. In the first half of 2024, Shanghai Yizhong achieved revenue of 0.122 billion yuan, a year-on-year decrease of 39.17%, with a net income attributable to the parent company of 34.5089 million yuan, a year-on-year decrease of 66.85%.

When looking at it on a quarterly basis, this situation actually started in the first quarter of this year, and further deteriorated in the second quarter.

When looking at it on a quarterly basis, this situation actually started in the first quarter of this year, and further deteriorated in the second quarter.

In the first quarter of 2024, Shanghai Yizhong achieved revenue of 68.703 million yuan, a year-on-year decrease of 25.65%, with a net income attributable to the parent company of 29.178 million yuan, a year-on-year decrease of 46.97%. Combining the above half-year performance, Shanghai Yizhong achieved revenue of 53.2188 million yuan in the second quarter of 2024, a quarter-on-quarter decrease of 22.54%, with a net income attributable to the parent company of 5.3309 million yuan, a quarter-on-quarter decrease of 81.73%.

Shanghai Yizhong frankly stated that as a non-reimbursed drug that has not yet entered medical insurance, the difficulty of prescribing the drug and the increased difficulty of drug preparation and infusion in the hospital (pharmacy) have directly affected product sales, posing certain challenges and pressures for the marketing in 2024.

Regarding this matter, at the 2024 interim earnings conference held on the 18th, a reporter from "Star Daily" asked Shanghai Yizhong whether the paclitaxel micelles had passed expert review after being included in the "preliminary review list," as well as Shanghai Yizhong's strategy for the negotiations this year. Apart from responding with "the national medical insurance negotiations progress for paclitaxel micelles is normal, and the final negotiation results will be subject to future announcements," Shanghai Yizhong's chairman and general manager Zhou Jinsong did not provide any other answers.

According to the information, the injectable paclitaxel micelle is a new paclitaxel dosage form following the ordinary paclitaxel injection, paclitaxel liposomes, and paclitaxel albumin. It was approved by the National Medical Products Administration as a Class 2.2 innovative drug for listing in October 2021, used in combination with platinum-based drugs for first-line treatment of non-small cell lung cancer (NSCLC) patients.

According to the "Initial Review List" released by the National Medical Insurance Administration in August this year, paclitaxel micelles applied as an exclusive drug outside the directory will participate in the 2024 medical insurance negotiation. Also listed in the "Initial Review List" are paclitaxel liposomes for injection, a product from Nanjing Luye Pharma, participating in this year's negotiation as a listed drug, with a unit price of 228 yuan per 30mg, and an annual treatment cost of 13680 yuan.

Shanghai Yizhong regards the injectable paclitaxel liposome as a reference drug for their own product and states that the paclitaxel micelles have two advantages over the reference drug.

On one hand, compared to paclitaxel liposomes, paclitaxel micelles significantly improve the overall objective response rate (ORR) and prolong progression-free survival (PFS). On the other hand, paclitaxel micelles have better safety compared to paclitaxel liposomes (135-175mg/m²) with a significant dose increase (300mg/m²), no need for premedication for allergic reactions, no special infusion device required, and no need for reconstitution oscillators, effectively improving patient tolerance, reducing patient-related pain, and decreasing related expenses.

In fact, whether paclitaxel micelles can pass this year's national negotiations has clearly become a focal point of external attention. At the earnings conference, several investors inquired whether Shanghai Yizhong participated in the medical insurance pre-negotiations, and the probability of paclitaxel micelles passing the national negotiations, among other issues.

"Science and Technology Board Daily" journalist questioned Zhou Jinsong about the new measures Shanghai Yizhong has taken to expand the market in the shutdown of self-paying pharmacies and whether sales have improved in the second half of the year, but received no answer. As for the indications for which paclitaxel micelles are being developed and the expected indication of being the first to be approved, Zhou Jinsong stated that the additional registration clinical studies currently underway focus on breast cancer and pancreatic cancer.

Shanghai Yizhong disclosed that besides the treatment of NSCLC, paclitaxel micelles are widely used in the actual clinical practice for the treatment of various other types of cancers, such as esophageal cancer, gastric cancer, nasopharyngeal cancer, pancreatic cancer, breast cancer, and gynecological tumors.

Recently, Shanghai Yizhong revealed that the National Medical Products Administration has approved clinical trials of paclitaxel micelles for the new indication of pancreatic cancer, evaluating the effectiveness and safety in first-line treatment of metastatic pancreatic cancer when combined with gemcitabine versus paclitaxel (albumin-bound) combined with gemcitabine in Phase III clinical trials.

若分季度来看,

若分季度来看,